An extra £1.5bn to be raised from income taxpublished at 15:54 GMT 19 December 2023

The Scottish government projects that an extra £1.5bn will be raised by income tax in Scotland next year. This will continue to rise over the next five years.

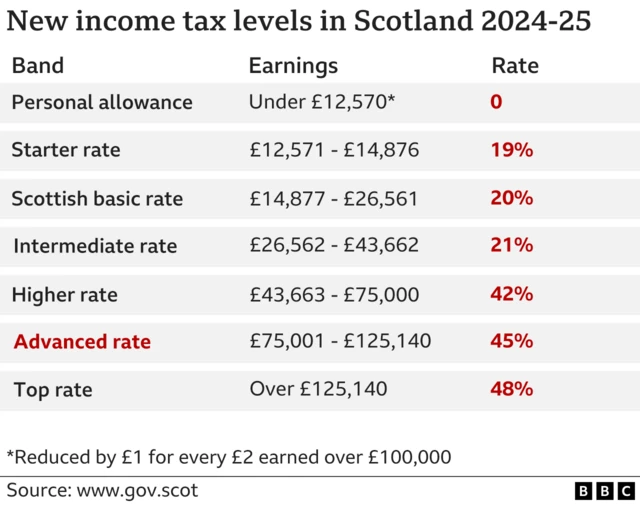

Scottish Finance Secretary Shona Robison announces a new 45% tax rate, as part of her budget

It will apply to earnings between £75,000 and £125,140

In addition, the top rate of tax for the highest earners is increasing from 47% to 48%

She also confirms plans for a council tax freeze

The Fraser of Allander Institute says the government is facing a funding shortfall of about £1.5bn

Scottish Labour describe the budget as "chaotic", while the Scottish Conservatives say the government is not taking responsibility for Scotland's fiscal circumstances

Edited by Catherine Lyst

The Scottish government projects that an extra £1.5bn will be raised by income tax in Scotland next year. This will continue to rise over the next five years.

David Henderson

David Henderson

BBC Scotland Business and Transport Correspondent

The new tax band at £75,000 might take many headlines but the bigger revenue-raiser is what's called fiscal drag.

This means more people are pulled into the higher rate tax band.

Shona Robison froze the higher rate tax threshold and it will now capture almost half a million Scots and raise an extra £300m.

The higher rate (42%) now applies to folk on £43,662.

Lots of people may be surprised to see they are higher rate tax payers!

Now it's the turn of Alex Cole-Hamilton to make his points and ask Shona Robison questions.

The Scottish Lib Dem leader criticises the SNP for not having a long-term economic strategy.

He says the SNP has also failed to grow the economy and adds that "councils are on the brink".

He asks why the government is slashing energy efficiency during a climate emergency and why the housing budget is being slashed during a housing emergency.

The finance secretary replies that there has been a 10% cut to the capital budget from the UK government over the next five years.

Ms Robison reiterates that her tax decisions raise £1.5bn of additional revenues that would not be there if they had followed UK tax policy.

She argues there is a record level of funding to local government, at over £14bn.

Shona Robison replies that she is not sure if Mr Marra is against those with the "broadest shoulders" paying a bit more.

"What Michael Marra is saying is that Labour would see £82m less investment in public services," she says.

She adds that the Welsh Labour government is also facing the same issues that the Scottish government is facing.

"We will work with our trade union colleagues in making sure that we reform our services in a way that can make them sustainable and high quality," she says.

"That's what we will get on with, we'll leave Micahel Marra and the Labour party to whinge from the sidelines as they always do."

Scottish Labour MSP Michael Marra says: "This is a chaotic budget from an incompetent government that will leave ordinary Scots paying much more and getting much less in return.

“If our economy had kept pace with other parts of the UK it would now be £8.5bn larger," he adds.

He asks if the deputy first minister accepts that her government's "failure to grow Scotland's economy" means the country is lagging behind England and Wales.

He also asks why she thinks Scottish people should bear the brunt of her government's failures in higher taxes and cuts to services.

Image source, PA Media

Image source, PA MediaThe biggest council union, Unison, has criticised the terms of the council tax freeze.

