Church of England will not take on Wonga's loans

- Published

The Church of England has said it will not attempt to take on the loans of failed payday lender Wonga.

Concerns were raised that the debts of thousands of borrowers could be passed to another high-interest lender after Wonga went into administration.

MP Frank Field had urged the Archbishop of Canterbury to lead a group of "good people" to buy the loans.

But the church said it had discussed the idea and decided it was "not as well placed as others" to buy them.

Administrators were officially appointed last month to conduct an "orderly wind-down" of Wonga - a firm that was criticised for charging huge interest rates for its loans.

Following Wonga's collapse, ex-Labour MP Mr Field wrote to Archbishop of Canterbury Justin Welby to express concern that borrowers could be ripped off if another payday lender bought the firm.

He said Wonga's £400m loan book was likely to be sold at a "knockdown" rate, which risked the possibility of the "exploitation of the poor".

Mr Field said buying it would protect 200,000 borrowers from having to make repayments to another lender at high commercial rates.

Church commissioners - who manage the Church of England's investment fund - met to discuss the option this week.

However, on Friday, the Church said: "The church commissioners for England today also confirmed their non-participation in a potential buy-out of the UK loan book having concluded that they are not as well placed as others to take this forward."

It added that "confidential approaches" may now be made by parties from the charitable and finance sectors for the loans.

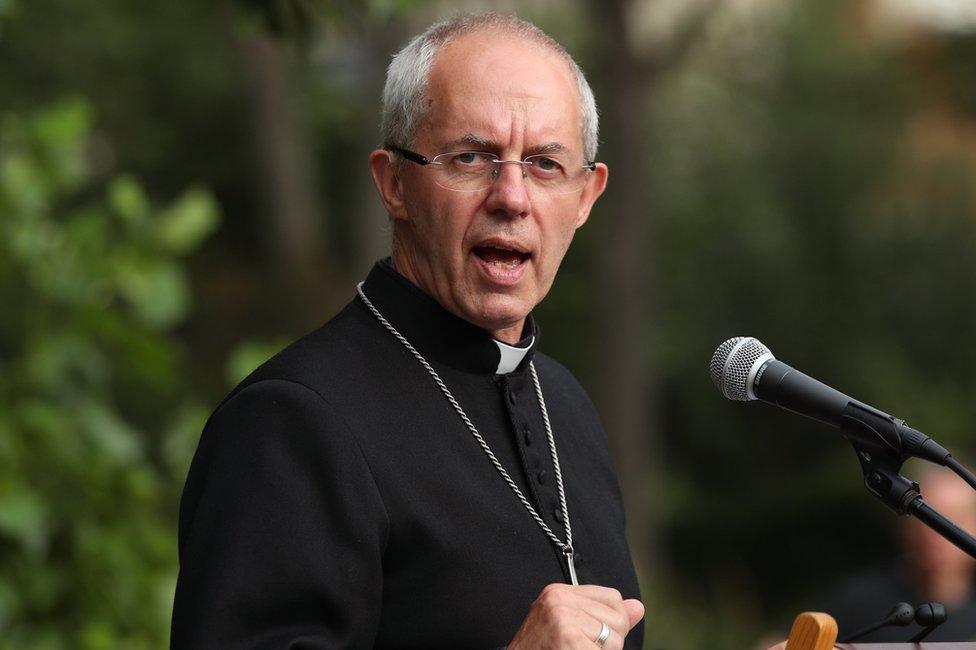

Archbishop of Canterbury Justin Welby has been a critic of firms like Wonga

The Church of England has a £8.3bn investment fund, which it says it invests in an "ethical and responsible way".

The Church holds investments, external in firms including pharmaceutical giant GlaxoSmithKline, the bank HSBC, supermarket Tesco, as well as tech firms Microsoft and Samsung.

However, it has been criticised for some of its investments.

Last week, the Church said it was keeping its shares in Amazon - a day after the Archbishop Welby said the firm was "leeching off the taxpayer".

The archbishop had questioned Amazon's tax record.

In 2014, the commissioners sold around £75,000 of shares in Wonga after the archbishop pledged to "put it out of business".

He had admitted to being "embarrassed" and "irritated" when details of the link emerged in 2013.

- Published31 August 2018

- Published11 July 2014

- Published30 August 2018

- Published5 September 2018