Tech results bring sweet Valley highs

- Published

- comments

Jack Dorsey's Twitter beat expectations and impressed investors for the first time in more than two years

The busiest tech earnings day of the year brought good news for many of Silicon Valley’s big names - including, for the first time in recent memory, Twitter.

The social networking site has seen its share price on a pootling down for more than two years, but after cutting costs and bumping up some revenue sources, the company thinks it may post its first ever profit as soon as the new year.

That news offset the awkward admission that it had, since 2014, been over-counting the number of users it has. The site’s current number of active users - 330m - takes into account the error; 4m non-existent users have been taken off the total.

That adjustment didn’t trouble investors in the slightest, as they were encouraged by positive news on one of Twitter’s historically tricky data points: Daily Active Users, or DAU.

Twitter will never be as big as Facebook, and it has been overtaken by Snapchat, but what it can do is try and hold the attention of its users for longer. And this quarter shows signs that they are doing that, daily active users were up 14% on this time last year.

So for the first time in as long as I can remember, Twitter’s shares are up. Up! By 20% as I write this.

It’s some much-needed good news for chief executive Jack Dorsey, whose other company, payments firm Square, has also been doing pretty well of late, external.

Next week will be tougher, Twitter is among the companies appearing in front of the US Senate Investigative Committee to explain its actions in the run up to the election. If the company reacts badly in the face of tough questions, the 20% bump might not last long.

Alphabet’s clicks

That’ll be on the mind of Alphabet, Google’s parent, as well. As is repeatedly said, the company relies heavily on advertising revenue, and any minor threat to that model (from increased government scrutiny) could have an impact.

Right now though, in the words of the company’s chief financial officer Ruth Porat, Alphabet had a “terrific quarter”. Profits are through the roof, $7.8bn for the quarter, up 33% on this time last year.

Google parent company Alphabet had a big rise in profits thanks to more ad clicks

That’s mostly thanks to more people clicking ads. There are two big data points here that are worth thinking about. First, the cost per click - the amount companies pay Google each time a person clicks an ad - and also Traffic Acquisition Costs, or TAC.

TAC, the amount that Google invests in order to get its advertising platform in front of internet users, has gone up dramatically - $5.502bn, up 31.6% on this time last year.

Cost Per Click - CPC - has declined compared to last year too, meaning Google makes less money each time an ad has been clicked. There is some good news there though, while the year-on-year CPC is 18% lower, if you compare it to last quarter, CPC is marginally up. Alphabet will hope it’s the start of a new upwards trend.

I also like to keep half an eye on Alphabet’s "Other Bets", the slightly more outlandish and experimental side of the business. Revenue here is a drop in the ocean compared to ads, but it’s improving - the Other Bets brought in $302m in revenue in the last quarter, $105m more than this time last year.

Amazon gets bigger and bigger

I know strictly speaking Amazon isn’t a Silicon Valley company, nestled as it is up in Seattle - with a second headquarters being built soon in an as-yet undecided location.

My money’s on Canada, though there are few parts of North America that haven’t made their bid to be the new home for a company that on Thursday’s evidence looks unstoppable.

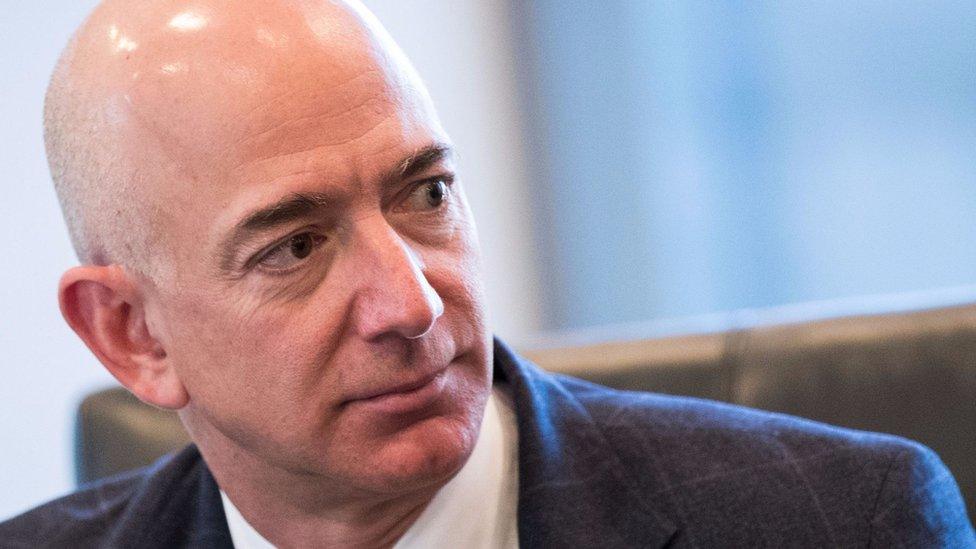

Jeff Bezos' Amazon had huge revenue increases with the help of Whole Foods

These earnings were the first to include revenues from Amazon’s big acquisition: Whole Foods. Revenue there was $1.3bn - a tiny but important slice of Amazon’s overall revenue, which came in at $43.7bn.

Profits rose by only $4m in the last quarter, but that’s expected - all of Amazon’s money is going towards rapid growth right now. As well as the Whole Foods deal, Amazon is ploughing money into its home assistant product, Alexa, and more data centres and expansion for Amazon Web Services, its cloud computing business.

We’ve also just learned that Amazon has been given a pharmaceutical licence to operate in at least 12 US states, news that sent the share price of established drug store brands such as CVS, Walgreens and Rite Aid into a nosedive.

It is moves like these that have led to the increased use of the phrase “Amazon-proof”. Per some Bloomberg reporting, chief executives of other companies are routinely trying to reassure investors that they are in a space Amazon can’t touch.

"With our Amazon-proof business, strong recurring revenue, high-margin, solid growth opportunities and attractive growing dividends, I know of no better place to invest,” said Jim-Reid Anderson, chief executive officer Six Flags, a company that builds and runs theme parks, an area Amazon hasn’t touched. Yet.

Maybe some day they will - a rollercoaster inspired by of the company’s stock price sounds utterly terrifying… you’d go up, and perhaps never come down again.