A spokesman questioned whether the money being offered would be sufficient and added: "This is really bad news for local services.

"The council tax freeze is fiscally feckless, doesn't help the poorest - and so much for the Verity House agreement [the agreement reached between councils and the Scottish government this autumn]."

David Henderson

David Henderson

BBC Scotland Business and Transport Correspondent

Scotland's income tax rates and bands are gradually diverging from the rest of the UK.

Today's statement underlines that trend.

And that should play a key role in helping the Scottish government fill the gap between what it brings in and what it spends.

Today's headline is a new tax band of 45% on earnings between £75,000 and £125,140.

Shona Robison said that's fairer, and that those with the broadest shoulders should pay a bit more.

But with income tax rates and bands devolved, this is just the latest change.

Scotland already has a 19% starter rate that doesn't apply in the rest of the UK.

Both Scotland and the UK have a 20% basic rate.

But Scotland also has a 21% intermediate rate.

And a higher rate of 42% - compared to a 40% rate elsewhere.

The threshold for the starter, basic and intermediate rates will rise with inflation, we're told.

But crucially, Shona Robison has left the higher rate and the top rate thresholds unchanged.

So with inflation still rising, more Scots are set to become higher rate tax payers -with the threshold frozen at £43,662.

It's called fiscal drag.

According to the Scottish Fiscal Commission which advises the Scottish government, all that will increase Scottish income tax receipts by £1.5bn between this year and next.

By coincidence, that's exactly the same amount as the spending gap which the economists warned us about.

The finance secretary points out that more money for the public sector and for capital were quite modest asks of the UK government, as it had £27bn of fiscal head room.

Yet the UK government chose to deliver only tax cuts and no investment in public services, a political choice made by the Tory Chancellor, she says.

Image source, Getty Images

Image source, Getty ImagesThe £1.5bn addtional money that the Scottish government has to spend is due to the tax decisions it has taken and she lambasts UK government failed policies.

Ms Robison tells the chamber: "The tax position is going to only impact on the highest-earning taxpayers in 2024/25."

A total of 51% of Scottish taxpayers will continue to pay less than the rest of the UK, she says.

The Scottish government estimates that 114,000 will pay the new advanced tax rate for those earning between £75,000 and £125,000.

About 40,000 people will pay the top rate - over £125,000.

The higher rate of tax (for those earning between £43,663 and £75,000) will be paid by 494,000 adults.

The intermediate rate (for those earning between £26,562 and £43,6662) will be paid by 918,000.

The basic rate (for those earning between £14,877 and £26,561) will be paid by 1,157,000 people.

The starter rate (for those earning between £12,571 and £14,876) will be paid by 266,000.

About 1,647,000 adults do not pay any income tax.

Liz Smith says the Scottish government does not take any responsibility for the current fiscal circumstances in Scotland.

"Indeed there was a complete abrogation of responsibility for the running of the Scottish economy, not just for this financial year, but for the last 16 years," the Tory MSP says.

"It will not wash with the public."

Ministers have failed to improve public services, they've failed to undertake public sector reform and they have failed to grow the economy, she says.

Ms Smith asks: "Why are you not supporting business more?"

She also asks if the government is sending out the right message that Scotland is open for business.

The National Care Service Bill should be shelved to allow for more local government funding, she says.

STARTER RATE (19%) £12,571 - £14,876

BASIC RATE (20%) £14,877 - £26,561

INTERMEDIATE RATE (21%) £26,562 - £43,662

HIGHER RATE (42%) £43,663 - £75,000

ADVANCED RATE (45%) £75,001 - £125,140

TOP RATE (48%) Above £125,140

"We cannot spend money that we do not have," explains Ms Robison.

"And we can't mitigate every cut made by the UK government."

The finance secretary tells the chamber: "We'lll always do our best with the powers that we have, there is simply no substitute for independence"

She says: "Through the choices we have made in this budget we've been true to our values and rigorous in prioritising our investment where it will have the most impact."

The social contract with the people of Scotland is at the core of this budget, she says, adding that she is proud to commend it to parliament.

