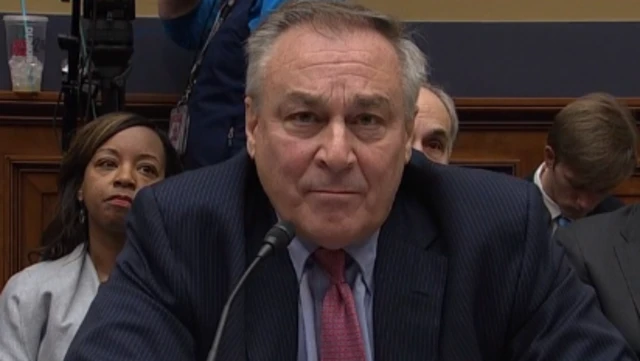

I don't trust a single piece of paper at FTX - John Raypublished at 17:10 GMT 13 December 2022

Speaking about the lack of corporate governance at the FTX group, CEO John Ray III says he has never seen such a lack of paperwork.

Explaining that there was no independent board of directors, Ray also adds there was "absolutely no internal controls whatsoever" at the firm to prevent the collapse.

"We've lost $8bn of customer money. So, by definition, I don't trust a single piece of paper in this organisation," Ray says.

In a later question, Ray tells the US congressional committee that the company does not currently know where all of its cryptocurrency wallets - where digital crypto tokens are stored - are being held.

He also said some passwords for key wallets were "kept in plain text format" (which is another way of saying they were written down) and described FTX as being a company "uniquely set up to fail" over its lack of record keeping.

Image source, EPA

Image source, EPA