Tax haven link to rainforest destruction and illegal fishing

- Published

Investments that have caused deforestation in the Amazon have been linked to offshore tax havens

Deforestation in the Amazon and widespread illegal fishing have both been linked to tax havens, according to a new study.

Some 68% of the investments tracked in the Amazon came from companies based in countries where no tax is paid.

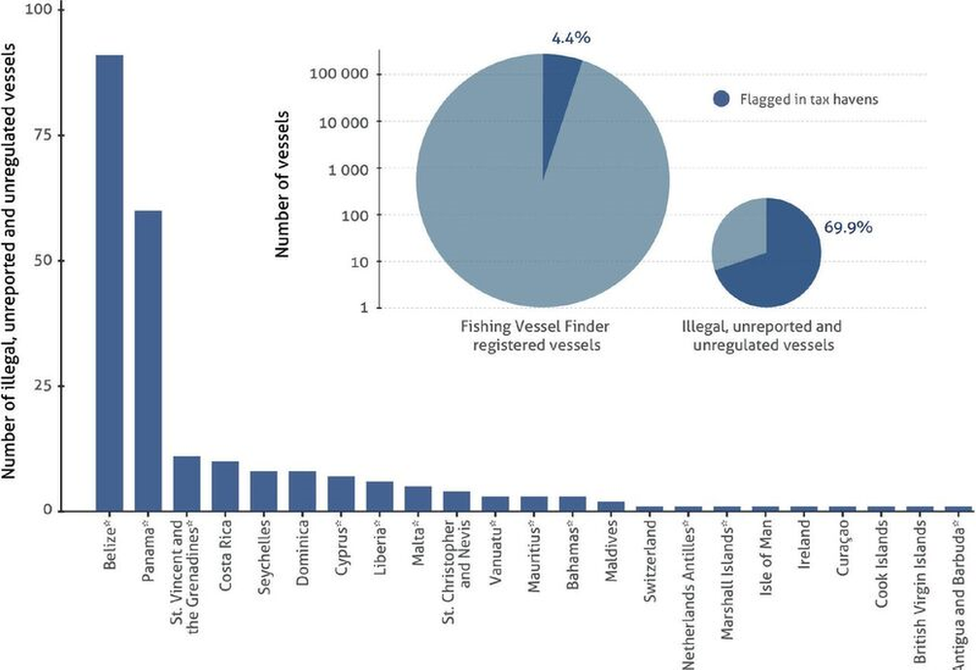

When it comes to illegal fishing, around 70% of known vessels are registered in tax havens.

Tax avoidance schemes say the authors, are essentially subsidising the destruction of the environment.

While the Paradise Papers and the Panama Papers exposed how wealthy individuals and companies dodged personal and corporate taxes, this new study claims to be the first to show that tax havens have a significant environmental impact as well.

When it comes to deforestation, these havens play a key role.

The analysis shows that of the almost $27bn of foreign capital that was transferred to key companies involved in beef and soy production in the Amazon between 2000 and 2011, more than $18bn was transferred from tax haven jurisdictions.

The biggest provider for these activities was the Cayman Islands.

"It is not illegal!" said Victor Galaz, the study's lead author, from the Stockholm Resilience Centre.

"This is part of the internal financing of companies, but we need a better assessment of the environmental consequences of the uses of tax havens both legal and illegal."

"What we can see in the data, in these sectors there are subsidiaries placed in tax havens that are providing loans to activities in Brazil and the Amazon. That you can see."

Illegal, unreported and unregulated fishing is also a major blight on the oceans of the world but according to this paper, the vast majority of the boats involved are or have been flagged under a tax haven jurisdiction, in particular Belize and Panama.

Illegal fishing activities all over the globe are often linked to tax havens

There's a bit of a double whammy going on when it comes to illegal fishing as these tax havens are often what are known as 'flag of convenience' states - meaning essentially that the governments in these countries do not prosecute if the ships on their register are involved in illegal activities.

Cattle ranching and the growing of soya for cattle feed have been found to have been funded from offshore accounts

"The global nature of fisheries value chains, complex ownership structures and limited governance capacities of many coastal nations, make the sector susceptible to the use of tax havens," says co-author Henrik Österblom, also from the Stockholm Resilience Centre.

Overall, the impact of these tax havens is to give an indirect subsidy to the loggers, beef farmers and illegal fishing activities.

That needs to be recognised at a global level say the authors if something is to be done about it.

"We need to promote financial transparency so country by country reporting by multinationals and giving that information in the public domain will provide big benefits so we will be able to see what's happening with that capital on the ground," said Victor Galaz.

"This is a global issue it requires international action - we need to acknowledge that tax havens as a social, economic and now environmental issue needs to be tackled globally."

The study has been published, external in the journal Nature Ecology & Evolution.