Tax credit changes: Your views

- Published

Chancellor George Osborne will "lessen" the impact of tax credit cuts on families after the House of Lords voted against the government's plans.

But the Treasury says the changes will save over £4bn a year from 2016 and claims most working families will still be better off by 2017, as a result of the introduction of the National Living Wage and changes to income tax thresholds.

People have been contacting the BBC about the recent proposals by the Chancellor of the Exchequer. Here is a selection for their comments:

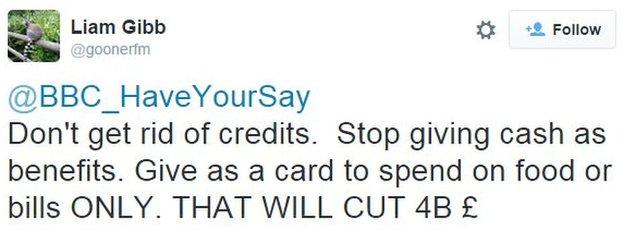

@goonerfm tweets, external his alternative:

Leza Brumbill in Romsey, Southampton: I am a single mum with three boys.

I go to work 24 hours a week, and have to pay for childcare. I rely on my tax credits to top up my earnings.

The pressure is on me to provide a loving, secure, good standard of living for my children but cutting my taxes by nearly £1,000 is going to put more pressure on me to achieve this.

Rachel in Norfolk: I believe the cuts should go ahead. I live in a deprived area. My husband has a zero hour contract and only works a few hours a month. He primarily cares for our daughter. I work full-time.

Our net income is about £2,000 per month at best. We know families on tax credits who have higher net incomes than us but pay almost no tax and National Insurance.

These families can afford to smoke, drink, go clubbing and eat out yet we cannot. It is demotivating, going to work and knowing others earn more than you for doing less.

I have started to wonder why I don't take a less stressful job for a minimum wage and receive tax credits to top it back up.

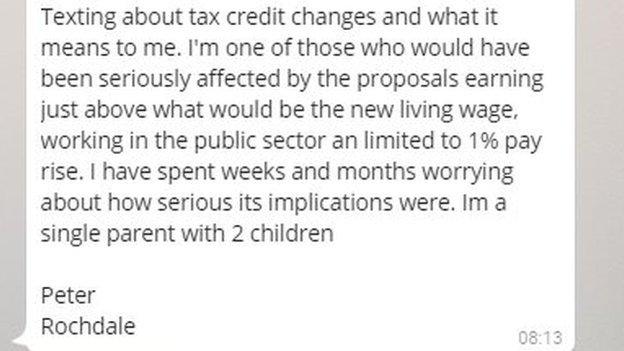

Peter in Rochdale messaged on WhatsApp to express his concerns as a single parent:

Sharon Court in Portsmouth: We are a working family, but our income is low.

I have a degree and I do freelance work part-time as my children are in primary school.

Without tax credits we would almost certainly be plunged into debt. Raising the minimum wage is important, but it has no direct impact on me as I'm self-employed.

Lots of people like me are slipping through the cracks.

Martin Godfrey in Cheshunt, Hertfordshire: I have never claimed tax credits. I object strongly to a system that hands my hard-earned taxes to people who should be taking responsibility for their own lives and the decisions they make rather than relying on the state to look after them.

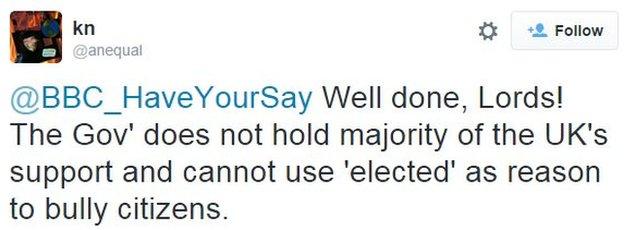

@anequal tweets, external his satisfaction at the House of Lords' rejection of the chancellor's plans:

Lee Dunlop in Williton, Somerset: My wife and I receive tax and child tax credits.

I work 25-30 hours per week as a school caretaker.

My pay is £8.08 per hour out of which I contribute towards a pension.

I am ex-army and in February 2013 received a kidney transplant. I am unable to work more hours. What are we supposed to do?

Stacey Sutton in Worcester: These tax cuts will be catastrophic for my family.

I have a six and one-year-old. Nursery fees are extortionate. I work 16 hours per week and my husband works in retail full-time - it's barely above the minimum wage.

I want to work. I don't want to just be sitting at home claiming off the state. Even with the tax credits we get now we are really struggling to buy food and pay the bills.

God knows how we are going to be able to afford Christmas!

Tony Dessauer in Eaton Bray, Bedfordshire: I had become complacent about the income from the tax credits.

I now deliver groceries 39 hours a week on a low wage. I am 63 and see nothing wrong with working.

I appreciate why there is an uproar about the cuts but I don't believe they should be the norm. People like me who are perfectly capable, should work.

The poorest earners and single parents need help definitely. We should all work if we need to and not rely on the state to pay us a wage.

Compiled by Sherie Ryder

- Published27 October 2015

- Published26 October 2015

- Published26 October 2015

- Published24 November 2015