Overdrafts: Why you shouldn't ignore that message from your bank about fees

- Published

It's the biggest change in overdrafts in a generation and could mean you paying double.

If you recently ignored a text from your bank with something about "fees", you might soon wish you hadn't.

If you use an overdraft, how much you pay could be about to drastically change.

That's because new rules have come in that some experts have called the biggest overhaul in fees for a generation.

For many of us, it means we'll likely save a few quid every month. But for some it could get a lot more costly to go into debt.

Young people, specifically 16-24-year-olds, are the group who use an arranged overdraft the most and 44% have dipped into theirs, external during the past 12 months.

Many of the major banks have now announced their new charges and how they'll dish them out.

Radio 1 Newsbeat's found 10 major UK banks that will now charge almost 40% interest for going into the red.

They are Lloyds / Halifax / Bank of Scotland, Monzo, TSB, Barclays, HSBC, M&S bank, First Direct, Nationwide, Natwest / RBS and Santander.

The new rules kick in on 6 April, so there's a bit of time to make a plan.

What's going to happen?

Banks are being forced to charge a simple annual interest rate (APR) on all overdrafts - so if you use an arranged or unarranged overdraft you will get a set rate.

The Financial Conduct Authority (FCA), the people who regulate banks, brought in the changes.

Their aim was to stop people getting charged big daily fees for dipping into their overdrafts.

From now on banks also need to tell you clearly what the overdraft charges are.

The FCA told Newsbeat their reforms fix the market "where too often the vulnerable were missing out because of complex and disproportionate charges".

They say it will especially help people who dip into unarranged overdrafts - borrowing not agreed in advance.

In April the fees are changing, which means good news for people on daily charges, but bad for those with high arranged overdrafts

Am I going to be a loser?

"People who have arranged overdrafts which they use regularly or long term will pay a truly awful price," according to BBC Money Box presenter Paul Lewis.

The FCA reckon most people will now avoid unexpected costs, but admit there is a significant group of people who will miss out.

For example, someone who's set up a £1,000 overdraft limit with their bank.

The rates on these overdrafts are currently around 16% - 20%.

Many of the big banks are raising that figure to around 40%.

So in the case of a maxed-out £1,000 arranged overdraft, the annual interest would jump from around £180 to almost £400.

Who's the winner?

Paul says the winners are "people who accidentally (or on purpose) go a bit over what they are allowed for a short time".

This is often those on daily fees, for example £5 a day, for just being a few pounds overdrawn.

Also benefitting are those people who dip into their unarranged overdrafts - the borrowing you've not agreed with your bank.

Many of those charges will be capped at around £20 a month.

The FCA told us these unarranged overdraft fees "are often ten times as high as charges for payday loans".

Forty four per cent of under 25's have used an arranged overdraft in the last year

'I may have to take out a loan to pay off my overdraft'

Tom's from Glasgow and estimates that fees on his overdraft are likely to increase from close to £160 a year to around £450 after the changes.

"I've worked out I'm going to be paying more than double what I'm paying now," the 25-year-old tells Radio 1 Newsbeat.

"It's one of these things I didn't plan for and I'm very much a forward-planning person. I'm going to look at cutting some things out and maybe taking a loan out just to pay off my overdraft, which is something I didn't think I'd have to do.

"It's definitely going to change my habits now, I wish there would have been a bit more information from the banks."

Rhiannon hadn't heard about the changes to overdraft charges before today

And Rhiannon Bowen, 21, says her goal for 2020 was to pay off her overdraft, but now feels extra pressure to do it before April.

"That was the goal for this year but now we've only got a couple of months. I want it gone so I don't have to pay the extra charges," she says.

"I've got quite a good wage now but within a couple of weeks of being paid I'm back in my overdraft. My plan is just to pay off as much as I can so I have a smaller overdraft and get charged less."

What does this mean for everyone?

Overdraft buffers are being cut by many banks such as Nationwide, TSB and Monzo.

That's the amount you can go into your overdraft, before the fees kick in.

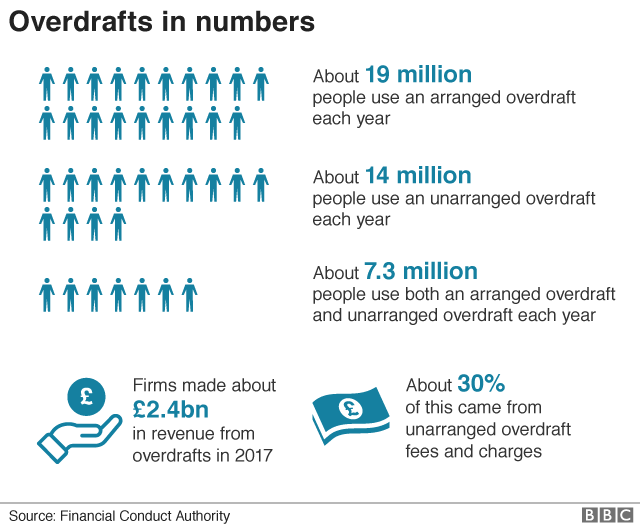

Overdrafts are big business.

In 2017, banks made more than £2.4bn from them - with 30% alone coming from unarranged overdrafts.

These figures are likely to drop, so they want to make gains elsewhere.

What's been the surprise knock on effect?

The FCA wanted to create a simple fixed rate of overdraft for punters.

However the 40% rate, which has been set by many banks, seems to have taken many by surprise.

Some accounts have higher annual rates - up to 49%.

Many campaigners wanted the banks to be forced to stop charging people more interest than they had borrowed.

Step Change is a charity that helps people who run into debt.

They told us young people are a growing and significant proportion of who they deal with on issues connected with overdrafts.

They say people in their 20s and 30s made up "two thirds of our clients in the first 6 months of 2019 - compared to just a quarter of the population".

Follow Newsbeat on Instagram, external, Facebook, external, Twitter, external and YouTube, external.

Listen to Newsbeat live at 12:45 and 17:45 weekdays - or listen back here.

- Published7 June 2019