General questions is nextpublished at 11:45 GMT 23 March 2017

Image source, PA/Thinkstock/Scottish Parilament

Image source, PA/Thinkstock/Scottish ParilamentGeneral questions is next

Holyrood holds a minute's silence as a mark of respect, sympathy and solidarity with the victims of the terror attack at Westminster

Nicola Sturgeon is quizzed by opposition MSPs during first minister's questions

'Above all we stand in solidarity with London,' says first minister

'We will not be silenced and we will not be cowed,' says Scottish Conservative leader Ruth Davidson

Colin Bell and Craig Hutchison

Image source, PA/Thinkstock/Scottish Parilament

Image source, PA/Thinkstock/Scottish ParilamentGeneral questions is next

Image source, bbc

Image source, bbcPresiding Officer Ken Macintosh

Presiding Officer Ken Macintosh says he has written to speaker Bercow, the Lords and the mayor of London to convey sympathy and condolences following the Westminster terror attack.

Mr Macintosh says flags are flying at half mast and Holyrood held a minute's silence as a mark of respect this morning.

Despite there being no specific threat, he says, secutiy has been heightened.

Mr Macintosh confirms the debate on Scotland's Choice will be rescheduled for next Tuesday.

He says: "This shocking event should serve to remind us of the importance of holding on to our humanity."

At today’s first minister's questions each of the party leaders will ask questions about yesterday’s terror attack at Westminster (effectively in lieu of a statement).

The other selected questions will be asked as normal but there will be no additional constituency questions from backbenchers.

MSPs hold a minute's silence

Flags at the Scottish Parliament are flying at half mast as a mark of respect.

Holyrood held a minute's silence at 9.33am, the same time as Westminster held one.

The first minister has expressed her concern for those caught up in the terror attack, adding that "we all feel a sense of solidarity with the people of London".

The Scottish Parliament debate on whether to seek a second independence referendum is to resume next Tuesday.

The debate was suspended on Wednesday afternoon following the terror attack in London that has left four people dead.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

SNP MSP Colin Beattie asks where oil workers are deemed to be resident.

National Audit Office director Steven Corbishley says it all depends where they live and that is the residence test.

"They will have a home" and that will be used to determine whether that person is a UK taxpayer, he says.

Committee convener Jenny Marra moves the committee into private session.

Image source, bbc

Image source, bbcAuditor General for Scotland Caroline Gardner

National Audit Office director Steven Corbishley says if HMRC need further evidence they will go on the number of days you physically spend in Scotland to determine whether you are a Scottish taxpayer.

Auditor General for Scotland Caroline Gardner says the focus for HMRC will be on WILLIEs, those working in London and living in Edinburgh, when the threshold for paying the 40p rate starts at £43,000 in Scotland instead of the £45,000 elsewhere.

National Audit Office director Steven Corbishley

Committee convener Jenny Marra asks if there is going to be a loss to the public purse because of the communications not being as good as they should be.

National Audit Office director Steven Corbishley says it is not just about the letters, it is about the database.

Mr Corbishley says the database must be kept up to date and taxpayers must be aware of their responsibilities to keep the HMRC up to date.

Auditor General for Scotland Caroline Gardner say it is the responsibility of all taxpayers in the UK to keep HMRC up to date and it has never had as much importance than now because of the powers are being devolved.

Ms Gardner says before this everyone paid the same rate of income tax but that will now change.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

According to Audit Scotland's latest report on financial devolution, external :

Image source, Scottish Parlimaent/PA

Image source, Scottish Parlimaent/PAFinance Secretary Derek Mackay will read the Audit Scotland report with interest

Caroline Gardner, Auditor General for Scotland, said: "Implementing and managing the new financial powers will transform the work of the Scottish Government on an historic scale.

"It's made some good progress by getting the foundations in place for managing the new powers but the major funding and staffing implications of the next stage of financial devolution must be planned for and managed in an open and transparent way."

SNP MSP Alex Neil

SNP MSP Alex Neil raises the potential of loss of talent because of the higher levels of income tax.

