What happened today?published at 20:58 BST 23 September 2022

Image source, .

Image source, .We're going to wrap up our live coverage now - let's take a look at what we learned today:

What happened? Kwasi Kwarteng delivered a sweeping mini-budget in his first major speech as chancellor.

What was announced?

- Cuts to stamp duty foe homebuyers in England and Northern Ireland

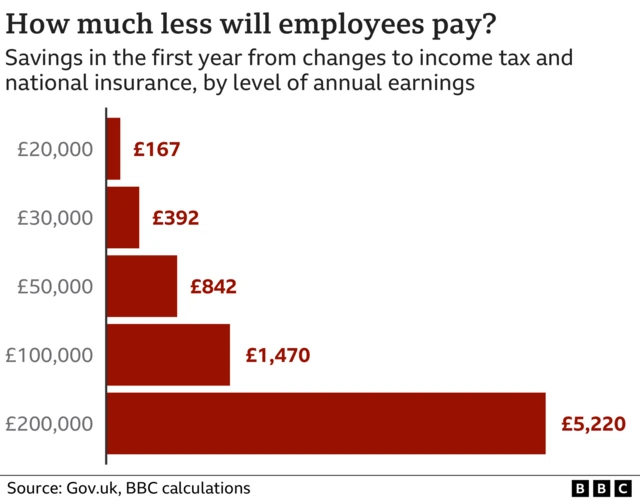

- A cut in the basic rate of income tax will be brought forward by a year, and the 45% rate was scrapped

- A hike in National Insurance contributions was reversed

- Rules around universal credit were tightened, by reducing benefits if people don't fulfil job search commitments

- A UK-wide rise in corporation tax, which was due to increase from 19% to 25% in April 2023, was cancelled

- A cap on bankers' bonuses was scrapped

Find an easy-to-read list of all today's announcements here.

How was it received?

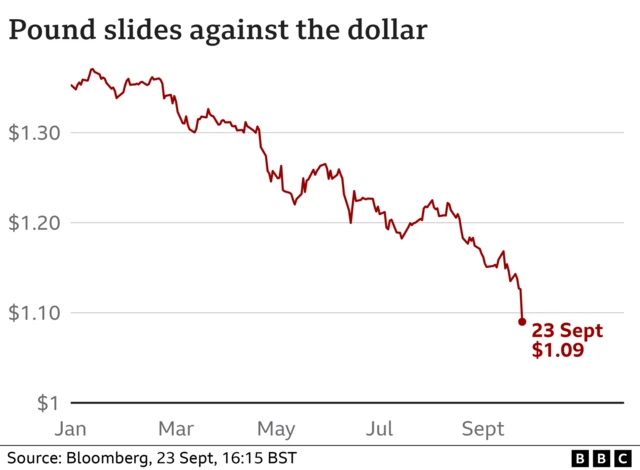

- The pound fell to a fresh 37-year low against the dollar as financial markets

- The government was accused by Labour and some charities of prioritising the richest proportion of the population

- Shadow chancellor Rachel Reeves called it "the wrong tax cut, at the wrong time"

- Meanwhile, Lib Dem leader Sir Ed Davey said the government was "totally out of touch with ordinary people and businesses"

- In an interview with the BBC, Kwarteng defended his policies, saying that they weren't a gamble

Image source, .

Image source, .