SNP's Hosie: Osborne cutting more than neededpublished at 17:25

Spending Review: Stewart Hosie says chancellor cutting more than needed

George Osborne delivers Autumn Statement and Spending Review

The chancellor says he has abandoned planned cuts to tax credits

Police budgets also escape cuts with economy boosted by £27bn windfall

Labour says working families will still lose out

Autumn Statement sets out state of UK economy and signals tax and welfare plans

Spending Review set out details of plans to cut government spending over next few years

Tom Moseley, Rajdeep Sandhu, Tom Espiner and Pippa Simm

Spending Review: Stewart Hosie says chancellor cutting more than needed

BBC personal finance reporter tweets...

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

The apprenticeship levy is the "big revenue raiser" in the Autumn Statement, says the Chartered Institute of Taxation, "raising an extra £3bn a year from business by 2020" that "will mean a hefty additional cost for some businesses".

John Cullinane, tax policy director of the Chartered Institute of Taxation, says:

Quote MessageThe Government is keen to stress that businesses that invest in apprenticeships should do well out of this new source of funding. It is odd that the levy appears in the... documents as improving the government’s finances by £3bn a year when it is meant to be hypothecated toward increasing the quality and quantity of apprenticeships: government accounting sometimes is odd."

Former shadow work and pensions secretary tweets...

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Following the pensions reforms put in place last year, the Chancellor has taken a "wait-and-see" approach this year says Andy Cummings, head of asset management firm Close Brothers.

He says the state pension should not be solely relied upon as a source of income as the population, and therefore retirement, becomes longer. He says the chancellor should have encouraged more long-term saving.

Quote MessageThe chancellor missed a trick by not taking action to encourage this behaviour. Reduced tax relief for high earners, not to mention a lower lifetime allowance, has penalised long-term pension saving, and reversing these policies would have helped encourage and reward the necessary pension saving to reduce the dependency on the State Pension.”

BBC News Channel

BBC News Channel

If George Osborne thought tax credit cuts were a good idea several months ago, why has he scrapped them altogether now? Treasury minister David Gauke says the public finances are in a stronger position than initially forecast "so we've got greater scope for flexibility", meaning the £12bn welfare cuts can be found elsewhere.

Labour's shadow business secretary Angela Eagle said the chancellor was forced into a rethink by the Lords defeat and opposition. But she says the "small print" suggests the same families will still lose money as a result of other cuts. She says government should be creating "higher value, better paid" jobs.

Quote MessageYou can grow your way out of some of these problems, rather than cut, cut, cut."

Who will build the 400,000 houses promised in the Autumn Statement, recruitment firm Randstad asks?

Quote MessageOur analysis shows the vast gap in the capacity of the UK workforce to build homes, and the need for places to live for a growing population. As a country we need to find 100,000 carpenters, 89,000 plumbers, 27,000 bricklayers. We’re facing a shortage of 9,000 floorers and 14,000 roofers. To build enough homes the UK needs to train an extra 30,000 quantity surveyors and 61,000 project managers."

Owen Goodhead, Managing director, Randstad

Former adviser to Tony Blair and Gordon Brown tweets...

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Ross Hawkins

Ross Hawkins

Political correspondent

Image source, PA

Image source, PAThe chancellor has reversed some of his tax credit cuts but says he has still managed to save the £12bn in welfare he promised before the election.

How come?

The Treasury says the £12bn saving was always intended to be made in 2019. By then tax credits will make up just a small part of the planned savings, because they will be a legacy of an old system as people move on to Universal Credit.

So the U-turn will cost the Treasury £3.4bn next year - when lots of people will still be claiming tax credits - but in 2019 when more are claiming Universal Credit the cost be just £910m.

The chancellor has made up for that £910m by other welfare savings in the Autumn Statement including a cut to housing benefit, a change to Universal Credit for the self-employed and delaying social care reforms.

The way temporary accommodation for the homeless is funded will change, and it will be counted as local government spending, not welfare, in future.

