Scottish Fiscal Commissionpublished at 14:04 GMT 14 December 2017

Labour MSP Neil Findlay says the statement has not been given to MSPs, but is told that is not a point of order.

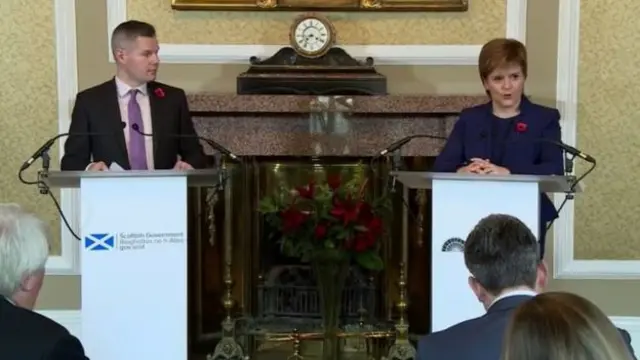

Mr Mackay continues saying the fundamentals of the Scottish economy remain strong.

He says the Scottish Fiscal Commission underlines these strengths.