Bankman-Fried accused of 'one of the biggest financial frauds in American history'published at 20:16 GMT 13 December 2022

We're closing our live coverage but you can read more here. Today we brought you the latest following the arrest of Sam Bankman-Fried, founder of the cryptocurrency exchange, FTX.

Here's a quick summary of what we've learned today:

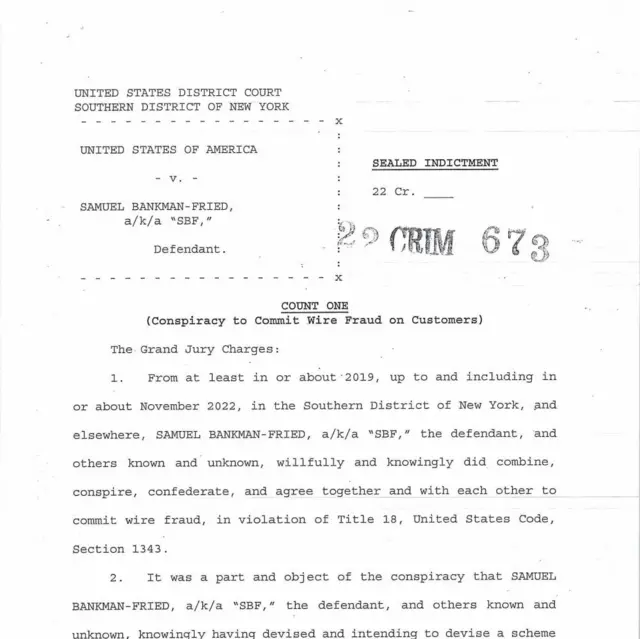

- FTX's former CEO, Sam Bankman-Fried, has been charged by the US government with eight criminal counts, including defrauding investors and violating political campaign finance laws

- Laying out the charges, the US Attorney for the Southern District of New York, Damian Williams, described Bankman-Fried's actions as being among the "largest financial frauds in American history"

- These come on top of civil charges filed by US financial regulator, the Securities and Exchange Commission

- Bankman-Fried went to court in Nassau in the Bahamas, where he lives, after the US requested his arrest and extradition to face the charges

- His attorney has requested bail and cited Bankman-Fried's mental health challenges

- Meanwhile, the company's new CEO, John Ray III, has testified before the US Congress about FTX

- He described FTX as a firm run without any corporate governance, internal controls, or risk management. He heavily criticised the conduct of Bankman-Fried and other executives at the crypto exchange

The page has been brought to you by Marianna Brady, Sarah Fowler, Adam Durbin, Rob Corp, Thomas Mackintosh and Samuel Horti. Thanks for joining us.