What's all this got to do with my money?published at 11:45 BST 12 October 2022

Kevin Peachey

Kevin Peachey

Personal finance correspondent

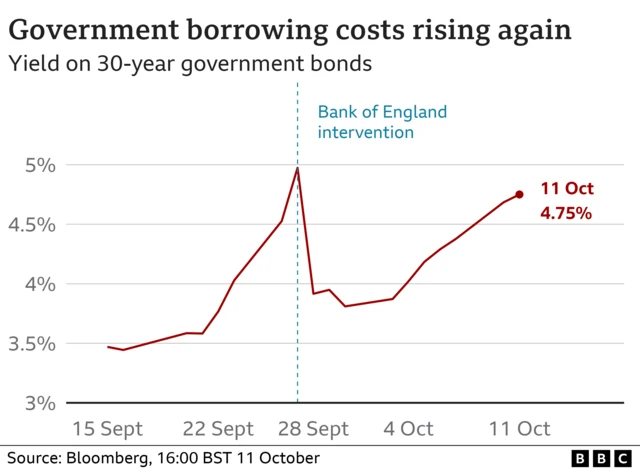

Markets, government bonds and Bank of England interventions may seem a world away from your own finances - but they do have an impact.

For example, if the cost to the government to borrow money rises then that affects its ability to deliver services (and indeed tax cuts) to all of us while trying to balance the books.

That brings spending cuts into the equation, hence the debate over the increase in benefits next year.

Of course, the government is prioritising growth, which would create a more buoyant economy.

Meanwhile, in the background, prices are still rising fast, in part owing to global factors. That is generally controlled by putting up interest rates, which makes borrowing, such as mortgages, more expensive. Savers may get better returns, but the buying power of those savings is being eaten away by rising prices.