Pound sinks as investors question huge tax cutspublished at 17:12 BST 23 September 2022

Image source, .

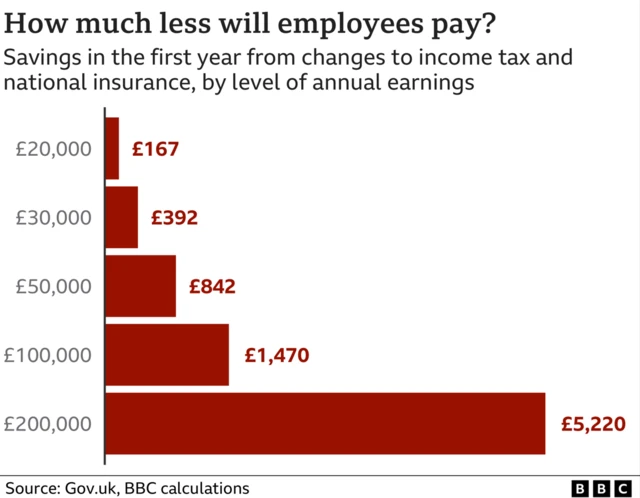

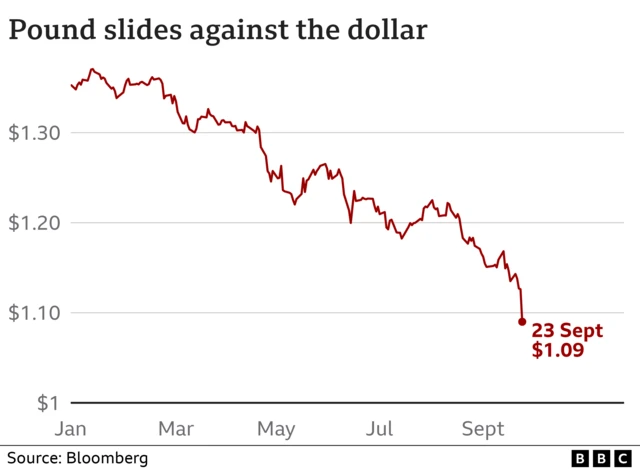

Image source, .The pound has fallen to a fresh 37-year low against the dollar as financial markets reacted to the biggest tax cutting moves since 1972.

It's fallen to $1.09 after Kwasi Kwarteng outlined a series of economic measures in a massive shake-up of the country's finances - but why?

Paul Johnson, director of the Institute for Fiscal Studies think tank, says: Today, the chancellor announced the biggest package of tax cuts in 50 years without even a semblance of an effort to make the public finance numbers add up.

"Instead, the plan seems to be to borrow large sums at increasingly expensive rates, put government debt on an unsustainable rising path, and hope that we get better growth."

He adds: "Injecting demand into this high-inflation economy leaves the government pulling in the exact opposite direction to the Bank of England, who are likely to raise rates in response.

"Early signs are that the markets – who will have to lend the money required to plug the gap in the government’s fiscal plans – aren’t impressed."