Time for reflectionpublished at 14:02 BST 29 May 2018

The Very Reverend Dr Lorna Hood OBE, Chair of Remembering Srebrenica Scotland, delivers today's time for reflection.

Witnesses criticise the lack of consultation over bank closures at the Economy Committee

MSPs agree the general principles of the Planning (Scotland) Bill but calls are made for substantial changes

SNP MSP leads a debate on support for the families of missing people

Louise Wilson and Craig Hutchison

The Very Reverend Dr Lorna Hood OBE, Chair of Remembering Srebrenica Scotland, delivers today's time for reflection.

Image source, PA

Image source, PAComing up after lunch, two topical questions will focus on interventional radiologists and the SNP's growth commission report.

Then MSPs will debate the Planning Bill for the first time.

Rounding off the day, SNP MSP Fulton MacGregor leads a member's debate calling for support for families of missing people.

Image source, Getty Images

Image source, Getty Images Image source, bbc

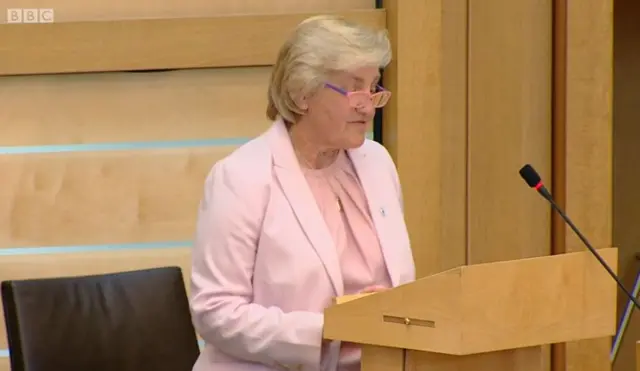

Image source, bbcCurrie Community Council chair Allister Mackillop

Currie Community Council chair Allister Mackillop says the UK government failed to bring in legislation to address bank closures in 2014.

Mr Mckillop argues: "With 71% ownership of the Royal Bank of Scotland, is it not the tail wagging the dog?"

"It's beyond my comprehension why the government hasn't done something about this already."

The committee session draws to a close.

Image source, PA

Image source, PASNP MSP Gillian Martin asks what governments can do about bank closures, particularly RBS which is majority share holded by the UK government

Professor Cliff Beevers says: "It's almost too late for our communities."

Prof Beevers reiterates the point the elderly, the disabled and those who can't go on line and won't go on line.

He cites: "The TSB situation has not helped."

On 25 May we reported that online payment problems were continuing for frustrated TSB customers - five weeks on from the IT switchover that has caused a crisis at the bank.

Prof Beevers: "We aint seen nothing yet I am told."

Ms Baillie notes the RBS AGM is tomorrow and government ownership of ordinary shares is 71%.

"What message if you were the government would you convey to RBS?"

"They've done very little so far, haven't they?" responds Lyn Turner.

He confirms Unite will be demonstrating outside the AGM.

The trade union spokesperson says there is an "arrogance" about shutting branches and RBS is not listening.

Labour MSP Jackie Baillie

Labour MSP Jackie Baillie says the access to banking protocol has existed since 2015 yet branches are still being closed.

If you were to design a system which resisted closure, what would your top recommendations be, she asks.

Consultation, transparency and honesty, replies Unite Scotland's Lyn Turner.

Would this require legislation, asks Ms Baillie.

"Yes," Mr Turner states.

Quote MessageCosta seems to be the winner at the moment with ex branches I don't know if there's some sort of deal being done there."

Lyn Turner, Unite Scotland

Image source, PA

Image source, PAAn "urgent review" of plans to cut the fees paid by banks to UK cash machine operators has been urged by consumer rights group Which?.

It warned the proposals to reduce the amount paid could lead to operators closing free-to-use machines.

Which? warned people, especially in rural areas, could be left isolated.

However, the UK's largest cash machine network, LINK, said it would only reduce fees when there was another cash machine within a kilometre.

LINK administers the interchange fee, which is paid by card issuers (banks and building societies) to ATM operators, who are often independent companies such as Cardtronics and Notemachine.

It argues that more than 80% of the UK's 54,000 free-to-use ATMs are within 300m of each other, making the system inefficient.

Keith Dryburgh from Citizens Advice Scotland banks, ATMs and post offices must all be taken together and all are under thereat.

Mr Dryburgh argues the colosure of "ATMS is a disaster waiting to happen if things don't pan out as we hope".

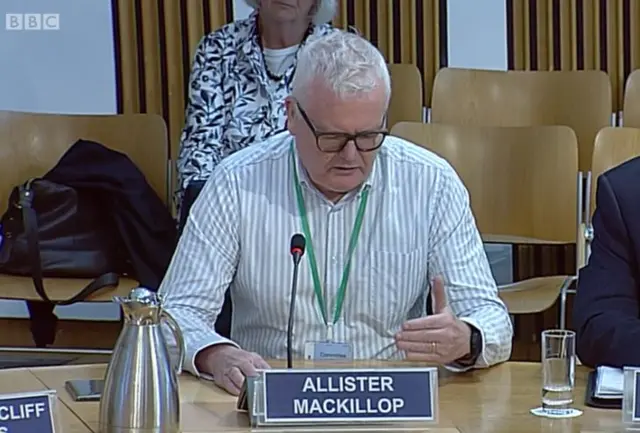

Juniper Green and Baberton Mains Community Council councillor Professor Cliff Beevers asks: "Why not a punitive tax on the banks when they sell their buildings?"

People could bid for this money for community use, Prof Beevers argues.

