Background: Draft budget and income taxpublished at 11:21 GMT 10 January 2018

Image source, bbc

Image source, bbcThe Finance Committee takes evidence on the draft budget from the OBR and the finance secretary

Justice Secretary Michael Matheson will now give a statement on the future of Police Scotland's chief constable amid claims he illegally blocked his return to work

The Scottish government leads a debate on the Glasgow 2018 European Championships

MSPs mark Holocaust Memorial Day 2018

Craig Hutchison and Louise Wilson

Image source, bbc

Image source, bbc Image source, bbc

Image source, bbcWith both Murdo Fraser and Derek Mackay citing the Fraser of Allander Institute to back their claims of a real terms increase or cut to the Scottish budget, here is there summary of the spending proposals., external

Douglas Fraser

Douglas Fraser

Scotland business & economy editor

Another thing: a wee note about £2bn. It's not a wee sum, but it might help to have some explanation.

It's the claim made by Philip Hammond for the additional money in his Budget coming to Scotland.

Sounds good. But what does it include?

For a start, it's spread over this year (a modest bit) and the next three financial years.

The source of controversy is that around £1.1bn is reckoned to be 'financial transactions'. That's a new-ish Treasury accounting device to distribute funds, on the understanding that they have to be repaid, eventually. They're for investments in realisable assets.

Image source, HM Treasury

Image source, HM TreasuryPerhaps Gladstone, the Treasury cat can make sense of it all?

That includes funds going into government co-funding of strategically significant new industries. The Scottish Investment Bank could benefit.

It's also for student loans and for the Help-to-Buy scheme, aimed at supporting first time homebuyers by taking an equity stake, to be repaid when that first home is sold.

There's around £500m of the big number for conventional government capital spending, to build roads, bridges, schools, hospitals, courts and trams.

That's welcome, but not as much as being able to splash around the resource (aka revenue, or day-to-day spending) budget on public services, much of which goes into public sector pay. That comes to somewhere between £350m and £400m over the four years.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Green MSP Patrick Harvie suggests the majority of revenue raised in income tax will go towards funding business rate cuts.

The finance secretary disagrees.

He says the overall policy decisions of income tax lead to £366m in revenue, exceeding the cost of the non-domestic rates changes.

Mr Mackay defends taking forward several of the recommendations from the Barclay review by stating most of the parliament is supportive of the proposals.

Image source, bbc

Image source, bbcMr Mackay and Mr Fraser enter their annual ding dong about funding from the UK government, both citing the Fraser of Allander Institute, but using different base line years.

The finance secretary says there has been a real terms reduction in the resource budget since 2010/11.

Mr Fraser says Fraser Of Allander says there has been no real terms cut in the budget in the last 10 years and he asks if that is correct.

The finance secretary says no, adding there has been a real terms cut in the resource budget since 2010/11 and Fraser of Allander accepts that.

Mr Fraser says there has been no real terms cut since 2007/2008.

'Interesting ding dong', says the conmittee convener.

In November the Scottish government dismissed the chancellor's pledge of extra funding for Holyrood as a "con".

Philip Hammond said moves in his Autumn Budget would "mean £2bn more for the Scottish government".

But Scotland's finance secretary said Holyrood had been "short changed", and that funds for day to day spending would actually fall.

Image source, PA

Image source, PAThe £2bn cited by Mr Hammond is spread over the period from the current financial year through to 2020-21, and includes more than £1.1bn in financial transaction funding.

This is capital funding for loan or equity initiatives, like "help to buy" schemes, meaning the government is constrained in how it is spent.

Mr Mackay said it was "money with strings attached" which could not be spent "directly on frontline public services" and would eventually have to be repaid to the Treasury.

He said the overall deal was "disappointing", telling the BBC's Politics Scotland programme that "it's not a £2bn boost to Scotland, it's a con".

Image source, Tory MSP Murdo Fraser

Image source, Tory MSP Murdo FraserTory MSP Murdo Fraser

Tory MSP Murdo Fraser asks if the Scottish government's discretionary spend is up or down.

Derek Mackay confirms it is up, but says he has been focusing on resource.

Mr Mackay says he has welcomed the financial transactions funding, but Mr Fraser notes he had originally described it as a con.

Image source, Thinkstock

Image source, ThinkstockMr Mackay says the government has held true to the four tests it set itself on income tax.

The four tests were:

Convener Bruce Crawford asks how the Scottish government has approached this budget given income tax devolution means economic growth in Scotland is increasingly important.

The finance secretary says he has looked a bit closer at the impact of policy in economic growth as it will directly impact resources available.

Committee Convener Bruce Crawford

Asked about the impact of UK government decisions, Derek Mackay says over the ten year period from 2010, overall resources are down in real terms.

Frontline services have been most effected by decisions at the UK level, he says.

While welcoming announcements on financial transactions, Mr Mackay emphasises this cannot be used on frontline services.

Elsewhere, the Federation of Small Businesses said a majority of its members were against income tax rises, and that the Scottish government was steering the country into "uncharted economic waters".

The Scottish Chambers of Commerce welcomed much of the budget as being positive for business, but repeated its concerns about "Scotland's new status as the highest-taxed part of the UK."

Andlocal government body Cosla said councils would continue to face "really difficult times" in the future, despite the "more measured approach" by the Scottish government.

Image source, PA

Image source, PAScottish Conservative finance spokesman Murdo Fraser branded the creation of a new basic rate the "Nat tax".

He accused the SNP of breaking a 2016 manifesto promise pledging not to increase the basic rate of income tax for those on low or middle incomes, and claimed the real reason was that Scottish economic growth is lagging behind the UK.

