Ethereum Merge: How one big cryptocurrency is going green

- Published

Ethereum co-founder Vitalik Buterin says The Merge has been planned for years

The second biggest cryptocurrency, Ethereum, is about to switch over to a new operating model that uses 99.9% less energy.

The change, called The Merge, is designed to win over critics who see cryptocurrencies as environmentally harmful.

Ethereum currently uses as much energy as a medium-sized country.

Other cryptocurrencies, including the biggest, Bitcoin, will remain as energy-intensive as before.

Ethereum's co-founder Vitalik Buterin says The Merge has been part of the plan for Ethereum since it was launched in 2014 but has had to be postponed many times due to its technical complexity.

The task has been compared with rebuilding the foundations of a skyscraper while it remains standing.

The Ethereum blockchain supports not only the Ethereum currency but also hundreds of millions of dollars' worth of other coins and crypto products like NFTs.

If something goes wrong it could jeopardise arguably the most important ecosystem in cryptocurrency, affecting large and small investors around the world. If all goes well, consumers should not notice any change.

"It's really exciting and a major achievement. Yes there are nerves in the sense that things will probably not go 100% smoothly, but that's expected," says Ethereum Foundation researcher Justin Drake. "We have infrastructure in place now that allows us to still move forward even if some parts of the network go down for some reason."

Computers are already working on carrying out the switchover. Anyone who searches for The Merge on Google sees a countdown tool, which predicts it will be completed in the early hours of Thursday GMT.

What is The Merge?

The Ethereum blockchain is a giant, constantly updating database that logs every transaction that takes place. Up to now it has been updated, verified and maintained by a global network of volunteers with powerful computers, who are rewarded for this work with new coins - a process known as cryptomining.

The Merge is forcing workers at Prima Technologies to replace their Ethereum equipment to start mining for Bitcoin

This system is called Proof of Work and is used by many of the most popular blockchains including Bitcoin, Ethereum, Dogecoin and Litecoin.

The Merge will see the Ethereum Proof of Work blockchain merge with a carbon copy called the Beacon Chain which has been running on a new system called Proof of Stake since 2020.

Proof of Stake vastly reduces the number of computers needed to maintain the blockchain, and cryptominers are replaced with a smaller number of "validators", who stake their own stash of Ethereum coins against their work. They lose it automatically if they make a mistake.

As well as reducing the energy burden of Ethereum, Proof of Stake reduces the amount of coins given out as a reward and organisers say it will decrease the overall number of coins in existence.

More environmentally friendly

Not only does Proof of Stake reduce the number of computers needed, it also reduces the computing power needed.

Everyday laptops and desktops can be used instead of expensive computers with powerful GPUs (graphics processing units).

The decentralised nature of mining makes it hard to get an accurate picture of exactly how much energy is being used globally, but the Ethereum Foundation says that Ethereum was using as much electricity as The Netherlands, external in June.

