How is the cost of living affecting people in Sunderland?published at 11:13 BST 19 October 2022

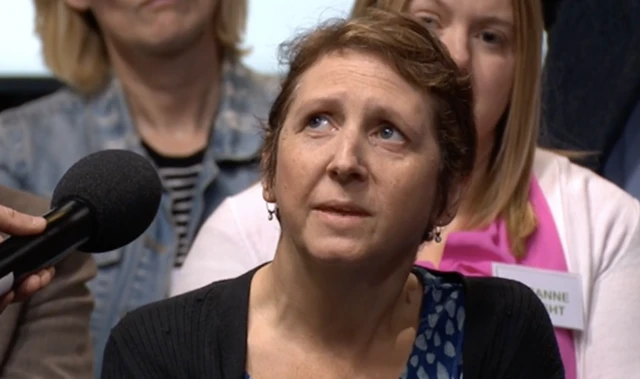

Amanda is finding it hard to afford the petrol to get her son to college

BBC Radio 5 Live's Nicky Campbell is in Sunderland talking to people about the impact the cost of living has had on them.

Eleanor, who has a daughter with Down's Syndrome, spoke about the cutbacks she's had to make at home.

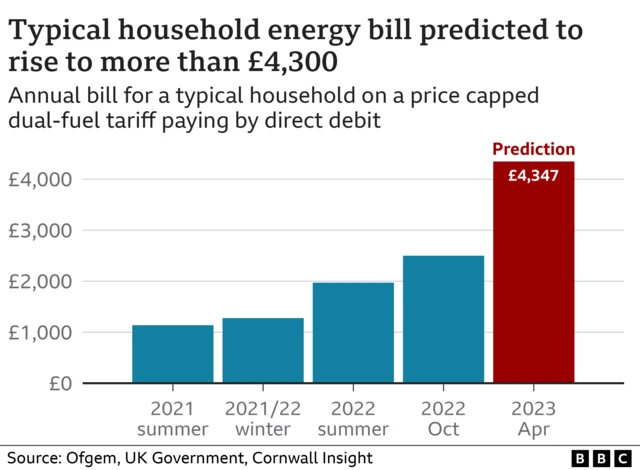

"We kind of looked at costs in the household and we did have to make some changes. We can't afford to just have the heating off because she has a history of getting quite ill."

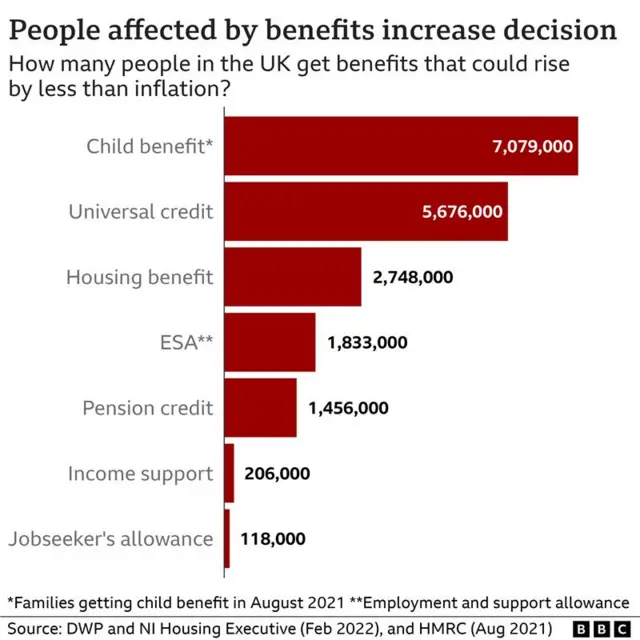

Denise, manager of Citizens' Advice Sunderland, said last October some 323 used their drop-in services. But this October there has been 206 people using the services in the first week alone.

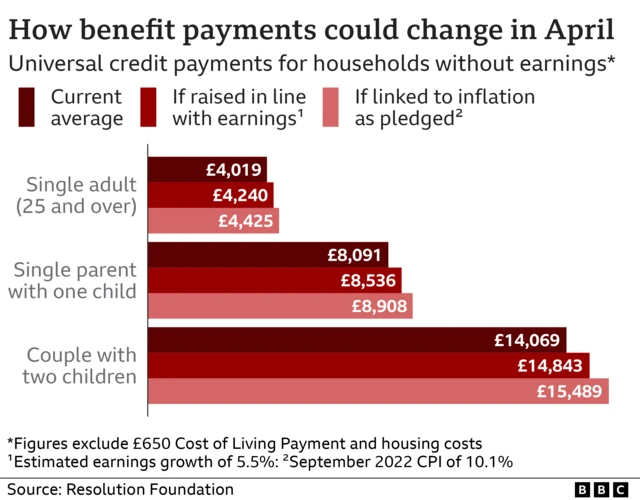

"Basically, people are looking for benefit checks to see if they can increase their income, because people simply can't afford the essentials, they can't afford the energy and they can't afford the food bills."

Amanda, a single mum, is worried about the cost of getting her son, who has autism spectrum disorder, to college. "My son doesn't get any money, he used to get DLA (disability living allowance) but he doesn't anymore. And I have to pay for a new car to drive him to Shields for college every day. I'm struggling. I really am."