New parents 'hardest hit by cuts and benefits changes

- Published

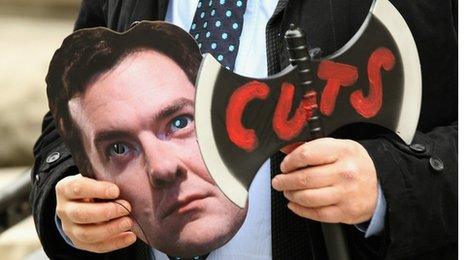

"Families ... asked to absorb much of the pain" of cuts

New parents are going to be among some of the hardest hit by government cutbacks according to the Family and Parenting Institute (FPI).

It says "families are being asked to absorb much of the pain" of higher taxes and lost benefits.

The government says cuts are needed to put "public finances back on a stable footing".

The FPI's chief exec, Dr Katherine Rake picks out the changes she thinks are "the biggest blows" for new parents.

Benefit freeze

Dr Katherine Rake: "Budget for the long term - not just the end of the month."

For most people, payments are frozen at their current level for three years.

Basic rate taxpayers will continue to get £20.30 a week for their eldest child, and £13.40 a week for each of their other children.

Higher rate taxpayers (currently most people earning £37,401 or more a year) will lose Child Benefits altogether next year.

How to make the best of it:

You can do very little, except plan for the cost of living to go up and try to budget accordingly.

Dr Rake says you should "budget for the long term - not just for the end of the month."

Losing the Child Trust Fund

The government stopped paying into new Child Trust funds on 1 January 2011.

Under the scheme, all parents of newborns got a £250 voucher from the government to invest for their children until they're 18.

An additional £250 payment for children from poorer families has also been scrapped - and a top-up payment when the child reaches seven years of age will no longer apply after August.

How to make the best of it:

If you already have a child with a Trust Fund, the government will not take money back off you.

You'll still be able to use the CTF as a tax-free way of saving for your child's future.

Family and friends can still place a tax-free £1,200 a year into the account.

Ending the 'Health in Pregnancy' grant

You won't qualify for the grant if you reached the 25th week of your pregnancy after 1 January 2011.

It's a one-off payment of £190 for each pregnancy, to encourage mums-to-be to live and eat healthily - regardless of how much money you have.

How to make the best of it:

If you're pregnant, make sure you do the maths.

If you hit 25 weeks before 1 January, talk to your doctor or midwife about making a claim.

Changes to the Sure Start maternity grant

The Sure Start maternity grant is a £500 one-off payment to help people on low incomes with the cost of a new baby.

You used to be able to claim each time you got pregnant - but from April 2011 you'll only get the money for the first child you have.

How to make the best of it:

Having fewer benefits available means you need to get more clued up about what you might be entitled to.

The FPI's Dr Rake says: "Visit your local Sure Start centre to find out what support services they offer to parents and parents-to-be."

The abolition of the baby element of Child Tax Credits

Most families with children get Child Tax Credits. You used to get a higher payment for looking after babies under one year old. This extra payment, known as the 'baby element' is being scrapped.

How to make the best of it:

Even though you won't get the extra 'baby element' any more - there are other elements of Child Tax Credits you are likely to qualify for.

Get expert advice where necessary.

Parents with part-time jobs

From April 2011, parents who work part-time will need to work 24 hours a week instead of 16 if they want to qualify for Working Tax Credits.

How to make the best of it:

Consider asking your employer if you can work more hours.

The FPI says "parents who can't increase their hours in response to the change could lose £3,810 a year."

Cap on total household benefits

The government's talked about putting a maximum on the total benefit money that can be paid to any family, regardless of the number of children.

This will have the biggest impact on families on lower incomes with several children.

The government's responded to the FPI report by saying it is "committed to reducing the deficit in a fair way ... whilst preserving key benefits for vulnerable people."

- Published11 October 2010

- Published22 June 2010