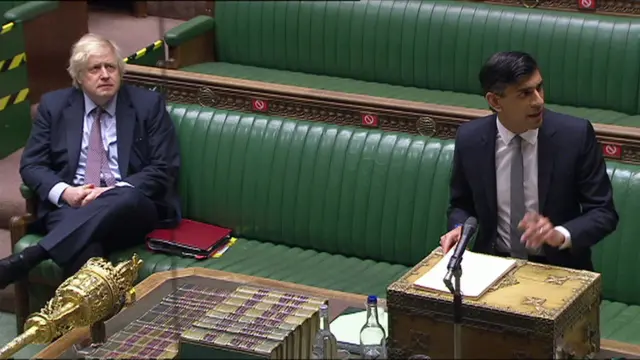

Recap: State of the economy and public financespublished at 13:12 GMT 3 March 2021

Image source, PA Media

Image source, PA Media- UK economy forecast to return to pre-Covid levels by middle of 2022

- Annual growth set to rebound by 4% this year, followed by 7.3% growth in 2022

- Unemployment expected to peak at 6.5% next year, lower than 11.9% previously predicted

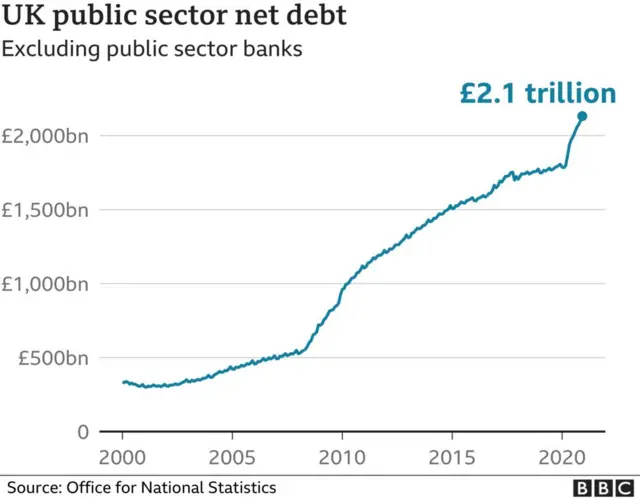

- Borrowing at highest peacetime levels in history