RBS, NatWest and SEB banks employ virtual staff

- Published

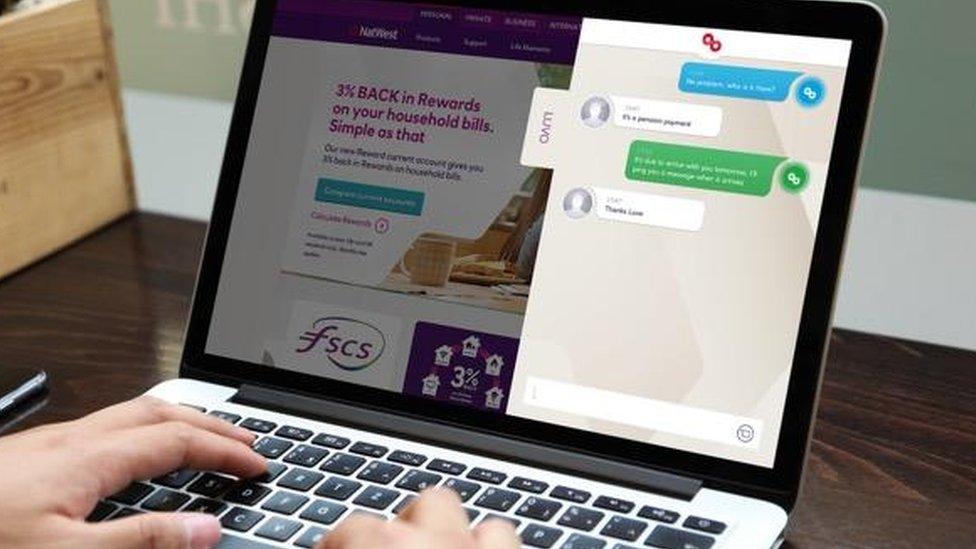

Users will have the option of whether to chat to a human or a bot

Customers at Royal Bank of Scotland and NatWest may soon be sorting out issues with help from a virtual chatbot.

Web-based Luvo will be able to answer simple queries such as how to order a replacement card.

Designed using IBM Watson technology, the virtual agent is able to understand and learn from human interactions.

In future, Luvo may be able to understand if a customer was feeling frustrated or unhappy and change its tone and actions accordingly, IBM said.

The service will initially be rolled out to RBS and NatWest customers, starting in December with about 10% of RBS customers in Scotland.

Previously, Luvo had been piloted among 1,200 RBS and NatWest staff.

For the bank, the chatbot is complementary to existing customer service agents.

"Luvo frees advisers from spending time on simple, easily-addressed queries so they can help customers with more complex issues," said Jane Howard, head of personal banking.

It will start off with about 10 questions it is equipped to answer but as the cognitive system learns over time, IBM is confident it can be expanded to "more complex areas".

Use of the chatbot will be monitored, as will customer feedback

The bank will make it clear to customers that they are talking to a bot, and they will have the option to move the conversation to a human agent at any point.

"We will monitor customer feedback and, if we find that customers are getting frustrated, we will quickly look to address that," Ms Howard told the BBC.

'Never deviate'

IBM is not the only company using artificial intelligence in banking. This week, rival IPsoft, which already employs its virtual agent Amelia in a range of industries, announced a similar deal.

Amelia will provide customer service in one of Sweden's largest banks, SEB.

Chetan Dube, IPsoft's chief executive, said that virtual staff represented a "fundamental shift in the way that banks manage their operations".

"Virtual agents never deviate from regulations and provide a full audit trail of every interaction," he said.

- Published4 October 2016

- Published4 August 2016