Minister quits over bet crackdown 'delay'published at 21:40 GMT 1 November 2018

Sports Minister Tracey Crouch says fixed-odds machines should be curbed now to save gamblers from harm.

Read MoreMinister resigns over 'delays' to maximum stake for fixed-odds betting machines

MPs debated an urgent question on the matter this morning

MPs concluded debate on 2018 Budget during afternoon

They later approved series of motions authorising government spending plans

Legislation implementing Budget expected to be published next week

Lords debated social mobility and problem gambling

Sophie Morris, Robbie Hawkins and Richard Morris

Sports Minister Tracey Crouch says fixed-odds machines should be curbed now to save gamblers from harm.

Read MoreFollowing a short adjournment debate on the future of financial clearing houses after Brexit, the day in the Commons come to an end.

MPs will be back next Monday.

Former sports minister Tracey Crouch tweets:

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Budget Debate

House of Commons

House of Commons

Parliament

By 312 votes to 295, MPs approve budget resolution 79, which empowers the Treasury to maintain the effect of certain taxes after Brexit.

Some MPs suggested it was a power grab by the government, allowing ministers to make certain changes without consulting Parliament.

Benefit cuts debate

House of Lords

House of Lords

Parliament

Image source, HoL

Image source, HoLWork and Pensions Minister Baroness Buscombe says the government spends more than any other developed nation on supporting families.

She says that Labour created "complicated" systems of tax breaks and benefits for families.

1.4m people spent the majority of 2000-2010 on benefits, she says.

"The system simply was not sustainable," she states.

There are 637,000 fewer children growing up in "workless households" since 2010, she states, adding that the government believes the "best way out of poverty" is through work.

With that, the Lords adjourns.

Benefit cuts debate

House of Lords

House of Lords

Parliament

Image source, HoL

Image source, HoLOpposition spokesperson Baroness Drake says the Department for Work and Pensions has "routinely dismissed evidence" that "it does not want to see".

Levels of child poverty are rising, along with household debt and insecure contracts or self employment, she says.

She says most of the projected increase in child poverty comes from a limit on paying child benefits to families with three or more children under universal credit.

"This is a system that is causing anxiety and hardship, wherever it is rolled out," she says.

"The budget was a missed opportunity to bring children in from the cold".

House of Commons

House of Commons

Parliament

By 314 to 31, MPs pass budget resolution 5, which authorises government plans to bring forward a planned rise in the personal allowance threshold.

Under government plans, the point at which people start paying income tax will rise to to £12,500 next April - a year earlier than planned.

After quickly approving a series of other motions, they divide to vote on resolution 79, which Labour said earlier they will oppose.

The resolution relates to the way government can make tax changes after Brexit.

BBC political correspondent tweets:

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Budget Debate

House of Commons

House of Commons

Parliament

First up, MPs vote on resolution number 1, which authorises the government to levy income tax during the next financial year.

Under parliamentary rules, this is the only one of the budget resolutions which can be amended.

However they vote to reject Labour's amendment calling on the government to assess the Labour's own income tax proposals by 313 votes to 246.

The amendment was tabled last night, amid reports Labour MPs would defy their party whip and vote against government plans to change the higher rate income tax threshold.

Shadow chancellor John McDonnell had said Labour would not oppose plans to raise the 40% rate to £50,000 from next April.

The government resolution is then later approved.

Debate on the Budget comes to a close, and MPs will now vote on a series of ‘ways and means’ resolutions to bring in the finance bill.

This is the legislation which implements the government’s proposed changes to income tax and corporation tax. It is expected to be published next week.

Budget Debate

House of Commons

House of Commons

Parliament

Image source, HoC

Image source, HoCChief Secretary to the Treasury Liz Truss says "this is a budget that will help working families and grow our economy."

"Even the shadow chancellor has welcomed our tax cuts," she says, adding: "it's just a shame his party don't agree with him...But there is always a space for him on our front bench".

During her speech, Tory MP Iain Duncan Smith intervenes to ask if ministers are willing to discuss the date for the new maximum stake for fixed-odds betting terminals before the publication of the finance bill, the legislation which implements the Budget.

