A number of assumptions underpin Labour costingspublished at 11:49 BST 13 June 2024

Dharshini David

Dharshini David

Chief economics correspondent

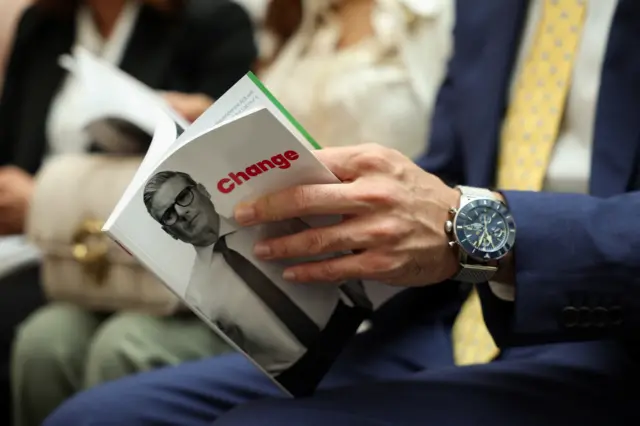

As Starmer continues outlining his plans, we've been picking over the manifesto.

Labour's plans will be funded by intentions to raise £8bn through putting VAT on private school fees, clamping down on those who are underpaying tax and closing loopholes and a windfall tax on oil and gas.

As we’ve been saying with all manifestos, there is much uncertainty about the amount these sources can raise, and the assumptions that underpin the numbers.

For example, the sum from putting VAT on private school fees will depend on the number of families who opt away from private schooling – a figure no one can be sure of, particularly following a cost-of-living crisis. And cutting down on tax avoidance is often easier said than done.

Remember, Labour’s intended fiscal rules look very similar to the Tories – meaning, that as per current plans, there could be substantial cuts to the budgets of some public services in the years following the election.

And Labour's plans point to a bigger net increase in tax take than the Conservatives - even while they pledge not to raise income tax, VAT and National Insurance.