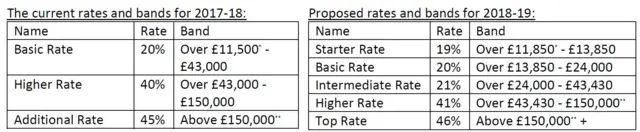

Finance secretary lacked 'political will' and 'tinkered around the edges'published at 14:57 GMT 20 February 2018

Mr Kelly says his party has proposed a taxation plan to create an extra £960m because that is what is required.

He says: "What we have heard from Mr Mackay is a litany of excuses as to why he can't increase tax."

The Labour MSP says the finance secretary did not have the political will and has only "tinkered around the edges".