Premium bonds: The unclaimed £68m in NS&I prizes

- Published

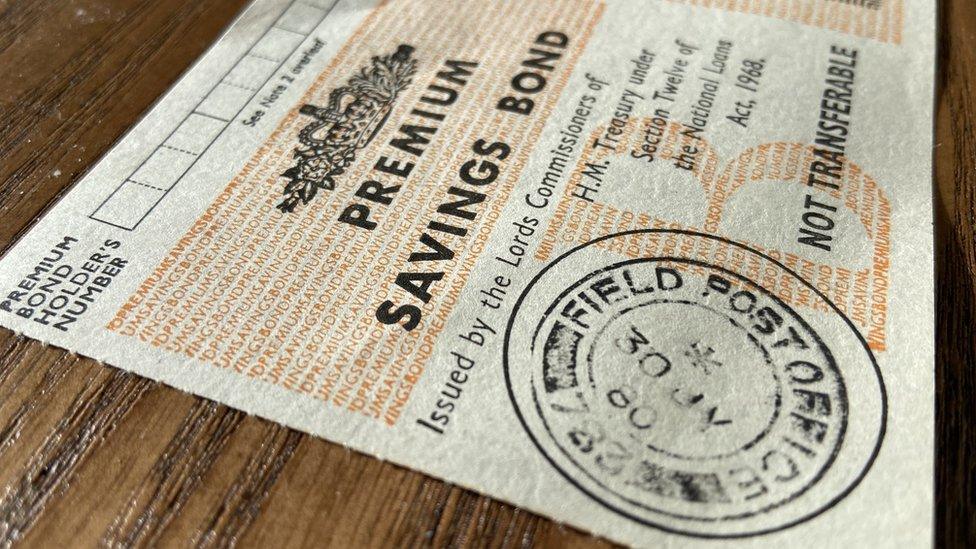

People often don't know they have old premium bonds because they were gifted to them as a baby

Each month in the UK, premium bonds are entered into a draw that could net lucky holders £1m.

But while the jackpot winners have all been accounted for over the years, a huge £68m in prizes dating back as far as 1957 are still unclaimed - including three in England for £100,000.

Imagine a letter dropping on the doormat that is neither junk mail, a bill, nor a suspicious brown envelope. Instead, it's the news that £25 worth of premium bonds bought in 1984 have finally borne fruit.

Except this £5,000 windfall might not ever reach this particular winner because their contact details with National Savings and Investments (NS&I) are four decades old.

Instead, the state-owned savings bank has done the only thing it can to unite the customer with their prize: write to an address they have on file in the Herefordshire and Worcestershire area that 37 years on might not even be the right one.

Not having the correct contact information is one of the main reasons people never receive their money, explains NS&I's retail director Jill Waters.

"Sometimes the winner has forgotten they have bonds and in some cases, such as those gifted to babies and children, they might not even know they had them in the first place," she says.

"But most commonly, customers will move house. Letting NS&I know [your change of address] is probably not top of the list but it's the major reason for customers not receiving prizes. And it's just one of those things that you have to know it's there to claim it."

Customers signed up for premium bonds on the first day of their availability, 1 November 1956, outside the Royal Exchange

The Hereford and Worcestershire example is just one of 2,004,588 unclaimed prizes worth an enormous £68,670,200.

The area is also home to one of the only three winners in England who have still not claimed the second largest prize - £100,000 - which, in this case, was won in 2014 with a tiny £14 investment.

The other two were won in outer London and Greater Manchester in 2007 and 2010 respectively. Elsewhere, a £10 holder in Lothian still does not know they won £100,000 in 2013, nor does an overseas winner who won the same amount in 2007 with just £6 in bonds.

Then there are the millions of prizes of descending value - from the nine people who are none-the-wiser that they could be £50,000 better off to the countless winners of £25.

NS&I has been plagued by this issue since June 1957 when its Electronic Random Number Indicator Equipment - known as Ernie - began generating the numbers for 587 million tax-free prizes worth approximately £23.6bn to date. The oldest unclaimed prize is in fact from the same year and practically every month since, that tally has grown and realistically will continue to do so.

The first person to win the £1,000 top prize in 1957 did so with bond 1KF341150

This version of Ernie was in service from February 1973 until August 1988

In October alone - a draw which allocated almost five million prizes - there are numerous winners whose likelihood of claiming is questionable: there's the person in London who bought £25 of bonds in 1966 and another in Essex who bought £30 worth in 1983, to pick just two.

The good news is that if they don't come forward, the prizes will always remain available should they one day realise - whether they find their holder's number tucked into a long-forgotten notebook or not. If all you have is a faint recollection that a distant relative once bought you a bond, NS&I can find out for sure with the scantest of information, says Ms Waters.

"If you've got something with numbers on, just go on the NS&I website or app and punch it in and it will tell you. But if you've got nothing at all, use the online tracing service, external. The more information we have [the better] because we're looking at old historic systems and some of them are even on microfiche [photographic film with small-scale reproductions of prints].

"But we will search the archives and find out what you've got, then we'll write to you and let you know. Prizes stay there forever and are always available for customers to get, there isn't a time limit to claim."

NS&I's retail director Jill Waters is urging people to update their contact details

If this seems an unlikely scenario, prepare to be proved wrong. In the past two years, NS&I has paid out 42 prizes from the 1970s alone, the oldest of which - £25 - dated back to May 1970.

"We get reports every month saying customers have been reunited with their money but to see that increase would be a real success - it's theirs to take and for reclaiming," says Ms Waters.

"But customers need to be more aware that in the future, if they move they need to protect themselves."

The majority of winners are contacted by text message or email. If those details aren't available, they are contacted by post using the address their bonds were registered to. Despite the unclaimed cash mountain, more than 90% of prizes make their way to winners and are reinvested into more bonds or paid directly into customers' bank accounts.

The remainder are sent a cheque, except for those that win £5,000 and above, who are sent a claim form. This is where NS&I invariably hits a snag and anything unclaimed is held in a suspended account. Ms Waters says now is the perfect time to check for prizes.

"If there's money there, get your hands on it, especially now during a cost-of-living crisis. It doesn't matter what the prize is, even if it's £25 it's still relevant because things are hard at the moment, so anything is an unexpected bonus. And that's a lovely thing to do, to put that in customers' pockets. It gives them some choices, especially when it's a large value."

A holder in London won £1m in 2004 with just £17 of bonds bought in 1959

In her 20 years at NS&I, Ms Waters has worked in various roles but she says one of the nicest was at the department that contacts winners. She's seen many a happy customer in her time but one in particular sticks out - a young painter and decorator in the north of England who won £1m in 2015.

"He chose to carry on working and he said, 'I could have thought about getting a different job but I love it and now I don't have to [do it] to pay the mortgage'," she says.

"It gave him freedom and that's what it's about - the relief and peace of mind. If you win, it's unexpected and it gives you the chance to do something else. And how good is that?"

NS&I has been making millionaires since it first introduced that prize amount in 1994. Since bond numbers are drawn randomly, each one has a separate and equal chance of winning a prize.

It really does come down to the luck of the draw, as a holder in Newham, London, found in 2004 when they won £1m with the lowest ever holding: £17 of bonds bought in 1959. The wait paid off in this instance, since the top prize at the time of purchase was £1,000.

"The key message is that it doesn't matter how little you've got in, it stays in forever and every month it'll go into the draw and have the same chance as anyone else," says Ms Waters.

"But keep your details up to date, it costs nothing to do that and you get your prizes quicker."

- Published22 January 2021

- Published11 November 2019

- Published1 March 2019