A lack of Budget excitement among Tory MPspublished at 11:43 GMT 7 March 2024

Henry Zeffman

Henry Zeffman

Chief political correspondent

Jeremy Hunt’s Budget has been reasonably well-received by Conservative MPs. But certainly not spectacularly well-received.

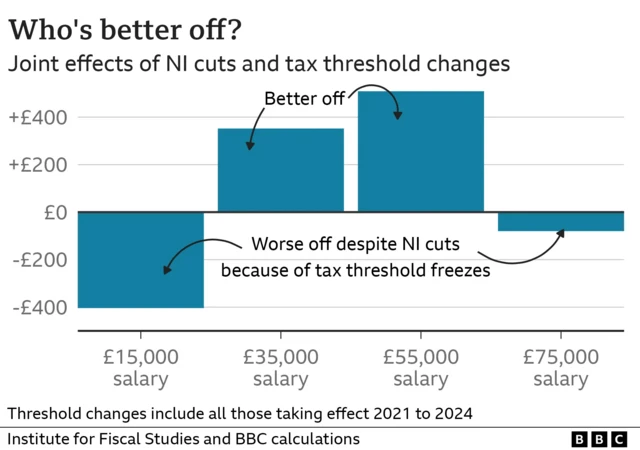

Part of that is probably in the sequencing. The simple fact is that the chancellor’s immediate audience already knew about the biggest announcement - the 2% cut in National Insurance - and nothing came along to overtake that.

It’s also the case that a lot of Tory MPs had been hoping for an income tax cut, believing that would be an easier, more straightforward sell on the doorstep in a general election. Ultimately the chancellor decided that this was not possible within his own fiscal rules and the broader economic environment.

“Average”, “solid”, “relatively good” were three of the phrases offered up by MPs when I asked for their reaction - all strikingly mild adjectives.

It’s been the case for a while that even when fairly big political events happen, many Conservative MPs seem resigned to them rather than exercised by them. That’s a source of frustration for some of PM Rishi Sunak’s supporters, who believe the election is still in play and MPs should behave accordingly.

The Budget didn’t do enough to shake those MPs out of their political stupor.