When algorithms control the world

- Published

Algorithms are spreading their influence around the globe

If you were expecting some kind of warning when computers finally get smarter than us, then think again.

There will be no soothing HAL 9000-type voice informing us that our human services are now surplus to requirements.

In reality, our electronic overlords are already taking control, and they are doing it in a far more subtle way than science fiction would have us believe.

Their weapon of choice - the algorithm.

Behind every smart web service is some even smarter web code. From the web retailers - calculating what books and films we might be interested in, to Facebook's friend finding and image tagging services, to the search engines that guide us around the net.

It is these invisible computations that increasingly control how we interact with our electronic world.

At last month's TEDGlobal conference, algorithm expert Kevin Slavin delivered one of the tech show's most "sit up and take notice" speeches where he warned that the "maths that computers use to decide stuff" was infiltrating every aspect of our lives.

Among the examples he cited were a robo-cleaner that maps out the best way to do housework, and the online trading algorithms that are increasingly controlling Wall Street.

"We are writing these things that we can no longer read," warned Mr Slavin.

"We've rendered something illegible. And we've lost the sense of what's actually happening in this world we've made."

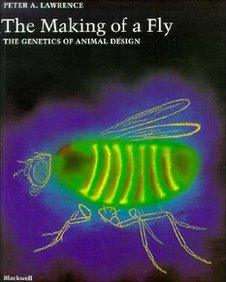

Million-dollar book

The book was briefly one of the world's most expensive

Algorithms may be cleverer than humans but they don't necessarily have our sense of perspective - a failing that became evident when Amazon's price-setting code went to war with itself earlier this year.

"The Making of a Fly" - a book about the molecular biology of a fly from egg to fully-fledged insect - may have been a riveting read but it almost certainly didn't deserve a price tag of $23.6m (£14.3m).

It hit that figure briefly on the site after the algorithms used by Amazon to set and update prices started outbidding each other.

It is a small taste of the chaos that can be caused when code gets smart enough to operate without human intervention, thinks Mr Slavin.

"This is algorithms in conflict without any adult supervision," he said.

As code gets ever more sophisticated it is reaching its tentacles into all aspects of our lives, including our cultural preferences.

The algorithms used by movie rental site Netflix are now responsible for 60% of rentals from the site, as we rely less and less on our own critical faculties and word of mouth and more on what Mr Slavin calls the "physics of culture".

Leading role

Code is playing its own lead role in Hollywood

British firm Epagogix is taking this concept to its logical conclusion, using algorithms to predict what makes a hit movie.

It takes a bunch of metrics - the script, plot, stars, location - and crunches them all together with the box office takings of similar films to work out how much money it will make.

The system has, according to chief executive Nick Meaney, "helped studios to make decisions about whether to make a movie or not".

In the case of one project - which had been assigned a £180m production cost - the algorithm worked out that it would only take £30m at the box office, meaning it simply wasn't worth making.

For another movie, it worked out that the expensive female lead the studio had earmarked for a film would not yield any more of a return than using a less expensive star.

This rather clinical approach to film-making has irked some who believe it to be at odds with a more creative, organic way that they assume their favourite movies were made.

Mr Meaney is keen to play down the role of algorithms in Hollywood.

"Movies get made for many reasons and it credits us with more influence than we have to say we dictate what films are made.

"We don't tell them what the plot should be. The studio uses this as valuable business information. We help people make tough decisions, and why not?" he said.

Despite this, the studio Epagogix has worked with for the last five years does not want to be named. It is, says Mr Meaney, a "sensitive" subject.

Secret sauce

If algorithms had a Hollywood-style walk of fame, the first star would have to go to Google.

Its famously secret code has propelled the search giant to its current position as one of the most powerful companies in the world.

No-one would doubt that its system has made searching a whole lot easier, but critics have long asked at what price?

In his book, The Filter Bubble, external, Eli Pariser questions how far Google's data-crunching algorithm go in harvesting our personal data and shaping the web we see accordingly.

Meanwhile, a recent study by psychologists at Columbia University found that reliance on search engines for answers is actually changing the way humans think.

"Since the advent of search engines, we are reorganising the way we remember things. Our brains rely on the internet for memory in much the same way they rely on the memory of a friend, family member or co-worker," said report author Betsy Sparrow.

Increasingly, she argues, we are knowing where information can be found rather than retaining knowledge itself.

Flash crash

Move over traders, there's a new code in town

In the financial markets, code is increasingly becoming king as complex number-crunching algorithms work out what to buy and what to sell.

Up to 70% of Wall Street trading is now run by so-called black box or algo-trading.

That means, along with the wise guy city traders, banks and brokers now employ thousands of smart guy physicists and mathematicians.

But even machine precision, supported by the human code wizards, doesn't guarantee things will run smoothly.

In the so-called Flash Crash of 2.45 on May 6 2010, a five minute dip in the markets caused momentary chaos.

A rogue trader was blamed for the 10% Dow Jones index fall but in reality, it was the computer program that the unnamed trader was using that was really to blame.

The algorithm sold 75,000 stocks with a value of £2.6bn in just 20 minutes, causing other super-fast trading algorithms to follow suit.

Just as a bionic limb can extend a human's capability for strength and stamina, the electronic market showed its capacity to exaggerate and accelerate minor blips.

No-one has ever managed to pinpoint exactly what happened, and the market recovered minutes later.

The chaos forced regulators to introduce circuit breakers to halt trades if the machines start misbehaving.

The algorithms of Wall Street may be the cyber-equivalent of the 80s yuppie, but unlike their human counterparts, they don't demand red braces, cigars and champagne. What they want is fast pipes.

Spread Networks has been building one such fibre-optic connection, shaving three microseconds off the 825-mile (1327km) trading journey between Chicago and New York.

Meanwhile, a transatlantic fibre optic link between Nova Scotia in Canada and Somerset in the UK is being built primarily to serve the needs of algorithmic traders and will send shares from London to New York and back in 60 milliseconds.

"We are running through the United States with dynamite and rock saws so an algorithm can close the deal three microseconds faster, all for a communications system that no humans will ever see," said Mr Slavin.

As algorithms spread their influence beyond machines to shape the raw landscape around them, it might be time to work out exactly how much they know and whether we still have time to tame them.

- Published25 October 2010

- Published14 July 2011