Truss manoeuvres fail to quell market fearspublished at 11:44 BST 15 October 2022

Much of the drama following the government's 23 September mini-budget has been to do with how international financial markets have responded.

Your mortgage and pension can be affected by turbulence in the markets - something that's often reflected in the government's cost of borrowing money.

Government borrowing costs rose yesterday, despite a second U-turn from the Prime Minister on her tax-slashing plans. The value of the pound, which initially held firm earlier on Friday, also lost ground.

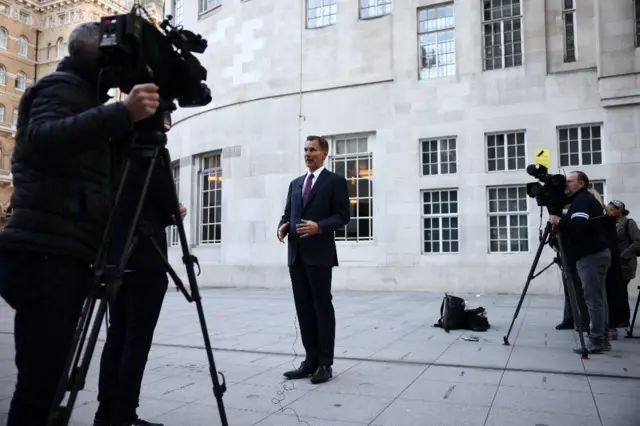

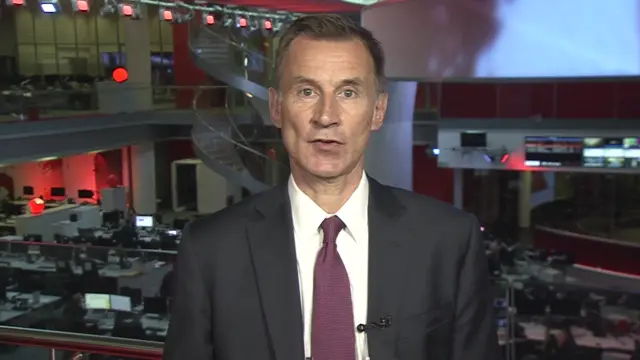

The moves came as Liz Truss sacked her chancellor, Kwasi Kwarteng, and said a rise in corporation tax would now go ahead - a U-turn on one policy that had spooked markets.

Some economists have warned that these steps might not be enough to restore the UK's credibility.

It was "unlikely" that Truss's actions, on their own, would be sufficient to "regain the full confidence of the financial markets," said Paul Dales, chief UK economist at Capital Economic.

The PM has insisted she will stay in post to get the economy growing.