Money crisis: How Europe's debt headache affects you

- Published

The Euro started in 1995 and was a huge experiment involving lots of separate countries sharing the same currency.

Seventeen years later, many say that experiment has gone badly wrong.

Three Euro countries have had to be bailed out so far, after running out of money and struggling to pay their debts.

The problems started in Greece and spread to Portugal, Ireland and Italy.

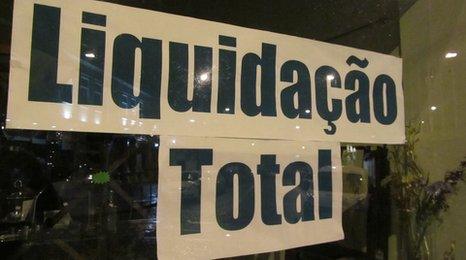

Now the focus is on Spain, which looks likely to be the next European country to need an injection of money, or a bail-out, to keep it from bankruptcy.

Overnight phone call

It's come out that Prime Minister David Cameron and US President Obama called for an "immediate plan" to solve Europe's financial problems after a phone conversation on Tuesday night.

It's a sign that the US and UK leaders are frustrated that things aren't being fixed quicker.

David Cameron is set to meet the German Chancellor Angela Merkel tomorrow (Thursday) to discuss the crisis.

His team have played down any suggestion of a split though, saying: "all leaders in the eurozone understand the need for urgency".

Why is Germany so important?

Germany is doing much better than its neighbours.

Business there has been steady, and it's been able to stay on top of its debts.

Germany has the biggest economy of the countries which use the Euro, so it contributes the most money to bailout funds.

But many think the country's leaders have been too slow to get a grip on the Euro debt crisis.

Germany has been under pressure to put up more cash to help its neighbours.

Why is bailing out economies controversial?

Many people in Germany are unhappy about their tax money being used to rescue other countries.

They feel nations like Greece should be allowed to drop out of the Euro and sort out their own problems.

But if that happened, banks and governments would lose much of the money they have lent to Greece.

Greek people are still protesting about pay cuts and tax rises

Why should I care?

Although Britain isn't in the Euro, European countries are the UK's closest neighbours and biggest trading partners, so lots of British companies rely on European economies.

Problems that start there will always ripple out and affect us too.

Even now, politicians partly blame Europe for the UK economy's failure to improve in recent years.

Stock markets around the world have been dropping because of uncertainty about what is happening in Europe.

The big fear is that a deeper crisis would lead to another global credit crunch and a much worse recession.

That would make life harder for millions of people in the UK.

- Published22 September 2011

- Published27 November 2012

- Published17 November 2010

- Published17 November 2010