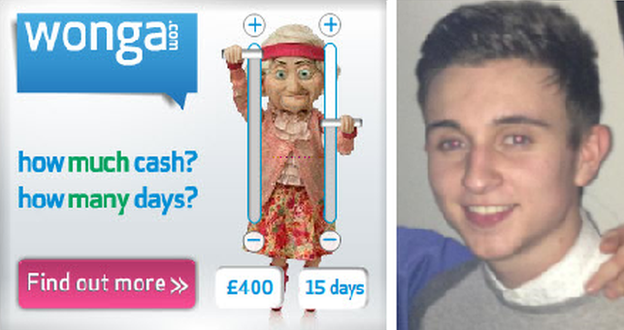

'I lied to get a £120 Wonga loan for a holiday'

- Published

When Elliott Gomme needed money for a holiday, like many people he turned to payday lender Wonga.

He needed £120 and says he didn't have a problem convincing them to lend him cash by saying he worked full-time.

But the 20-year-old admitted lying on his application and told Newsbeat it was "too easy" to be accepted.

He's now likely to be one of 330,000 people whose debts will be written off after a ruling that Wonga lent money to people who couldn't repay it.

"My bank couldn't give me an overdraft or anything, and so I went to them [Wonga]," he says.

He received his money and went on holiday, but a few weeks later he says the firm started calling him and he says they were "constant".

"They were ringing me every day," he says. "They were telling me how much I owe and that there was added interest."

Elliot says that a few months later he was being told his debt had risen to more then £800 and it began to affect his day-to-day life.

The longer it went on, the more he says he worried he would get about his situation getting out of control.

After a voluntary agreement between Wonga and the Financial Conduct Authority, new affordability checks have been put in place.

Anyone that would have been turned down under the new rules will have cash paid back.

Anyone affected will hear if they're getting a rebate by 10 October.

Thousands more customers in arrears will not have to pay interest on loans.

Elliott is likely to be one of those to have his loan cancelled and says it's come as a relief.

He says the amount of the debt was making him feel depressed and that he had "no idea" what he would have done if this ruling hadn't come.

In Elliott's opinion, the whole process is too simple and he wants payday lending to be banned.

"It's so easy to go online and get one that you don't really look at the small print and they don't really tell you that much," he says.

He also said it would have been easy for him to lie about his salary and increase the amount he could get.

He describes the payday loan system as a "vicious circle" and warns that you can end up owing more and more money each month.

Newsbeat have approached Wonga for a response but we've yet to hear back from them.

If you're struggling with debt, the Citizens Advice Bureau says not to use payday lenders.

They offer a service to help people re-organise and manage their repayments to make them more affordable.

There's a chance you may have also been treated unfairly and they'll deal with the lender on your behalf to get the debt cancelled.

To discuss your debts, call your local Citizens Advice Bureau or go online to www.citizensadvice.org.uk., external

Follow @BBCNewsbeat, external on Twitter and Radio1Newsbeat, external on YouTube