What are we expecting today?published at 07:28 BST 17 October 2022

This morning was already being considered a key test of whether investors believe the government’s latest economic plans are credible following a policy U-turn on corporation tax by Liz Truss on Friday.

The volte-face didn’t have the immediate desired effect. When the markets closed last week, the cost of government borrowing was creeping back up.

It was approaching the level at which the Bank of England was recently forced to make an intervention in the bond market that was designed to prop up investments held by pension funds. The pound also lost ground late on Friday.

The Bank made clear that its emergency scheme - which involved committing to buying government debt - would not continue beyond Friday, making today another key test.

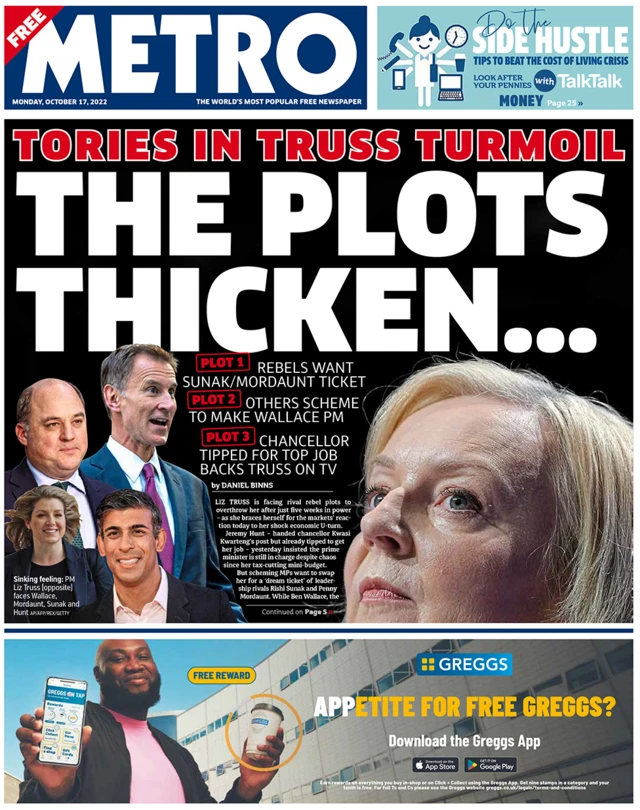

With the installation of Jeremy Hunt as chancellor, pundits say so-called “Trussonomics” has been killed off. Now he's moved early to reassure markets before they open, with an announcement about an announcement later today.

But some economists warn that these developments still might not be enough to restore the UK's credibility.

Image source, Getty Images

Image source, Getty Images