Berlin tech start-ups flex their muscles

- Published

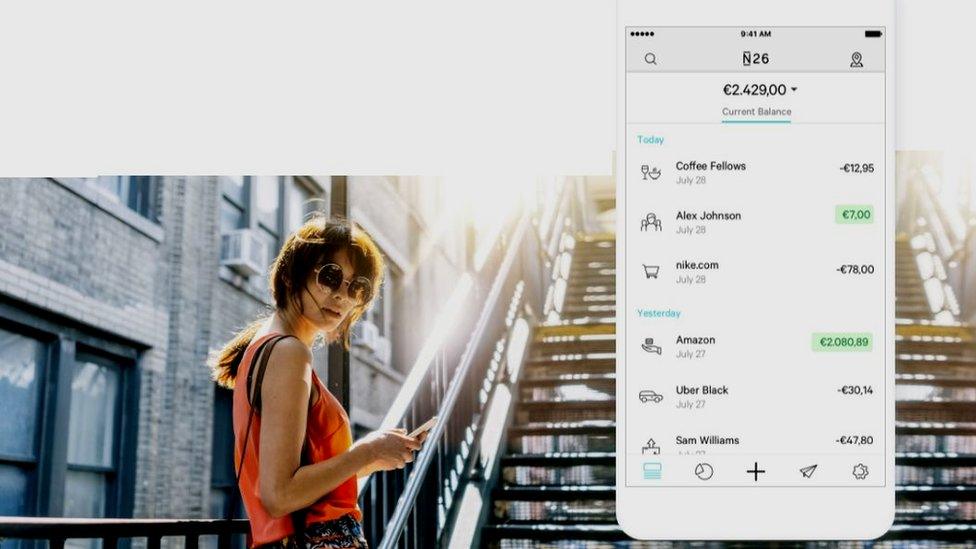

Dogs and fast growth are both welcome at the offices of Berlin-based banking app N26

I have just been on a tour of a couple of hot new tech companies. Each had motivational posters on the walls.

One had a bring your dog to work policy. The other had kitchens with free food on every floor. Both featured groups of young people from many countries all conversing in English.

This wasn't Silicon Valley but Berlin, which now seems ready to stake a claim to be one of Europe's top tech hubs.

It lacks the scale of London. But you can sense the confidence in this city, which is now attracting talented tech types from across the world.

Last time I visited, I found plenty of sparky start-ups but no real heavyweights. This time, the two companies I met seemed ready to take on the world.

Zalando says it offers Europe's largest online selection of clothing, shoes and accessories

My first stop was at Zalando, an e-commerce operation that in just a decade has transformed the online fashion market in Germany and 16 other European countries.

As I arrived, everyone was focused on Bread and Butter, the company's big annual fashion show to be held in the Berlin Arena over the weekend.

Note that it is not "Brot und Butter" - like everything else in this business that prides itself on its multinational workforce it happens in English

"Cheap, fun, dynamic," were the words that Zalando's head of partnerships, Ben Woerner, used to describe how the company was perceived by its customers.

Zalando says it employs more than 15,000 people

But its success is perhaps a marker of how undeveloped the German market was when it arrived.

When I ask what gap it was trying to fill back in 2007, Mr Woerner tells me e-commerce was "very different" back then.

Not really in the UK, I think, where companies such as Asos have a much longer heritage.

Germans, however, still needed convincing that buying clothes online was a good idea.

Ben Woerner joined Zalando in 2015

But today Zalando is a public company with a market capitalisation of $11bn (£8.5bn) and Berlin's most successful online business. Like everyone I meet here, Mr Woerner enthuses about the city's energetic vibe and living costs that are way below those of Silicon Valley or London.

"If I were a founder today, Berlin would be top of the list as a location," he says.

Just down the road, I find a young Austrian, Valentin Stalf, who decided Berlin was a great place to start a new kind of bank.

He describes N26 as "the first bank that people love to use".

It has an even steeper growth trajectory than that of Zalando.

N26 plans to launch its banking app in the UK soon

Just five years after it was founded, the app-based bank employs 550 staff and is adding 50 every month - some of who bring their dogs to work, in an office that feels a million miles away from a traditional finance environment.

It now operates across the eurozone and is about to bring its service to the UK, Europe's centre of fintech innovation.

What it offers - banking on a mobile phone, no branches, a simple cheap service - will not sound that revolutionary to many British consumers.

Again, Mr Stalf admits that German conservatism about banking online was an advantage when he and his co-founder got started, encouraging them to go international fast.

"We are now in 17 countries across Europe and I think Germany is the hardest market.

"Most of the time, German consumers are more conservative when it comes to new ideas - especially in finance."

If Germany overall is conservative, Berlin does seem a place where people with radical ideas can flourish.

"You have more role models," says Mr Stalf "It's a great place to be."

Mr Stalf worked at Deutsche Bank before co-founding N26 in 2013

Now N26 faces its biggest challenge, winning over British consumers who can already choose from the likes of Atom Bank and Monzo and may be hard to prise away from the mainstream banks, which are at last beginning to offer better mobile apps.

Berlin is definitely flexing its muscles as a European tech hub to rival London and Paris - but, a note of caution.

Following the UK's EU referendum vote in 2016, the Berlin city government launched a campaign to lure London companies to the German capital. It promised that it would provide an ideal post-Brexit environment.

This week, I asked the Berlin Senate for details of the companies that had signalled their intentions to move.

So far, I have had no response.