Scottish Labour leader Richard Leonard said the Scottish government's tax and spending plans had "tinkered round the edges" instead of implementing radical change and delivering a genuine alternative to "Tory austerity".

Scottish Greens co-convener Patrick Harvie said he was "delighted that the argument for a more progressive tax structure appears to have won the day", but said Mr Mackay should have gone further.

And Scottish Liberal Democrat leader Willie Rennie said the budget was a "missed opportunity" and "does not do enough to meet the long term needs in the economy".

Finance Secretary Derek Mackay

Finance Secretary Derek Mackay says he has tried to deliver both "sustainability and stimulus" to grow the economy and build a fairer country.

He commends the work of the Scottish Fiscal Commission in producing its first independent forecasts.

On income tax, he says the Scottish government took a consultative approach to try create a progressive system.

Douglas Fraser

Douglas Fraser

Scotland business & economy editor

The Scottish Fiscal Commission (SFC) last month rained on the finance secretary's budget parade with a dismal 0.7% growth forecast.

Elsewhere, the Fraser of Allander highlighted that real disposable household income - that's spending power after tax and benefits - was forecast by the SFC to fall for the next five years.

The Allander economists remind us that it's been falling for the past 10 years. We've never seen a period of stalled income as long as that - not in modern times anyway.

While the growth figures are grim, it's reckoned that the revenue figures aren't as bad as they could be. The fiscal framework was a (largely incomprehensible) deal between Holyrood and Westminster, which determined the formula for the block grant, now that income tax is devolved.

Image source, bbc

Image source, bbcHilarity abounds as Mr Crawford says the focus is on the constitution today!

Finance and Constitution Committee convener Bruce Crawford welcomes Finance Secretary Derek Mackay to talk about ......the constitution.

Mr Crawford apologises and says he has been obsessed with this, of course Mr Mackay is here to talk about the draft budget!

Image source, Getty Images

Image source, Getty ImagesDerek Mackay arrived in the Holyrood chamber alongside First Minister Nicola Sturgeon ahead of his budget speech

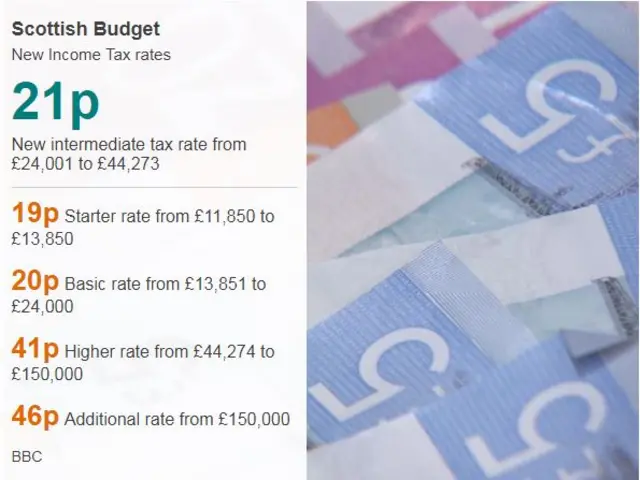

Last month the Scottish government announced income tax changes that will see higher earners pay more than elsewhere in the UK - and lower earners pay less.

Finance Secretary Derek Mackay announced a new tax band of 21p for those earning more than £24,000.

The higher rate of tax will be increased from 40p to 41p and the top rate from 45p to 46p.

But a starter rate of 19p in the pound will also be introduced, Mr Mackay confirmed in his draft budget.

Mr Mackay said the move to a five-band income tax system will mean no one earning less than £33,000 in Scotland will pay more tax than they do now.

Image source, bbc

Image source, bbcFinance Secretary Derek Mackay

That concludes the evidence session with OBR chair Robert chote.

Finance Secretary Derek Mackay is next in the hot seat.

Tory MSP Adam Tomkins asks if the Scottish government's planned restructure of income tax is likely to have a consequence on the economy.

He notes the UK's three income tax bands are spread quite far apart, but introducing rates of 19%, 20% and 21% in Scotland is bucking this trend.

Tory MSP Adam Tomkins

OBR Chair Robert Chote suggests changes to lower bands will not have a huge impact on the economy.

He says creating the new bands will come with an administrative cost but is unsure what the significance of this cost is.

Image source, bbc

Image source, bbcWilliam Pitt the Younger

William Pitt the Younger introduced the first ever version of income tax in the UK on 9 January 1799.

Happy Birthday.

People earning over £60 per year paid a little under 1%.

Image source, bbc

Image source, bbcThe changes to the income tax system in the Scottish budget mean almost everyone in the country will notice some difference in their lives.

The most significant change is the move to a five-band income tax system.

This isn't just as simple as lower earners getting a tax cut, while the better off pay more.

Because the higher-rate threshold is rising by the rate of inflation, people earning £50,000 in Scotland will actually be £85 better off in 2018-19 than they were the previous year - the rising threshold means less of their income is being taxed at the higher rate.

However, because Chancellor Philip Hammond rose those thresholds even further in the rest of the UK, someone earning the same amount outwith Scotland would be £655 better off.

Confused yet? Well, accountancy body ICAS has examined how things break down for different income groups - both compared to the current situation, and to how things will be in the rest of the UK.

Overall, 70% of Scottish taxpayers will pay less than they do at present, while 55% will pay less than they would if they lived elsewhere in the UK. That does, of course, mean 30% will pay more than they did last year - and 45% will pay more than they would if they lived south of the border.

Be warned, however, that these might not be the final figures - there's still the matter of Finance Secretary Derek Mackay finding someone to vote for his budget.