Ministers faced opposition this morning over alleged delays to the new £2 maximum bet, which will not come into force before October next year.

Liz Truss says says she is "happy to discuss" with MPs "what more we can do" about the matter.

There had been reports earlier today that ministers were facing a potential rebellion from Tory MPs who had wanted the maximum stake to be brought in earlier.

Budget Debate

House of Commons

House of Commons

Parliament

Image source, HoC

Image source, HoCShadow chief secretary to the treasury Peter Dowd, wrapping up for the opposition, says "austerity has never, and will not, end under a Tory government".

He says the government is making "unprecedented" attacks on Parliament and parliamentary scrutiny.

"There is nothing in this budget for our teachers, police officers or local government workers", he says, adding that the government has "broken all their own targets".

The money for the NHS "is not enough", he quotes the Health Foundation in saying, whilst social care funding is "less than half that what is needed".

He calls on Conservatives to support a Labour amendment to the resolution on income tax which will shortly be voted on, which sets out their plans for the tax system.

Benefit cuts debate

House of Lords

House of Lords

Parliament

Image source, HoL

Image source, HoLConservative Lord Shinkwin says one million disabled people gain around £110 per month due to the government targeting support to the "most vulnerable".

He says the government is "listening and acting" in response to issues raised by MPs. He describes Iain Duncan-Smith as a "champion of social justice".

He adds that he is pleased to learn that the DWP will fund Citizens' Advice in order to help out with Universal Credit payments.

He accuses Labour of a "total inability" to accept responsibility for the "high level of debt" that "Gordon Brown inflicted upon this country".

He says this would be worse under the "Marxist" Chancellor McDonnell if Labour were to win a general election.

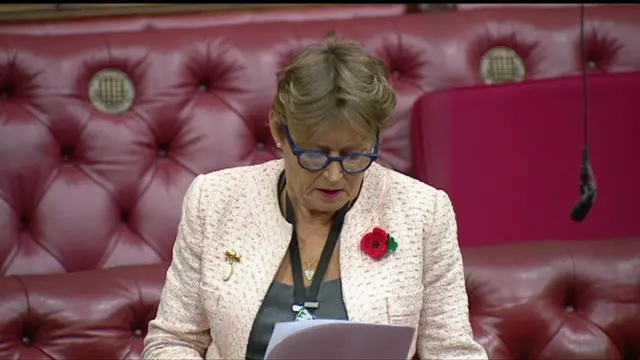

Benefit cuts debate

House of Lords

House of Lords

Parliament

Image source, HoL

Image source, HoLLabour's Lord Livermore, who worked for ten years in the Treasury during the last Labour government, says that Labour's work in office led to reductions in child poverty.

He says that any cuts the Chancellor now imposes, with "austerity over", are out of "political choice".

Those at the bottom 30% of income distribution will still earn less after the planned changes to the personal allowance, he says.

He says it would cost £1.5bn to reverse benefit cuts, but the Chancellor has made £2.8bn in tax cuts, of which half go to the top 10%.

He says many families in receipt of benefits are now £1,940 a year worse off.

He adds that it is a "bad choice for Labour to support" these new tax cuts.

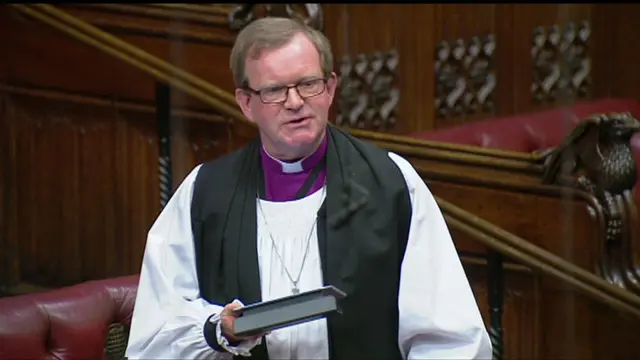

Benefit cuts debate

Image source, HoL

Image source, HoLThe Bishop of Portsmouth says it would be "negligent" to not express the "likely impacts" of other changes "coming down the tracks".

He says families with disabled children shortly face an "unjust, shameful reduction" in their benefits.

