Debt killed my dad

- Published

A year ago music student Jessica Hurst, 25, was told her father had died at the age of 56. Then came the discovery that he had killed himself after getting into debt. As she explains here, it had begun as a relatively small debt for unpaid council tax - but it multiplied many times after the council had him declared bankrupt.

It was Wednesday 4 October 2017. I was scrolling down my Facebook feed during a small break from my opera rehearsal when I saw my dad had posted the words, "Goodnight sweet world." I thought to myself, "This is odd." So I commented: "Have you been hacked? Lol" and I thought no more of it.

Several hours later, when my rehearsal was over, I saw lots of missed calls on my phone from my mum and gran. I remember walking along the corridor and picking up a call from my mum who said, "Where are you, lovey?"

"I've just finished rehearsal, why?" I replied.

"Your dad's gone," she said.

My legs collapsed and I fell to the floor.

Dad had been found by a bailiff that day at his house, our family home, in Lindale, Cumbria.

A few days later, I went to meet the policeman who had been on duty at the time. I broke down in tears when he described how my dad had killed himself. The policeman explained that dad had been discovered by a bailiff intent on evicting him from the house, because of an unpaid debt.

He told me dad had left a letter for the bailiff, which he had placed at the bottom of the stairs. It said: "I'm in the first bedroom on the left at the top of the stairs."

Dad also left a note for my sister and me.

"Jess and Sally, it breaks my heart to write this. This decision is nothing to do with you two. I love you with all my heart. I have been so unhappy in my personal life for so long that I cannot go on. Now that I am about to lose my house as well as my self-respect, I have decided to go."

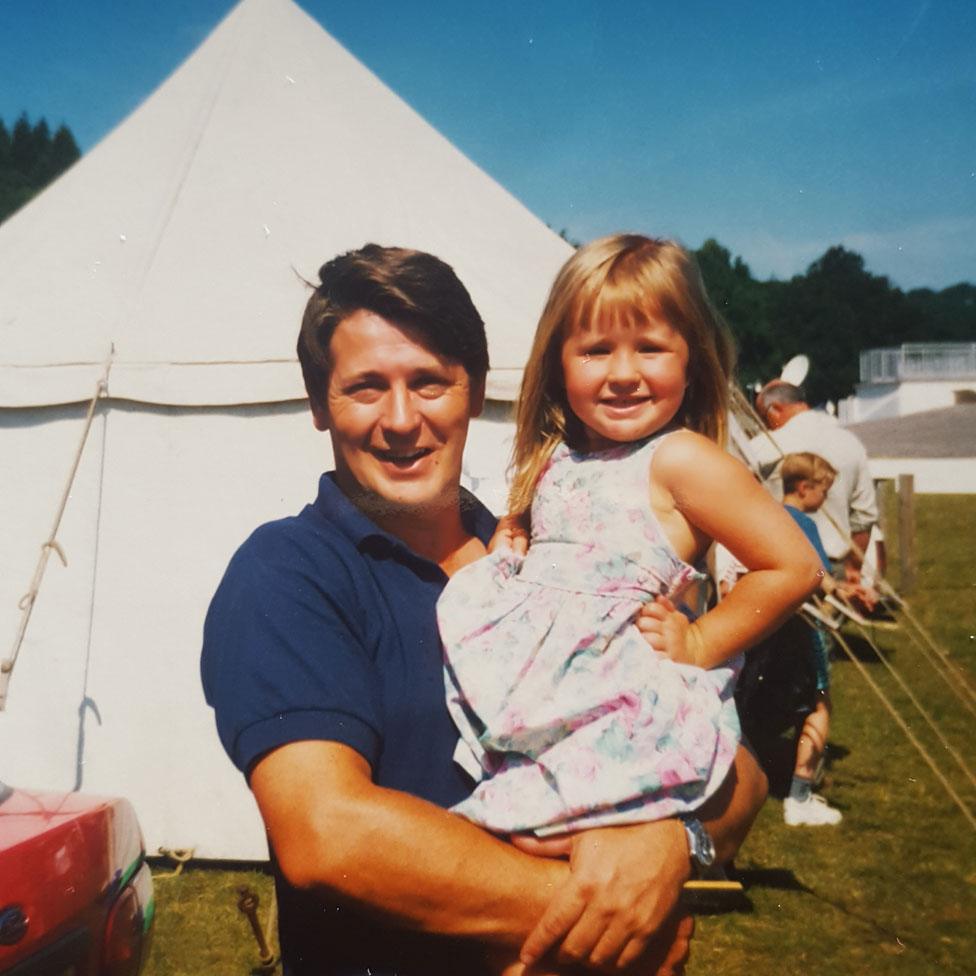

Nigel Hurst in better times with Jessica (right), and her younger sister

It was my parents' first home when they got married and the place where my sister and I grew up. The house is full of happy memories - of watching TV together on the ancient sofa and crowding around the table with relatives for Christmas dinner.

Find out more

Listen to Debt Killed My Dad on Radio 4's File on 4 at 20:00 on Tuesday 25 September

About 15 years ago my parents divorced and my dad was rushed to hospital due to a tumour bursting through his kidney. He was given 12 months to live and a 15% chance of survival. Although his cancer was successfully managed, the treatment was painful and exhausting. He also had to pay £36,000 to my mother as part of the divorce settlement and £200 maintenance every month both to me and to my sister.

In spite of his illness and divorce, dad was an upbeat person - he had a great sense of humour and always made light of every situation. He acted as a bit of an agony aunt for his friends, listening to their problems and giving advice. He organised community events such as bonfires and barbecues and loved cricket, rugby and the village pub. And all the time, he worked hard as a grounds-care specialist sales consultant.