Image source, PA Media

Image source, PA MediaThe Scottish government is investing £1.55bn in policing in 2024/25, increasing the Scottish Policing Authority resource budget by 5.6%, the deputy first minister says.

The policing core capital funding is also being increased by 12.4% to £64.5m for investment in the police estate, technology and its fleet, she adds.

Shona Robison also announces that the Scottish Fire and Rescue Service will also get a resource uplift next year of £13.5m and increased capital investment of £10.3m.

She adds the Scottish Prison Service will see an investment of £38.6m to its resource budget to meet rising costs and a £176m to modernise the prison estate.

Kirsten Campbell

Kirsten Campbell

BBC Scotland political correspondent

Tax is a key political dividing line.

Those on the left tend to think the better off should pay more to subsidise services for those who need them, while those on the right argue people should be able to keep more of the money they earn.

Scottish ministers tend to the left. But they argue that in return taxpayers benefit from a "social contract", which includes things like free prescriptions, free tuition fees and free bus travel for the young and old.

These benefits are universal, rather than means-tested.

While some claim that it would be better to target the funding on those who need it most, the Scottish government takes the view that the bureaucracy involved wouldn’t be worth it.

Instead it's created a new advanced tax rate of 45p on earnings between £75,000 and £125,140.

That salary level won't affect MSPs, but it will mean MPs have to pay more.

The deputy first minister says her government is "absolutely committed" to keeping the NHS publicly owned, operated and free at the point of need.

She says the Scottish government is giving an increase of more than £550m to NHS frontline boards.

"We are investing £2bn in health and social care integration, meaning that we are already exceeding our commitment to increase social care investment by 25% by the end of this parliament," she says.

Image source, PA Media

Image source, PA MediaSocial care and early learning and childcare workers in the private, third and independent sectors will also see more than £200m of additional funding to raise pay by at least £12 an hour from April 2024, she adds.

Shona Robison also announces that she will be reopening the independent living fund to support disabled people in Scotland.

Kirsten Campbell

Kirsten Campbell

BBC Scotland political correspondent

The announcement of a council tax freeze came as a surprise to local authorities during the SNP conference.

First Minister Humza Yousaf said the government wanted to be able to help people with rising bills during a cost of living crisis.

The Scottish government insists this freeze will be fully funded, but councils are not convinced.

Councillor Stephen Heddle, who is vice president of the local government umbrella body Cosla, warned that unless every council received additional money to the value of their planned increase, then service users would suffer the consequences.

The Fraser of Allander Institute notes that councils put their band D council tax up this financial year by between 3.9% and 10%, that's an average of 5.4% .

Shona Robison says councils will be compensated for an above-inflation 5% increase, taking local government funding to a new record high.

But some councils are bound to feel short-changed.

Image source, PA Media

Image source, PA MediaShona Robison turns to education and says "delivering excellence and equity in Scottish education remains a top priority".

The finance secretary tells the chamber: "We remain committed to investing £1bn over the course of this parliament to tackle the poverty-related attainment gap."

She says £130m of pupil equity funding will continue to empower head teachers across Scotland.

And £145.5m will continue to be provided for paying teachers via permanent contracts.

The finance secretary then turns to colleges and universities with more than £2.4bn of investment, which includes protecting free tuition.

Jamie McIvor

Jamie McIvor

BBC Scotland education correspondent

Councils are now poring over the details of the announcement.

They will get Scottish government money equivalent to the amount they would have raised by putting up council tax by 5%.

But some had initially contemplated a bigger rise or had anticipated gaining income from proposals to increase the council tax bills of those in the most expensive homes.

Individual councils should soon learn just how much government money they will get next year.

They will then work out exactly how much they may have at their disposal when they set their budgets in about two months’ time.

Council leaders from across Scotland are set to discuss the budget at a special meeting on Thursday.

There is a gamble for the government.

Will the public welcome a council tax freeze - one bill which is not going up at a time when many households are facing the squeeze?

Or will they feel resentful if they see obvious cuts in services which their council may blame on the details of the freeze or wider issues with council funding?

The deputy first minister turns to transport and says the next phase of the dualling of the A9 will be progressed.

Ms Robison says there will be a statement on the A9 in Holyrood tomorrow.