Barclays Android app makes £100 contactless payments

- Published

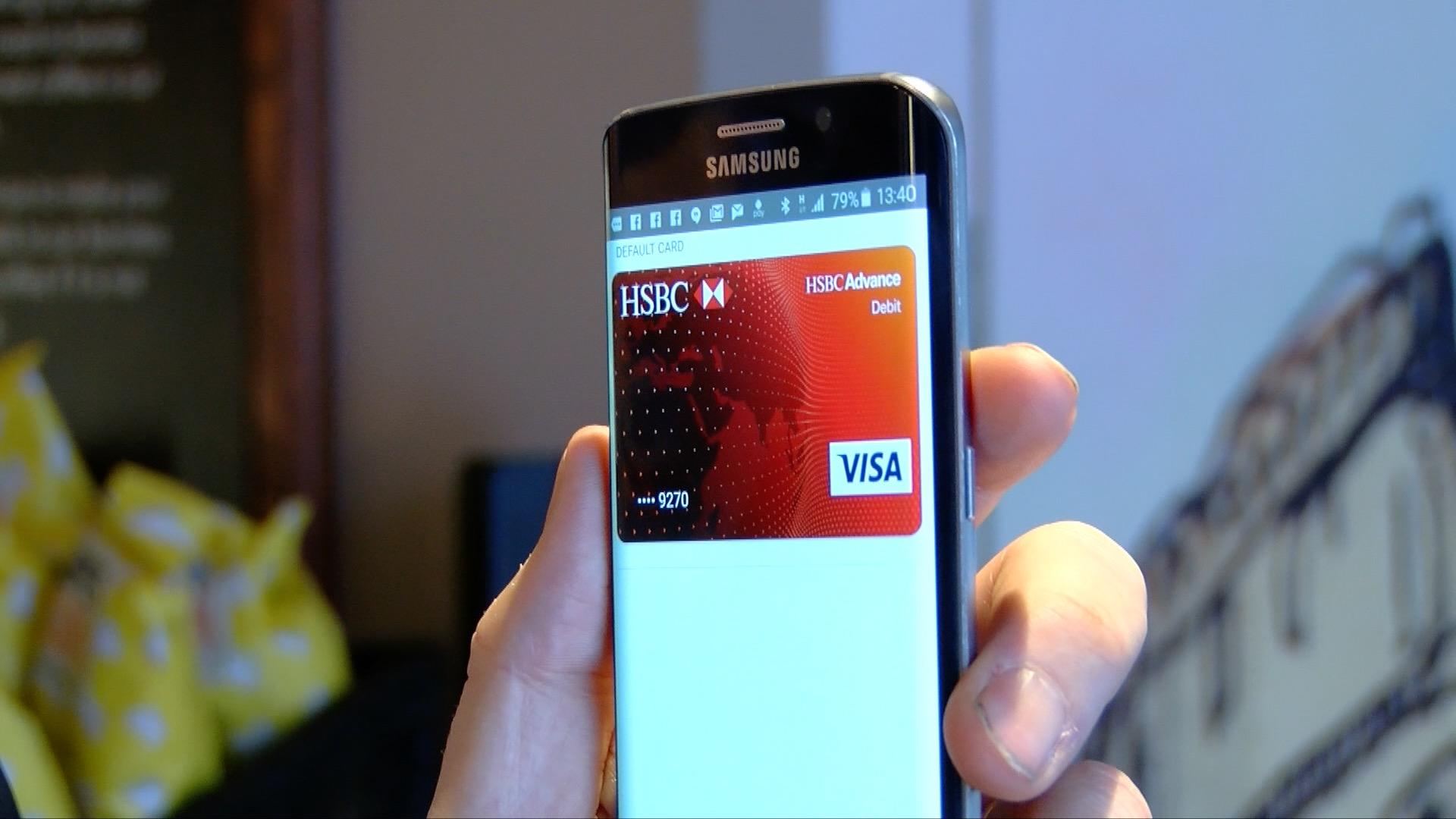

Barclays offers its own mobile payment facility on Android devices

Barclays has upgraded its Android app to allow UK customers to make contactless payments in stores via their handsets.

The bank has opted to provide the facility, external rather than support Google's Android Pay service.

Barclays allows payments of up to £100 via compatible terminals. Android Pay does not have this limit if merchants agree to accept larger sums.

In both cases, payments over £30 require the use of a Pin code.

Barclays says its app also allows customers to carry on spending if they lose one of their physical cards.

That is because if a card is cancelled, Barclays can immediately upload the details of its replacement to the app, as soon as it is issued.

However, this is also possible via Android Pay, whose customers are told they need to wait up to 48 hours for a new account number to be created and the updated details sent to the app.

However, one analyst said that Android Pay had another factor in its favour: a growing number of apps allow people to use the tool as a way to make payments without having to type in card details.

Other banks support Google's Android Pay service in the UK

This is also possible via Apple Pay, but not Barclays' service.

"Swiping your phone in a store doesn't often offer that much benefit to the user compared with just using a contactless card," said Jack Kent from the IHS Technology consultancy.

"But what we think will be a big driver to adopting Android Pay or Apple Pay is the in-app purchases, in which people can have their shipping and billing information pre-loaded to help speed up transactions.

"That offers a very clear benefit to users that they can't get via Barclays' tool."

Barclays supports Apple Pay rather than offering a similar proprietary service on iPhones because Apple does not allow third-party apps to make use of its iPhones' near-field communication (NFC) chips.

Microsoft also launched a new version of its Wallet app this week that allows Windows 10-powered handsets to make contactless payments. However, it is currently limited to US-based phone owners.

- Published18 May 2016

- Published18 May 2016

- Published5 April 2016