Cameron ducks Gary Barlow tax avoidance question

- Published

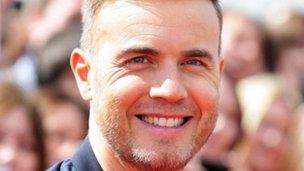

Gary Barlow organised the Queen's Diamond Jubilee concert

Prime Minister David Cameron has refused to criticise Gary Barlow over alleged use of a tax avoidance scheme.

Labour is calling on the Take That star to hand back the OBE he received in the Queen's Birthday Honours List.

He is facing questions about money he is alleged to have invested in a tax scheme - Icebreaker 2 - being investigated by HM Revenue and Customs.

There is no suggestion the scheme is illegal but it could still be closed down by HMRC at a tax tribunal.

Mr Cameron said he was not going to give a "running commentary" on people's tax affairs - but he had made an exception for comedian Jimmy Carr because "it was a particularly egregious example of an avoidance scheme that seemed to me to be wrong".

'Proper strategy'

Mr Carr earlier admitted he had "made a terrible error of judgement" over using a legal tax avoidance scheme after criticism from the prime minister.

Labour leader Ed Miliband opted not to join in with criticism of Jimmy Carr's tax arrangements, saying: "I'm not in favour of tax avoidance obviously, but I don't think it is for politicians to lecture people about morality."

But Labour has now accused Mr Cameron of having a partial view of "what's dodgy in the tax system".

Shadow commons leader Angela Eagle said: "The prime minister rushed to the TV studios to condemn the tax avoidance scheme used by Jimmy Carr but he did not take the opportunity to condemn as morally repugnant the tax avoidance scheme used by Conservative supporter Gary Barlow, who's given a whole new meaning to the phrase 'Take That'.

"If it's all so morally repugnant, why has he just been given an OBE in the birthday honours list?"

Shadow treasury minister Catherine McKinnell said that even though he had done nothing illegal, Mr Barlow should return his OBE.

"If he's using a tax avoidance scheme then, yes, I think he shouldn't be rewarded with this national honour because it doesn't send out the right messages to ordinary people who are paying their fair share of tax," she told the BBC News Channel.

She stressed that "we haven't got the full story about what these tax arrangements are" but said HMRC needed to "get on top" of what wealthy individuals were being advised to do by their accountants and close any loopholes in the system.

McKinnell: "I think he shouldn't be rewarded with this national honour"

The government needed a "proper strategy in place for tackling tax avoidance," she added.

Take That's manager Jonathan Wild declined to comment.

Tax tribunal

Mr Barlow, Mr Wild and Take That members Howard Donald and Mark Owen are said to have invested £26m in a scheme - Icebreaker 2 - that is facing a legal challenge from HMRC.

HMRC said: "We are now preparing to litigate Icebreaker 2 but for legal reasons cannot say more at this time."

A spokesman said that while not illegal in themselves some tax schemes went against the "spirit" of the regulations in the way that they used loopholes and reliefs.

Beneficiaries of such schemes were normally forced to pay money back with a penalty.

HMRC had already closed down a similar scheme, Icebreaker 1, and was hopeful of closing Icebreaker 2 down at a tax tribunal later this year, he added.

Icebreaker Management Services maintained on Wednesday that they work "within the law" and said it was "essential that anyone who seeks to make use of tax relief does so properly".

As a member of Take That, Mr Barlow has written 11 UK number one singles.

In recent years, he has become increasingly known for his charity work and TV projects including judging on The X Factor and organising the Queen's Diamond Jubilee concert.

- Published21 June 2012

- Published16 June 2012

- Published20 June 2012

- Published20 June 2012

- Published14 June 2012

- Published24 May 2012

- Published28 March 2012