Anger as Revenue's Hartnett refuses tax bill apology

- Published

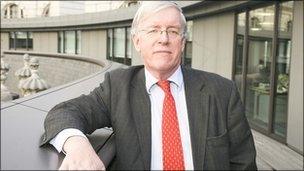

Dave Hartnett told the BBC there had been no blunders.

There has been anger after comments from the UK's top tax official who "saw no need to apologise" over the 1.4m people who must pay more tax.

HM Revenue and Customs Permanent Secretary Dave Hartnett said "tax reconciliation" was a routine measure.

But Tory MP Ian Liddell-Grainger accused HMRC of "built-in arrogance".

A coalition government source told the BBC Mr Hartnett should have explained himself more clearly and people would be given time to pay.

BBC News Website readers have joined in the criticism of HMRC.

One wrote: "HMRC should apologise - it is HMRC who calculate our taxes and who deduct them from our wages, so if a mistake has been made who is to blame?"

It is estimated 2.4m people underpaid income tax during the past two tax years due to errors in their Pay As You Earn (PAYE) tax code.

The mistakes were made because of miscalculations made by HMRC tax officials.

About 900,000 taxpayers will not have to pay anything after the Government raised the write-off threshold from £50 to £300, leaving 1.4m people owing about £2bn, or £1,428 each on average.

Mr Hartnett told BBC Radio 4's Money Box programme: "I'm not sure I see a need to apologise. I've read the papers, listened to the media and heard stories of HMRC blunder and IT failure. Neither of those are true.

"Every country that I know of that has deduction of tax from wages in salaries has to do a reconciliation at the end of each year and we're doing one.

Asked if the numbers involved were extraordinary - with 4.3m people having paid too much tax and 1.4 having to pay money back after paying too little, he said: "I don't think they are extraordinary. There is a need for reconciliation every year.

"Once or twice in the past the numbers have been very large, sometimes they're less. It depends on how the system has been operating and what issues there have been."

He also defended himself against criticism that those owing more than £2,000 would have to repay the money more quickly.

People owing less than £2,000 will be able to pay the money in monthly instalments taken from their salary over one to three years. Those owing more money will have three months to return it, once a self-assessment form has been issued.

Mr Hartnett said for those owing the most it "may actually mean they're earning the most."

He added: "I think it's very unlikely that a low earner will owe us more than £2,000 as a result of the process we're going through now."

Mr Hartnett said the 5.7m letters going out to taxpayers before Christmas were the result of a normal process of matching the tax deducted from each taxpayer with their circumstances.

His comments come amid reports of difficulties at HMRC.

Last week an unnamed tax officer told the BBC the department had not been fit for purpose for a very long time and had reached "melting point" without the staff or resources needed and subject to an "atrocious" computer system.

HMRC responded by saying the introduction of a new computer system would help reduce tax errors in future.

Conservative MP Ian Liddell-Grainger, chairman of the All Party Parliamentary Taxation Group, said the HMRC was "one of these organisations that's grown and grown. They aren't actually up to it.

"You get this built-in arrogance we're hearing, where 'I don't need to apologise because I've not done anything wrong'."

And John Andrews, chairman of the Low Incomes Tax Reform Group, said: "The £2,000 procedure gives me concern.

"There are circumstances in which over a two year period, for example on a bereavement where a widow suddenly inherits part of her late husband's pension, it is quite easy to run up this amount.

"I hope that HMRC would live up to the Your Charter expectations and look at individuals."

Time needed

And a coalition government source told the BBC David Hartnett could and should have explained himself more clearly when pointing out that tax reconciliation happens every year.

They said ministers have made it clear in Parliament that the HMRC has been told to treat cases of hardship sympathetically and give people more time to repay arrears - up to 3 years.

Some taxpayers can expect more letters and tax returns from HMRC in the coming months

An HMRC spokesman said help was available to all people ordered to pay back tax, including those owing more than £2,000.

Payments could be spread over a longer period with Revenue agreement but interest would still be due on the outstanding balance.

The main batches of letters to taxpayers would start going out in "early to mid October' and he still intended they would all arrive by Christmas, Mr Hartnett said.

Three quarters of those sent a letter - 4.3m people - will receive a rebate averaging £400.

The rest will be told they have to pay extra tax. Up to 250,000 could be asked for £2,000 or more.

BBC Radio 4's Money Box is broadcast on Saturdays at 1200 BST, and repeated on Sundays at 2100 BST.

BBC News website readers have been sending their reaction to the story. You can email your comments using the form at the bottom of the page.

This must be the most arrogant statement I have heard in years. Typical of the autocratic attitude taken by HMRC. I have not received a letter about my tax payment, but I am infuriated by Mr Hartnett's autocratic and arrogant attitude. Has he forgotten that he is first and foremost a servant of the British public. In private industry he would be forced to resign for such blunders. Joe Azzopardi, Skipton

Mr Hartnett's arrogance beggars belief. I remember watching him in an interview about tax office mistakes, and his attitude was exactly the same then: "we are a big organisation and we make mistakes - so what". John, Bristol

I can't quite remember what comes before a fall. Perhaps Mr Hartnett will remind me in due course. Ben, Dorset

I have to say that Mr Hartnett's comment that no apology is required seems somewhat arrogant to me. It cannot be disputed that "all is not well in the state of the HMRC". The response time to enquiries is now in excess of two months. My daughter wrote to her tax office in June because a bank had decided to change the way it dealt with tax on interest paid to her on a bond and that she owed HMRC some tax for last year. She is still waiting for a response along with thousands of others who are feeling quite exasperated about the Revenue's poor standard of administration. Philip Cooke, Birmingham

Regardless of how the error came to be made, the result has been confusion and expense, both for the taxpayers and HMRC. To say that no apology was required smacks more of stupidity than arrogance. Most people will apologise if they walk into someone. It's the sign of a weak character not to apologise. David Blake, London

I have been reading this story all week but not once has anybody, including HMRC, said how the error has happened. Now the big chief has said it is not an HMRC blunder, nor an IT failure, but has failed to give a satisfactory explanation. So exactly how did it happen? I am an ex-employee of HMRC and I can't see how it has affected only part of the population. Caroline, Pontypridd

Yes, HMRC should apologise - it is HMRC who calculate our taxes and who deduct them from our wages, so if a mistake has been made who is to blame? Rick Appleton, Rushall, West Midlands

I find it amazing that when a government department becomes more efficient in an effort to close the tax gap politicians try to lay blame on the brow beaten civil service. Isn't the country a bit strapped for the cash genuinely owed by taxpayers? In these times of austerity should we all not be paying our fair share as quickly as possible? Or this government will have to make even more severe public service cuts. Ray, Staffordshire

So taxpayers are to be punished for a fault that is not of their own making. Surely contrary to normal law? V M Alsford, Northampton

- Published11 September 2010

- Published9 September 2010

- Published4 September 2010

- Published7 September 2010