England sees 'boom' in second homes flipped to holiday lets

- Published

- comments

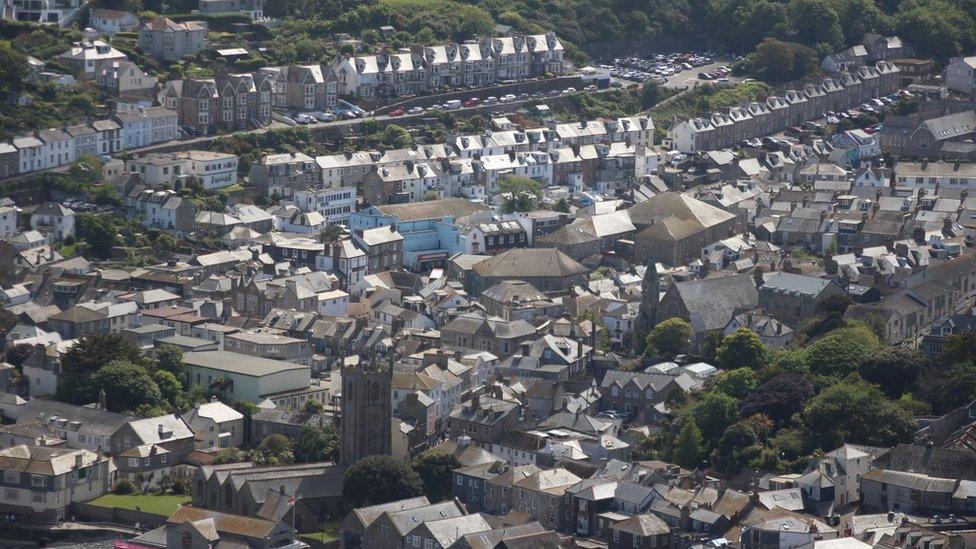

Travel restrictions because of the pandemic have seen a boom in people going on holiday in places such as Cornwall

More than 11,000 second homeowners in England have flipped their properties to become holiday lets since the start of the Covid pandemic, research shows.

Analysis of government figures by real estate advisers the Altus Group shows the number of holiday homes trading as businesses has jumped by more than 20%.

The group said a rental price "boom" in holiday hotspots had led to the shift.

Restrictions on foreign travel to other countries resulted in a surge in demand for domestic holidays, it added.

The data shows 67,578 homes classified as holiday homes have been flipped to become commercial premises, compared to 56,102 properties in March last year.

Almost 4,000 homes have been flipped in South West England alone since the start of the pandemic, amid record visitor numbers in Cornwall and Devon.

Meanwhile, the South East also has also seen a significant rise in the number of new lets, with a 27% rise - or 1,458 properties.

'Far more lucrative'

Transforming second properties into holiday lets has helped secure additional income for owners during the pandemic, but could also be beneficial for tax reasons.

Holiday homes were entitled to grants last spring worth £552m to support non-essential retail, hospitality, leisure, personal care and accommodation sectors.

Meanwhile, top-up grants worth a further £257m were made available in January, given the third national lockdown.

This year's Budget also saw further grant funding announced to take total grant support to £1.33bn since Covid first hit, according to Altus.

Changing second properties into holiday lets has brought extra income for owners

Robert Hayton, UK president of Altus Group, said: "The grants for second homeowners will have been far more lucrative than 'business as usual' for many, especially in the off-seasons, whilst there is a pivot towards holiday lets as rental prices boom in hotspots."

About 96% of holiday homes in England are also covered by the small business rate, external regime, so pay little to no property taxes.

However, the government announced in the March Budget that it planned to legislate to tighten tax rules for second property owners in England, meaning they would only be able register for business rates relief if their properties were genuine holiday lets.

- Published24 August 2021

- Published22 August 2021

- Published14 August 2021

- Published22 May 2021