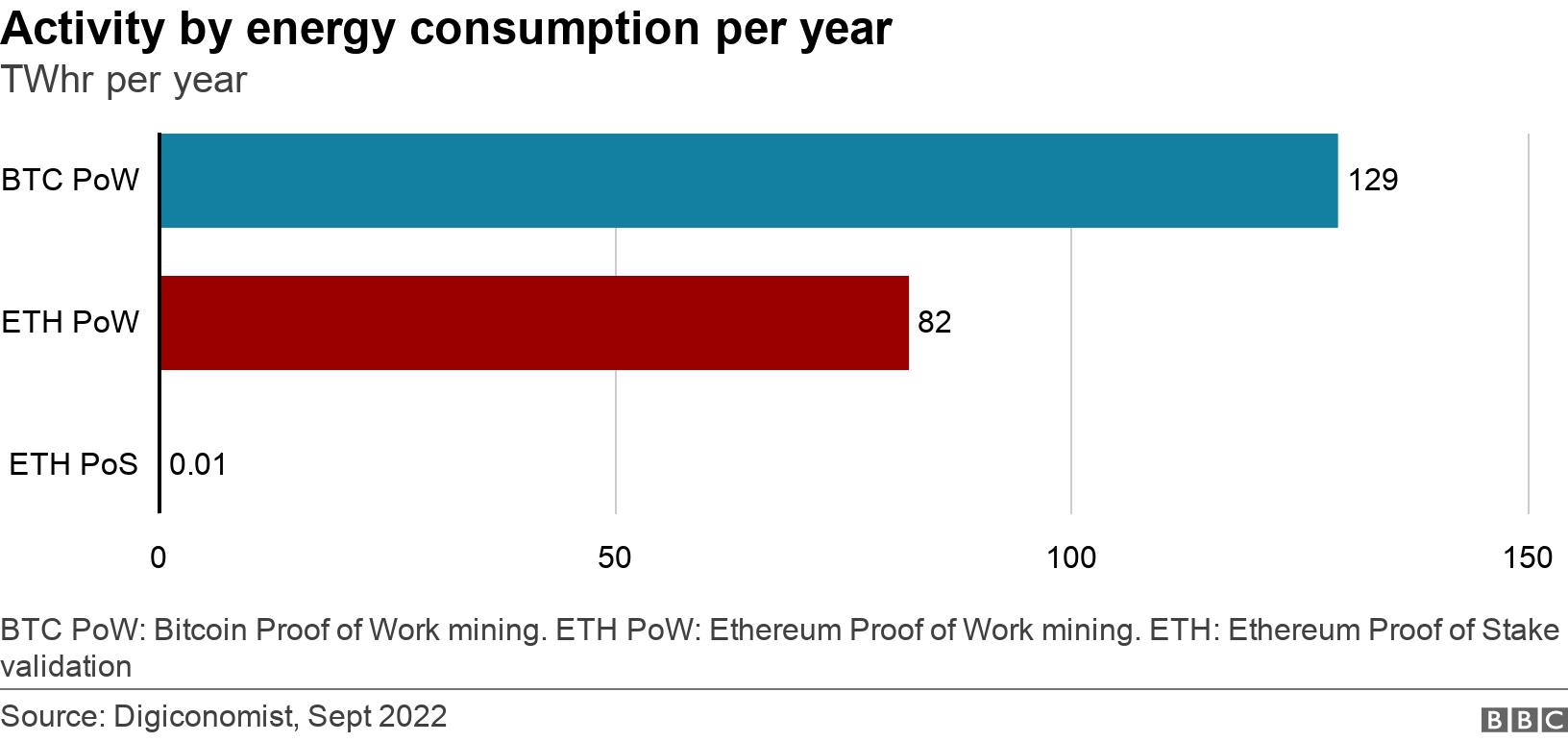

Moving to Proof of Stake will reduce energy consumption to 0.01 Terrawatt hours per year, the foundation says.

Latest estimates from Digiconomist, a group that studies the economics of digital trends, suggest the last few months has seen a reduction in the amount of power used in the network. It estimates that pre-Merge Ethereum usage is now at 82 Terrawatt hours per year, with a carbon footprint estimated to be similar to Finland's.

What happens now to cryptominers?

The Merge leaves Ethereum's vast army of mining volunteers with a tough decision.

Manchester-based Ethereum miner Josh Riddett hopes he'll still make money on less valuable coins

Already the cryptocrash in the spring, when the value of coins plummeted, made cryptomining less profitable.

Energy costs are also increasing in many parts of the world, reducing potential profits.

Now miners of Ethereum will need to find a new way to make money with their equipment, or sell up.

Some reports suggest a large-scale sell off of GPUs, external has already begun.

At Dubai-based mining company Prima Technologies, the team is investing tens of thousands of dollars to replace their Ethereum GPU mining computers with even more expensive and energy-hungry machines able to mine for Bitcoin.

How cryptocurrencies such as Bitcoin work

"It's tough, as no other Proof of Work currencies are as profitable as Ethereum," spokesman Ammar Lashkari said. "We're going to keep some of our Ethereum computers and start mining alternative coins but it will not be the same, so we're going to slowly diversify into Bitcoin mining."

In Staffordshire in the UK, Ash Andrews is hoping to still make profits mining for other coins with his existing equipment.

"I've got mixed feelings on The Merge. It's been an easy time for us miners just mining Ethereum, and now we'll have to switch to another coin. There's a lot of change." he said.

Some are more upbeat about the future of GPU mining.

Josh Riddett, CEO of Easy Crypto Hunter, based in Manchester, thinks mining less popular coins will eventually be profitable.

"During the price peak of Ethereum every mining rig we had was making $150 a day, which is pretty crazy. Yes we're going through a bit of a numerical down period but who's to say what the value of other coins might be in three to five years time."

Update, 16 September 2022: The chart on this story originally showed energy consumption figures for YouTube, the gold mining industry and Paypal. The figures were taken from the Ethereum Foundation but we have since learned they are inaccurate and removed these bars from the chart.

- Published31 January 2022

- Published27 February 2021