Take That stars could face tax bill of millions after court decision

- Published

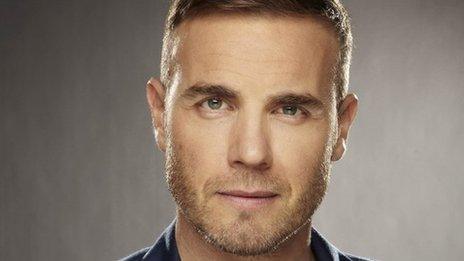

Howard Donald (left), Mark Owen and Gary Barlow (right) are among those who invested in schemes which apparently supported the music industry

Three members of the band Take That may have to pay back millions of pounds in tax after a tribunal ruling.

Gary Barlow, Howard Donald and Mark Owen - along with manager Jonathan Wild - were among about 1,000 people who put money into schemes purportedly supporting the music industry.

But tribunal Judge Colin Bishopp ruled the partnerships had actually been set up for tax avoidance purposes.

HM Revenue and Customs said they would not "tolerate abuse of the system".

The Take That stars and their manager invested money through a company called Icebreaker.

Since March 2010, the four men have been directors of Larkdale LLP - one of 50 partnerships that Icebreaker arranged to harness tax reliefs that the government had intended would support those in creative industries.

Gary Barlow has found success as a solo artist as well as with Take That

The tribunal found that shortly after money was put in to Larkdale LLP, it reported huge losses of more than £25m.

Those losses could then be offset against tax, reducing the men's tax bills.

The BBC's Andrew Verity said that while Barlow, Donald, Owen and Wild could face repaying millions of pounds between them for the tax relief applied to the losses, the exact amount was not known.

While tax evasion is illegal, tax avoidance is not a criminal activity, he added.

HMRC said that following Judge Bishopp's decision, those involved would receive letters outlining how much tax they had to repay.

An HMRC spokesman told the BBC that "anyone using a scheme that HMRC deems to be against the rules owes them money".

'Dodging tax obligations'

Judge Bishopp said in his ruling: "The underlying, and fundamental, conclusion we have reached is that the Icebreaker scheme is, and was known and understood by all concerned to be, a tax avoidance scheme."

In total, the Icebreaker partnerships generated losses of £336m.

HMRC pursued the issue through the courts after the Times newspaper first exposed Icebreaker in 2012.

In a statement, they said: "HMRC has put in place generous reliefs to support genuine business investment and our tax reliefs for the creative industries work well, enabling the UK's world-class film, television and video production companies to compete on the global stage.

"But we will not tolerate abuse of the system by people trying to dodge their tax obligations.

"HMRC will continue to challenge in the courts anyone who engages in tax avoidance schemes... [Such people] risk not only the high cost of these schemes but also lay themselves open to penalties and, potentially, prosecution."

The members of the scheme have until 2 July to decide whether they want to appeal. HMRC said it would be seeking payment of the tax in the meantime.

The other members of Take That were not involved in the scheme.

- Published21 June 2012

- Published16 June 2012