He states that he cannot accept the "government's rationale" for the two child limit on benefits, adding that this doesn't take into account a redundancy or a family breakdown.

"Children already in need will be in greater need" with further cuts, he says.

Benefit cuts debate

House of Lords

House of Lords

Parliament

Image source, HoL

Image source, HoLConservative Baroness Jenkin of Kennington says the government has a duty to ensure money is "well-spent," with benefits spending equivalent to 28% of government expenditure.

People are paying less in income tax since 2010, she says, and people are able to keep more of what they earn.

Youth unemployment has fallen by 40% since 2010, she adds.

"Those calling to dismantle UC risk throwing out the baby with the bathwater".

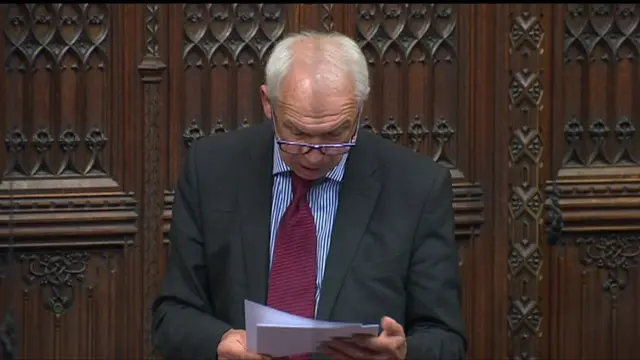

Benefit cuts debate

House of Lords

House of Lords

Parliament

Image source, HoL

Image source, HoLLabour's Lord Bassam of Brighton is now opening a debate on the impact of reducing welfare benefits, universal credit payments, tax credits, housing benefits and child benefit.

He pays tribute to former Labour minister Baroness Hollis, who died earlier this month, for fighting against cuts to universal credit and other benefits.

The last Labour government managed to bring 1.1m out of child poverty, he states.

Social security cuts "continue to hit the poorest hardest," he adds.

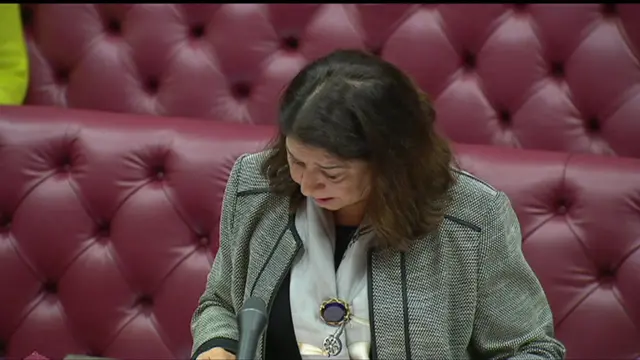

Problem gamblers debate

House of Lords

House of Lords

Parliament

Image source, HoL

Image source, HoLGovernment spokesperson Baroness Manzoor says that she "recognises the strong feelings across this House" on gambling addiction.

The rates of problem gambling in the UK have remained "relatively stable" over the years, she says, at around 1% of the population.

There is not enough data on what can be done to stop people from "stepping into problem gambling in the first place," she states.

The GambleAware charity commissions treatment services such as counselling and helplines, she adds.

Problem gamblers debate

House of Lords

House of Lords

Parliament

Image source, HoL

Image source, HoLShadow culture minister Lord Stevenson of Balmacara says that problem gamblers are more likely to relapse, and the rate of suicide among sufferers is high.

He says new technology enables more people "to get involved in this dreadful world".

Other countries have introduced bans on advertising for gambling during, before and after live sporting events on TV, he says.

The number of suicides is "such an extraordinarily worrying issue," he tells peers.

Budget Debate

House of Commons

House of Commons

Parliament

Image source, HoC

Image source, HoCLabour MP Dame Margaret Hodge says a "truthful conversation" needs to take place with voters about "how much we need to raise in tax to fund public services".

She had hoped to welcome the new digital services tax, she says, but calls the government's proposal "little more than a PR stunt".

Google and Facebook "should have paid £480m in 2017", she says, which exceeds the government's £400m projection for revenue from all tech firms.

"This tax gives us far too little and far too late", she adds.