Slough Borough Council considers selling £600m worth of assets

- Published

The strategy comes after the council froze all non-essential spending

A council is considering selling up to £600m worth of assets to end its financial crisis.

Slough Borough Council's chief financial officer, Steven Mair, has said the authority needs to take action over the next five years to make borrowing "more manageable".

Mr Mair presented a debt repayment and asset disposal report to senior councillors at a cabinet meeting.

The report calls for the council to cut its debt of £760m to £335m by 2027.

Cabinet members heard parks would be untouched in the suggested cuts, and tenants in council-owned homes "will be protected", according to the Local Democracy Reporting Service.

It comes after the council froze all non-essential spending after it predicted a financial black hole of £174m by 2025.

'Fire sale'

Cabinet members have now given the go ahead for a team of "external specialists" to deal with the operational aspects of disposing of the assets. It is not known which specialists and how much they will cost.

Mr Mair said nothing would be exempt when they look at the authority's 6,700 assets, which are worth a total value of £1.2bn.

The financial officer has also suggested selling up to £200m worth of property and land in the next two years to cover finance restrictions ordered by government.

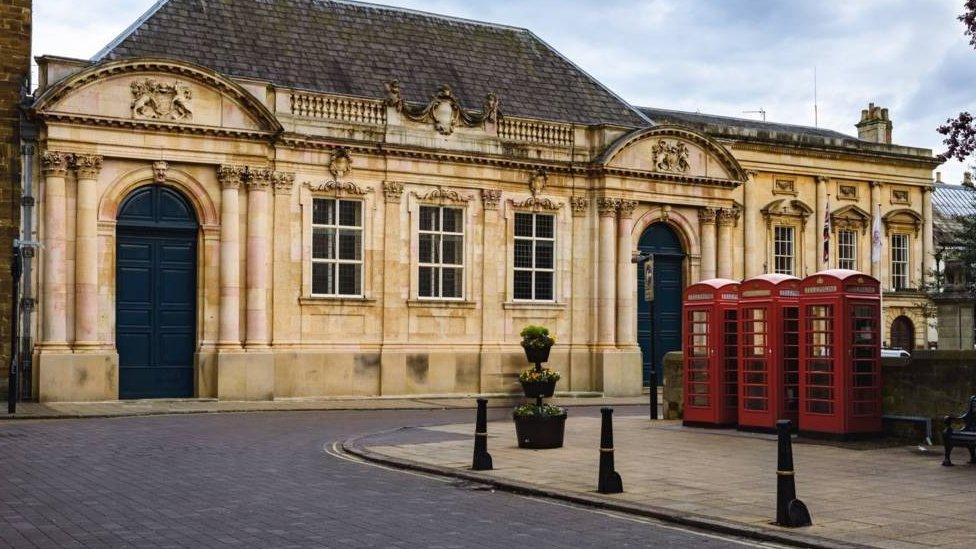

The cash-strapped authority has given the go ahead for experts to oversee the logistics of selling assets

Wayne Strutton, leader of the opposing Conservatives, said at the meeting: "It doesn't feel like this is really getting as much planning in looking at these assets and selling them and preparing for the huge pressures of debt repayment, loan renewals, and everything else this authority is facing."

Mr Mair denied they were engaging in a quick sale of properties.

He said: "We've tried to be extremely clear that this is not a fire sale, and that we must absolutely ensure best value in everything that we do, and we have some real experts on it."

Follow BBC South on Facebook, external, Twitter, external, or Instagram, external. Send your story ideas to south.newsonline@bbc.co.uk, external.

- Published29 July 2021

- Published9 July 2021

- Published2 July 2021

- Published11 November 2020

- Published24 July 2018