Liberal leader weighs inpublished at 08:59 GMT 26 November 2014

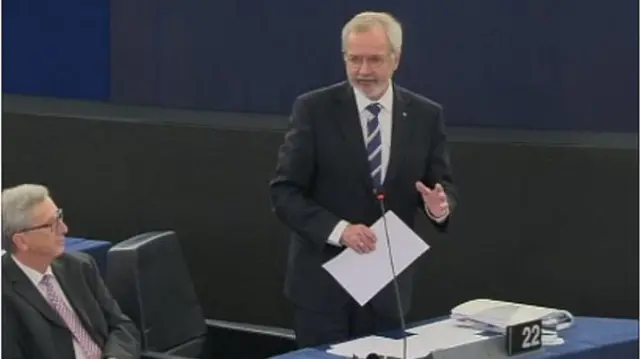

Liberal group leader and former prime minster of Belgium Guy Verhofstadt says the investment should be made conditional on structural reforms, and that the plan should be accompanied by regulations to further unify the EU's single market.

He says he supports a guarantee scheme to boost lending, and calls on the Council of Ministers to prompt the member states into supporting greater investment too.

The Liberal group have also come up with their own plan, external, which they say would mobilise around €700bn in investment.

They have also criticised the plan being put forward by the Socialists, since they say it relies on setting up a fund that is financed with contributions of the member states, thus creating more public debt.