Labour also U-turn to oppose NDR localisation measurespublished at 15:18 GMT 4 February 2020

Image source, bbc

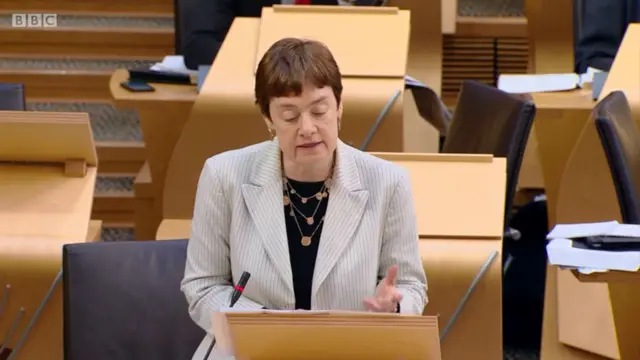

Image source, bbcLabour MSP Sarah Boyack

Labour have also changed their position and are no longer backing Andy Wightman's call.

Sarah Boyack argues MSPs were right to back Mr Wightman's amendment on devolving control over NDRs at Stage 2 but cites the concerns raised about the loss of business rates relief for her party's U-turn.

The Labour MSP also points out the concerns raised by Cosla and their call not to support the Green MSP's proposal.

Ms Boyack tells the chamber her party will not support the devolution NDRs in this bill, but stresses support for Cosla's call for work on the fiscal framework on local government funding and taxation.