Taken together they fill the hole which is much smaller in the year the Treasury say matters than the debate about a U-turn before today might have led you to think.

Susan Kramer and Douglas Carswell on chancellor's announcements

Welcoming today's Spending Review announcements, The Institute of Public Policy Research think tank warned more needs to be done to tackle possible financial problems in the future.

They were pleased that spending on education, adult skills and science would be maintained, alongside an increase in infrastructure.

Quote MessageHowever, the OBR’s latest forecasts suggest that the UK’s fundamental imbalances – weak export performance and a reliance on consumption for growth – are expected to stay with us for at least the next five years. Tackling these imbalances is essential if the UK economy is to weather future downturns."

Former Labour shadow chancellor Chris Leslie on tax credits: "Don't be under the illusion it's a u-turn. It's a delay."

BBC south west political editor tweets...

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

The Spending Review has revealed smaller cuts to government departments than were previously expected says the Institute for Government.

However they say councils receiving extra financial responsibilities will lead to "higher council taxes".

They add there are also "big challenges" to achieve "ambitious" plans of moving government services online, in order to allow people to pay over the internet. This is expected to happen by 2020 with fewer civil servants.

Quote MessageThe other striking feature of the statement is the big changes to local government financing. The increased powers for councils are being accompanied by increased financial responsibilities which are likely to result in higher council taxes."

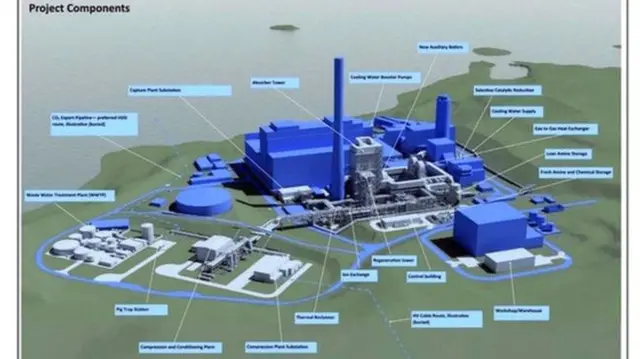

Peterhead power station was a bidder

For more on the news that the government is to axe a £1bn grant for developing new carbon capture and storage (CCS) technology, see our story here.

Two of the big announcements from George Osborne were the scrapping of tax credit cuts, and the news that there would be no cuts to police budgets.

Here's a brief look at some of the others things he announced:

Rob Burton, who runs interior design business DAPA, says there has to be a strategy behind the government's house building plans, citing the need to address skills shortages in the industry.

He also thinks the buy-to-let changes will have a "huge impact" on the market. Investors, he says, will put up their rents meaning that those who now can't afford to buy, won't be afford to rent.

An apprenticeship levy will create more bureaucracy for businesses according to accountancy firm Grant Thornton.

The firm says the Spending Review raised "more questions than answers" and "risks creating additional bureaucracy".

The Apprenticeship Levy will be introduced in 2017 and ensure the businesses pay for training workers.

Quote MessageAlthough there is positive intent behind the levy, the actual impact could be akin to 'a tax on jobs' and adds yet another layer of complexity to corporate compliance and reporting. Some specific sectors will be awaiting the detail with baited breath, including: care and education agency worker providers."

BBC News Channel

BBC News Channel

Mike Cherry, of the Federation of Small Business, says he was "very pleased" by the infrastructure investment announcements and by the extension of the small business rate relief.

"That was a positive for us," he tells the BBC, but adds that business will want to see the detail of the announcement on apprenticeships

The OBR confirms that the government is expected to break its own welfare cap in each of the three years from 2016-17.

That's the welfare cap that it reduced in the July Budget.

It will mean that the government will have to get approval from MPs for the additional spending.

And actually, the OBR says welfare spending only just manages to keep within the cap in 2019-20 and 2020-21. In fact, it is forecast to be above the cap, but by less than the 2% margin to allow for forecasting errors.