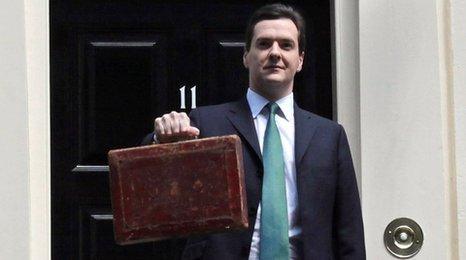

Budget 2010: What it means for you

- Published

George Osborne has announced his plans for the nation's finances.

In his first budget, the Chancellor laid-out his ideas for cutting the UK's budget deficit - the gap between the money coming in to the government from things like taxes and the cash going out as public spending, stuff like benefits, the NHS and schools.

Here are some of the main points:

Tax

Income tax cut for the lowest paid - workers will start paying tax on earnings above £7,475 (£1,000 higher than the current allowance).

VAT rises to 20% - but the rate won't increase from 17.5% until Jan 2011. Will add to the price of things like TVs and computers. Still no VAT on children's clothes, food, and books.

Council tax freeze - government will help local authorities so they can freeze their council tax bills for a year.

Tax cut for businesses - corporation tax will be reduced from 27% to 24% over the next three years. Small businesses will get a cut to 20%. Move is designed to help companies create new jobs.

Video games - scrapping of tax break for UK video games industry.

Benefits

Child benefit - will be frozen for the next three years.

Pregnancy - Health in Pregnancy payments of £190 to be scrapped.

Tax credits - families earning more than £40,000 per year will have their tax credits reduced.

Housing benefit - new maximum weekly allowance of £400. Chancellor claims reforms will save £1.8bn in housing benefit.

Disability Living Allowance - introduction of medical tests for new and existing claimants of DLA.

Duty

No increase on alcohol, tobacco or fuel.

Cider - Labour government's planned increase on cider is scrapped.

Banks - will pay a levy, expected to raise £2bn per year. However banks will get some benefit from reduces corporation tax.

Public pay

Pay freeze - public sector workers will have their pay frozen for the next two years.

However, public workers earning less than £21,000 will get a flat rate rise of £250 per year.

- Published22 June 2010

- Published9 June 2010