Panama Papers: Mossack Fonseca leak prompts call for tax haven crackdown

- Published

The PM has been urged to crack down on offshore tax havens, after a huge data leak exposed efforts by international figures to hide assets abroad.

Eleven million documents were leaked from one of the world's most secretive companies, Panamanian law firm Mossack Fonseca.

The firm says it has operated beyond reproach for 40 years and has never been charged with criminal wrong-doing.

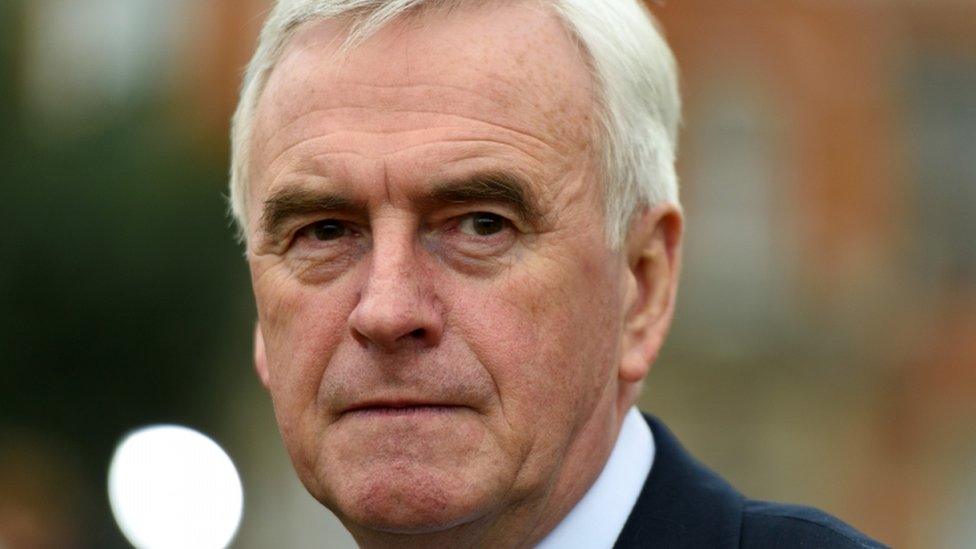

Shadow chancellor John McDonnell said "real action" on tax evasion was vital.

He called on the UK's tax authority, HM Revenue and Customs (HMRC), to launch an investigation, saying it would need more resources for this.

Although using offshore companies is not illegal, the disclosures have intensified calls for international reform of the way tax havens are able to operate amid claims of large-scale money laundering.

'Private matter'

HMRC said information it had received on offshore companies was the subject of "intensive investigation" and this data would be acted on "swiftly and appropriately".

The documents show 12 current or former heads of state and at least 60 people linked to current or former world leaders in the data.

Among them, the files show Icelandic Prime Minister Sigmundur Gunnlaugson had an undeclared interest linked to his wife's wealth. They also reveal a suspected billion-dollar money laundering ring involving close associates of Russian President Vladimir Putin.

The prime minister's late father Ian was among those named in relation to investments set up by Mossack Fonseca.

But Downing Street would not comment on the tax affairs of Mr Cameron's father, and said the issue of whether the Cameron family still had funds in offshore investments was a "private matter".

The leak also revealed some of the cash from the 1983 Brink's Mat robbery was laundered using a company set up by Mossack Fonseca.

Panama Papers - tax havens of the rich and powerful exposed

Eleven million documents held by the Panama-based law firm Mossack Fonseca have been passed to German newspaper Sueddeutsche Zeitung, which then shared them with the International Consortium of Investigative Journalists, external. BBC Panorama and UK newspaper the Guardian, external are among 107 media organisations in 76 countries which have been analysing the documents. The BBC does not know the identity of the source

They show how the company has helped clients launder money, dodge sanctions and evade tax

Mossack Fonseca says it has operated beyond reproach for 40 years and never been accused or charged with criminal wrong-doing

Tricks of the trade: How assets are hidden and taxes evaded

Panama Papers: Full coverage; follow reaction on Twitter using #PanamaPapers; in the BBC News app, follow the tag "Panama Papers"

Watch Panorama at 19:30 on BBC One on Monday, 4 April, or catch up later on the BBC iPlayer (UK viewers only)

Mr Cameron has been a vocal advocate of reform and legislation to force British companies to disclose who owns and benefits from their activities - which comes into force in June.

The prime minister's spokeswoman insisted the UK was "ahead of the pack" on tax transparency, had made this "front and centre" of the UK's G8 presidency, and had got 90 countries automatically to exchange information.

Mr Cameron faces pressure to secure progress at an international summit on tackling corruption, which he will chair in London in May, and where the use of offshore tax havens to escape scrutiny will be high on the agenda.

Foreign Secretary Philip Hammond, who recently met the Panamanian vice president to discuss the issue, insisted "significant progress" was being made.

"It's always interesting when information like this leaks because it reminds people who are up to no good how fragile and how vulnerable they make themselves by indulging in this kind of activity," he told the BBC.

"This is a key agenda for the prime minister."

'Tax secrecy'

But Labour's Mr McDonnell said not enough had been achieved by the UK.

"[Mr] Cameron promised and has failed to end tax secrecy and crack down on 'morally unacceptable' offshore schemes," he said.

"Real action is now needed."

Mr McDonnell said tax havens did not "serve any useful purpose" and the UK in particular had a role to play in tackling them because of its links to territories used for this purpose. He said he would like to see them closed down.

Dame Margaret Hodge, Labour MP and former chairwoman of the Parliamentary Public Accounts Committee told the BBC: "I think it's really important that we grasp this huge leak of documents as an opportunity to do something that David Cameron and his government said they would do three years ago.

"And that is to ensure that all the tax havens, whether it's Panama, whether it's the ones that we control here in Britain because they're Crown dependencies, to ensure that they produce a proper list of who owns the companies that are located in their jurisdiction."

She said once the list was in the public domain "a lot of this unsavoury hiding of money" would disappear.

Liberal Democrat leader Tim Farron called for an independent investigation, claiming the UK government has "failed to act until forced to by a scandal" over tax havens.

He said: "Rather than waiting until more headlines force action, the government should now commission a full independent investigation into the way the Virgin Islands and others have acted, what the UK government knew, and why they have not used their legislative powers to impose the transparency rules they previously claimed to support."

Shadow chancellor John McDonnell said "real action" on tax evasion was vital

Gerard Ryle, director of the International Consortium of Investigative Journalists (ICIJ), said the documents covered day-to-day business at Mossack Fonseca over the past 40 years.

"I think the leak will prove to be probably the biggest blow the offshore world has ever taken because of the extent of the documents," he added.

And Jennie Granger, a spokeswoman for HMRC, said the organisation had received "a great deal of information on offshore companies, including in Panama, from a wide range of sources, which is currently the subject of intensive investigation".

"We will closely examine this data and will act on it swiftly and appropriately," she said.

"Our message is clear: there are no safe havens for tax evaders and no-one should be in any doubt that the days of hiding money offshore are gone.

"The dishonest minority, who can most afford it, must pay their legal share of tax, like the honest majority already does."

She said the ICIJ had been asked to share all its data with HMRC.