I organised a visit to dad's house through the bailiff. He met my sister and I there. "You'll be shocked," he said.

Inside I found bankruptcy letters, court letters and other notices on table tops, kitchen surfaces and stuffed in plastic Co-op bags.

I went through them one by one.

Until he died I hadn't realised my father had been in debt, let alone declared bankrupt. Three days earlier he had dropped me off in Glasgow and helped me move into a flat, ready to start the second year of my master's degree. He had stayed with me all day, helping me to unpack, and called me three times on his journey back home. It was the last time I saw him.

He had never stopped supporting me and my sister financially, even though - as I discovered - he had been sliding into debt for 10 years.

It all began in 2008 when he missed a council tax payment.

Where to get help

If you are feeling emotionally distressed and would like details of organisations which offer advice and support, visit BBC Action Line or you can call for free, at any time, to hear recorded information 0800 066 066

When he failed to settle up, South Lakeland District Council billed him for a year upfront. This brought the debt to £1,473.

Over the next few years, the debt steadily grew as dad struggled to make ends meet. By 2014, he owed the council £9,332. He also owed smaller amounts to American Express, HSBC and United Utilities North West, bringing the total to £11,738.

It was then that the council petitioned to make my dad bankrupt. He was declared bankrupt on 10 March 2014 at Barrow-in-Furness County Court, and at that point his debt started growing at an incredible rate.

Nigel Hurst with Jessica as a young girl

Straight away he was charged £3,800 in something called "statutory interest", which took his debt to about £15,500. But that was just the start. Over the next three years my dad actually paid £15,000 to the trustees appointed to collect the debt - the accounting and consultancy firm, BDO - but over the same period the bill from the trustees grew to £72,000.

Sadly he never sought financial advice and never spoke to me or my sister. He was a very private person and would have seen asking for help as a failure - as a man, as much as anything else. I think he buried his head in the sand, put the letters to one side and tried to carry on life as normal.

How did a debt of £11,738 rise to £72,000?

Interest of 8% per annum increased the sum to £15,500 - this is a statutory rate intended to compensate creditors

In addition the trustees, BDO, charged £23,000 for their time and nearly £11,000 in legal costs

There was also £10,000 in "Secretary of State" fees, intended to cover the costs of the Official Receiver (though last year these fees produced a surplus of £14m)

And there were £5,500 in agents' fees, for changing locks, cutting off electricity and water, and a "drive-by" valuation of the property

Meanwhile, the council just kept sending more letters. The first person who ever turned up at his house to try to talk to him about his debt was a bailiff. And once dad was declared bankrupt, the sum quickly rose to one that he could never pay back.

Unlike my father, I tried seeking advice. I set about calling agencies experienced in helping people with debt problems. They just told me that my dad's case was unusual and implied that I must have the wrong figures and details.

Eventually, I decided to email my local MP, Tim Farron, who got in touch with South Lakeland District Council, who then got in touch with BDO, the trustees. I also emailed the bailiff to tell him about my dad's cancer and he said he would wait until I had finished my master's degree before clearing the house.

Soon after that, BDO told me that they were willing to reduce the debt owed by my dad's estate to £35,869. Then, a little while later, they cut it to £25,100. It felt like a process of haggling. If only they'd negotiated with my dad, he might still be here today.

Even the new, reduced debt is not a sum my sister and I can pay, however. I am a student and my sister is unemployed. We can't afford legal advice, so it looks as though we will lose the house we grew up in, as well as our dad.

I would like to know why the council decided to take my dad down the route of petitioning to make him bankrupt, when other routes were available.

How did South Lakeland District Council handle the case?

All bills, reminders and warnings of "enforcement action" were sent to Nigel Hurst by post - SLDC says it did not know his telephone number

No-one from SLDC visited him - the first people to visit were the bailiffs

SLDC could have taken out a "charging order" to "load" the debt on to the house - so that it would be repaid when the house was sold… but it didn't

It could also have applied to court for an order asking HMRC to provide details of Nigel Hurst's employer so debt payments could be deducted from his wages - but it didn't do that either

Instead, after seven years of missed payments, it petitioned for his bankruptcy

I understand that my dad didn't reply to the council's letters and that must have been frustrating. But if a client has been a good citizen, paid his council tax all his life and then suddenly stops, there must be something wrong. I believe that in those circumstances the council should try to reach out to that person.

Sadly, suicide rates for men over 50 are increasing. This is a generation that doesn't always find it easy to talk about problems. People should be aware of this, and try to talk to them instead. If not, this will happen again. And no young person should be left without their father because of a few thousand pounds of debt.

Michael Fisher, revenues and benefits manager for South Lakeland District Council, told the BBC: "Now we have the full picture of Mr Hurst's situation, we do regret starting the bankruptcy process. We would not have taken this course of action had we had the full picture from the outset. Mr Hurst did not co-operate and the reason his fees are as high as they are is because of the amount of time and effort which has been spent on trying to recover the monies that were outstanding. Really, I think Mr Hurst's case teaches us all a lesson - if anybody is experiencing any financial difficulties, they should speak to their creditors at the first opportunity. The earlier you speak to your creditors, the easier it is to resolve. I don't think burying your head in the sand is ever a solution."

The trustees, BDO, said they kept "detailed time records" for every case they handled and that many of the charges on Nigel Hurst's bill were "legal and regulatory matters" that did not necessarily bring them any financial benefit. They have now offered to waive their fees in Nigel Hurst's case.

Join the conversation - find us on Facebook, external, Instagram, external, YouTube, external and Twitter, external.