Debit card glitch means thousands charged twice

- Published

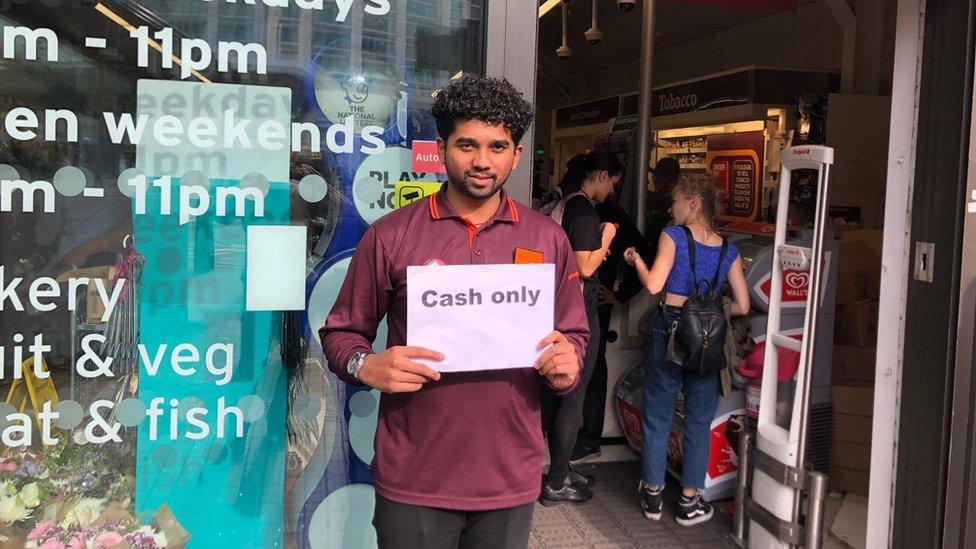

The issue affected many people who used debit cards to buy goods and services on 29 August

Thousands of people in the UK were charged twice for debit card payments.

The error occurred due to an issue with a particular card terminal run by Cardnet, a joint venture between Lloyds Bank and First Data.

Money came out of bank accounts twice but transactions only showed up once on many shop, pub and restaurant receipts.

Lloyds Banking Group said just under 5% of Cardnet machine transactions were affected on part of 29 August and all affected customers had been refunded, external.

However, customers are still being advised to check their statements and contact their bank if required.

Many people banking with different organisations were charged twice for spending money in shops, restaurants and businesses using Cardnet terminals as their way of taking payment.

The majority of affected transactions involved Visa debit cards.

Simon Alton was charged twice for a meal at Côte Brasserie

Simon Alton, 39, discovered he had paid twice for a meal at Côte Brasserie, in Shrewsbury, Shropshire, last Wednesday.

"It's a reminder to check your statement, it's an unexpected thing to happen," he said.

"I'm a bit lax, if it wasn't for the friends I had been out with who messaged me the next day, I might not have noticed."

Mr Alton, who works in PR, said he had spent about £60, adding: "The restaurant's been very good. As far as we know, we'll get the money back."

Côte Brasserie has been approached for comment.

Compensation call

David Stewart, 61, lives in Edinburgh and was charged £1,060 twice when paying a hotel for his daughter's upcoming wedding.

"I found out Saturday 1 September. At first I thought it was the hotel error. I went down to the hotel but I found out they had nothing to do with it.

"I phoned Santander on Monday morning and they said I would get my money back. The main thing has been the stress of not knowing what was happening.

"I received my money this morning. I think they should look at what's happened and give compensation as a goodwill gesture."

Other customers took to social media to express their concern about duplicate payments.

One woman, known as Lisa D, said she had visited the Oblix restaurant in The Shard, London, to celebrate her husband's birthday when she was charged twice.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Sara McCluskey went to Solita NQ in Manchester with friend Oriel Hardman when both were affected.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Billy Hatch visited German Donner Kebab (GDK) in Sutton, Greater London, and had the same problem.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Other businesses responded by saying it was a problem with the card processing data firm and not an issue with individual businesses or banks.

Brunning Host Pubs, which runs pubs in Devon, released a statement to customers on 1 September after being made aware of the problem.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

The Nab's Head, in Preston, Lancashire, said in its statement second duplicate payments would not be taken by them but refunded as soon as possible.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Cardnet handles more than 1.2 billion transactions every year, according to its website.

It claims to make it "easy for merchants to accept card transactions online, in person or by phone".

Analysis

Simon Gompertz, BBC Personal Finance Correspondent

We are all using cards more to make payments.

Last year cards topped cash for the first time ever, as contactless paying took off.

So it's vital we can have confidence in the security and reliability of the technology.

It has taken Cardnet nearly a week to send out refunds for its double-charging mistake.

In that time some customers will have been perplexed or even panicky about what happened to their accounts.

If banks want us to embrace the future, they need to be much sharper at dealing with the glitches.

A Lloyds Banking Group spokesperson said: "A small number of transactions processed last Thursday by Cardnet were duplicated.

"All customers have now been automatically refunded, however customers can check their statements and get in touch with their banks if required."

In July one of the UK's money transferring services had to deal with a backlog of payments after a system failure.

Visa experienced a similar issue in June that left customers across Europe unable to make some purchases.

While in May, TSB customers continued to face issues with online banking.

- Published9 July 2018

- Published18 June 2018

- Published6 June 2018

- Published2 June 2018

- Published1 June 2018

- Published25 May 2018

- Published5 May 2018

- Published23 April 2018