Image source, Scottish Parliament

Image source, Scottish ParliamentAccording to official figures, the number of bank branches across Scotland reduced by a third between 2010 and 2017.

The Economy, Jobs and Fair Work Committee launched a short inquiry with the following remit, external:

To examine the impact of bank branch closures in Scotland on local businesses, consumersand the Scottish economy and to explore what steps can be taken to address any issues identified by the Committee.

SNP MSP Gordon Macdonald raises mobile banking, noting in particular concerns about limited 30 minute slots.

Allister Mackillop recalls how a local told him that it took her 30 minutes to get on the bus due to mobility issues.

There were also concerns about privacy, he adds.

"A thirty minute slot is just ridiculous."

SNP MSP Gordon Macdonald

"It's not enough time but it's thirty minutes we didn't have," agrees Prof Beevers.

Is mobile banking being set up to fail, asks Mr Macdonald.

Prof Beevers says the cynics would say so, and that is why there is action in his community to encourage more people to use it.

I like to think that RBS are in listening mode, he adds.

Image source, GOOGLE

Image source, GOOGLEThe RBS branch in Castlebay is the last bank on Barra

Back in February we reported RBS was to keep 10 closure-threatened branches open until at least the end of the year.

The bank said the use of the branches would be reviewed by independent research over that period.

If the study finds that there is greater usage of a branch, its future will be subject of a further review.

The branches are Biggar, Beauly, Castlebay on Barra, Comrie, Douglas in South Lanarkshire, Gretna, Inveraray, Melrose, Kyle of Lochalsh and Tongue.

RBS had drawn up plans to close more than one in three of its Scottish branches.

A total of 62 branches were to be shut, with the loss of about 158 jobs.

Currie Community Council chair Allister Mackillop tells the committee: "The banks are obviously just, I mean, it sounds horrible but they are basically just.... the older population are just ignored.... they say well they're going to die anyway so we don't have to spend much time on them."

Allister Mackillop of Currie Community Council says he was a bank manager for 35 years and he points to the use of sub-branches previously, which were not financially viable but did respond to community needs.

I don't understand why these aren't still being used, he states.

Banks are not interested in looking at different uses, they just want to close them Mr Mackillop reiterates.

"Let's have a bit of imagination and think out the box, and make branches far more multi-purpose."

Image source, bbc

Image source, bbcLyn Turner from Unite Scotland

SNP MSP Fulton MacGregor points out an online petition against the RBS closure in his constituency of Coatbridge and Chryston flopped, but a paper petition went through the roof.

Mr MacGregor posits whether RBS are exploiting a particular demographic.

Lyn Turner from Unite Scotland argues: "They are stretching the truth to some extent."

Clearly there is a feeling out there that people are angry and communities are angry, but RBS will plough on with this regardless, Mr Turner says.

Douglas Fraser

Douglas Fraser

Scotland business & economy editor

Image source, Getty Images

Image source, Getty ImagesBack on 1 December Douglas Fraser wrote:

The list starts with Castlebay on the Isle of Barra. It's a Glasgow flight or a ferry to the nearest branch.

Royal Bank of Scotland has not been too concerned about access to nearby branches. Among the 62 closures in the latest cull, there's Hawick, Jedburgh, Langholm and Gretna in the south.

There's Campbeltown, Inveraray, Rothesay, Mallaig and Kyle on the west coast, with Tongue, Wick and Dornoch in the far north. In each case, it's a long, long way to the nearest branch.

While rural Scotland goes unprotected from such cuts, neither is prosperity a protection.

That familiar tale of piling more pain on those depressed shopping streets while protecting services for those with the most moola to stash. Gone too are Ellon, Dunblane and Strathaven.

RBS is hardly alone in this. The Bank of Scotland has cut 11 more branches this week, leaving only 206. Clydesdale has had a sharp slimming down.

Image source, Google

Image source, GoogleBridge of Allan, near Stirling University, has a prosperous shopping street which saw the Clydesdale quit three years ago, TSB last June, and this week, both the Bank of Scotland and RBS included it in their list of closures.

However, today's announcement suggests the Royal is in the forefront of doing this. With 62 branches going in Scotland, that leaves only 89, less than half its main rival.

Allister Mackillop suggests people are being forced to move online, irrespective of whether needs are going to be served by that.

"The banks are allowed to get away with that."

Prof Beevers says it seems "strange" that no banks are talking to one another, highlighting there are six banks in Corstorphine but none on the A70.

They probably hide behind confidentiality as a reason for not talking he states, but adds they get into the same room over other issues.

Image source, bbc

Image source, bbcTim McCormack said the closure in Coldstream had a "tremendous impact"

A former business analyst in the City of London has outlined the effect of a nearby bank closure on his newsagents in the Borders.

Tim McCormack was giving evidence to the Scottish Parliament's economy committeea a on 24 April 2018.

He said that he had seen business fall immediately after the Bank of Scotland in Coldstream shut.

Mr McCormack told the committee that other businesses had also been affected by the move.

Image source, Google

Image source, GoogleBank branch numbers have fallen significantly across Scotland

Quote MessageRBS is turning its back on local communities."

Lyn Turner, Unite Scotland

Image source, bbc

Image source, bbcRBS in Mallaig

SNP MSP John Mason says Unite Scotland have accused RBS of misleading the public.

Lyn Turner from Unite Scotland cites Mallaig, where RBS said there were only nine customers whereas there are 1,001.

He says RBS judged there were only nine by using those who came in a weekly basis.

Mr Turner argues the figures were massaged.

He also says in terms of redundancies RBS said it was 168 but that was full time equivalent, whereas 321 people are to lose their jobs including part-time posts.