Here are the main points from the Scottish budgetpublished at 17:20 GMT 9 December 2021

- Finance Secretary Kate Forbes says she has delivered a budget for "climate, recovery and equality"

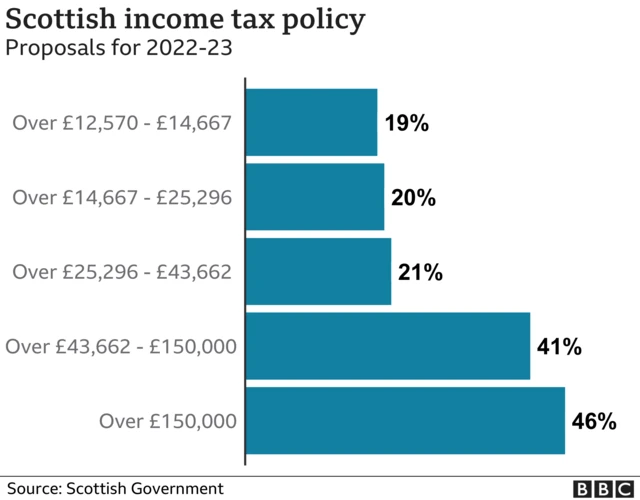

- Income tax rates will remain unchanged and and the threshold for the starter and basic rates will rise in line with inflation.

- Thresholds for the higher and top rates are frozen - meaning, as salaries rise, more people may be find themselves in the higher tax bands.

- The council tax freeze will end next year, with councils given full flexibility to raise rates for the first time since the SNP came to power.

- Forecasts from the Scottish Fiscal Commission predict the economy will be back at pre-Covid levels by next summer but there is uncertainty over future tax revenue.

- There is funding to deliver a £10.50 minimum wage for social care workers - but Labour says it's a "meagre" increase that does not go far enough to address staffing problems

- Business rates relief during the pandemic will be phased out in the first three months of the new tax year, avoiding a "cliff edge", but the Tories says there should be more generous business rate relief.

- The budget includes a record £18bn spending on health and social care, and Ms Forbes confirmed the doubling of the Scottish Child Payment to £20 from April, already announced by Nicola Sturgeon.

- There is also £2bn allocated to the decarbonisation of housing, transport and industry.

That's it for our live page coverage of the Scottish budget. Thanks for joining us.