Mr Neil asks if this could lead to "exporting of talent". He asks at what point some people may think "it is not worth the candle here".

He says "answers to these questions are fundamental," and the committee should carry out research work in this area.

Auditor General for Scotland Caroline Gardner says she would be happy to help the committees with any work in this area.

More work is required to manage the impact of new tax and spending powers, which are being devolved to Holyrood.

That's according to the spending watchdog, Audit Scotland.

In a report , external published today, it says a clearer picture's needed of what the changes will cost and how the right people can be recruited to run the system.

By 20-20, around half of all the money the Scottish government spends will be raised through taxes controlled from Holyrood.

That's a five-fold increase, in less than a decade.

Image source, Getty Images

Image source, Getty ImagesAs powers over social security are devolved, the Scottish government will process as many transactions in a week as it now does in a year.

Audit Scotland warns that presents a challenge.

The spending watchdog says the government's well organised to deliver what it calls these game-changing new powers.

However it calls for more work to identify what the changes will cost.

It also warns it may prove difficult to recruit people with the right skills, to manage the new financial powers.

Auditor General for Scotland Caroline Gardner

Auditor General for Scotland Caroline Gardner says from April the Scottish government will have control of all non-savings, non-dividend income tax.

Ms Gardner says roles and responsibilities are changing and it is very complex.

Tory MSP Liam Kerr asks if HMRC gets the number of taxpayers wrong the Scottish government could get less from the block grant and from its income tax revenue for 18 months.

Ms Gardner says Mr Kerr is correct to say that identifying the number of Scottish taxpayers is key to this.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Image source, Scottish government

Image source, Scottish government Image source, bbc

Image source, bbcNational Audit Office director Steven Corbishley

Ms Marra says there has been a proposal to close several centres across Scotland.

She asks how this will impact on the SRIT.

National Audit Office director Steven Corbishley says this more of a question for HMRC.

Mr Corbishley says this will be assessed by his office in due course.

Image source, Scottish Parliament

Image source, Scottish ParliamentHolyrood has made history by voting to set separate Scottish income tax rates and bands for the first time.

The SNP and Greens have agreed a deal which will see the basic rate, paid by most taxpayers, left alone.

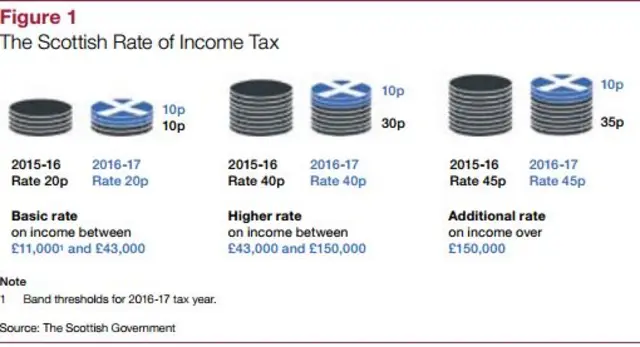

But the threshold for paying the 40p rate will start at £43,000 in Scotland instead of the £45,000 elsewhere.

In a separate move, Finance Secretary Derek Mackay also announced extra support for firms affected by business rate rises.

The income tax changes will mean people earning more than £43,000 in Scotland will pay up to £400 more than those on the same salary elsewhere in the UK.

The minority SNP administration had initially planned to raise the threshold for the 40p rate only in line with inflation, instead of increasing it to £45,000 as the UK government has done.

Committee convener Jenny Marra

Committee convener Jenny Marra says £8.4m is the amount paid by the Scottish government to HMRC for the implementation of the Scottish rate of income tax (SRIT).

Ms Marra says she is looking at that compared to the amount of tax being brought in.

She says the higher rate taxpayers pay the 40p rate at £43,000 and above compared with the band being £45,000 and above in England.

Ms Marra asks if any calculations have been made into how much extra tax this will raise for Scotland and how that compares to the £8.4m figure.

Auditor General for Scotland Caroline Gardner says no calculations have been done on that.