Bristol renters looking for security turn to housing co-ops

- Published

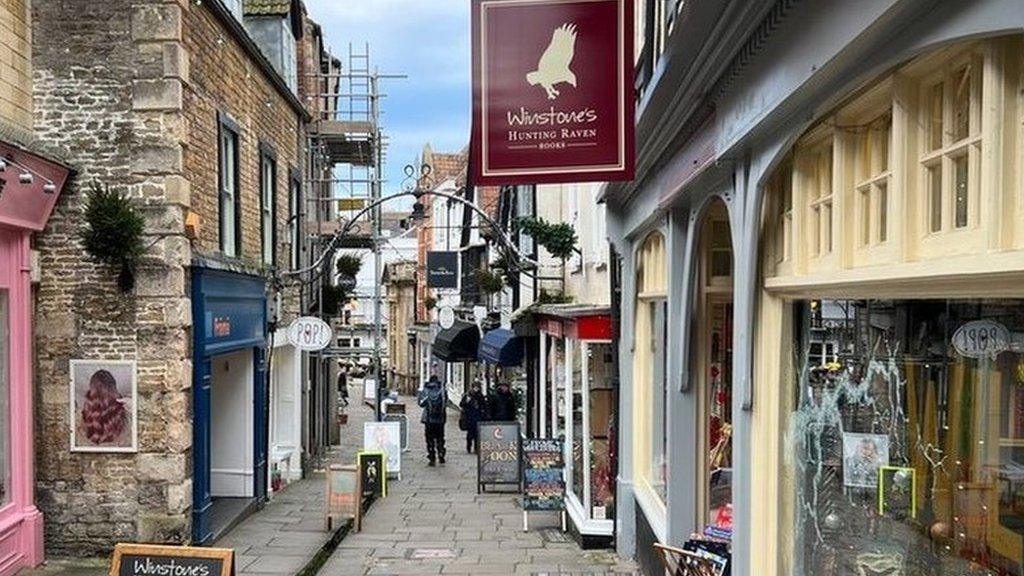

Members of the Sorrel co-operative in Bristol are looking for a house together

Getting on the property ladder is a struggle for millions, with high rental costs and low incomes making home ownership seem an unachievable dream for many.

Rising interest rates and the increasing cost of taking out a mortgage have also added to the problem.

Looking for a solution, some are turning to housing co-operatives.

People in co-ops share the houses they live in; members are their own landlords, set their own rent based on repairs needed and typically do not invest capital.

Since their house are not owned for profit, rents can be kept at a lower level, and tenancy terms can last for decades in some cases.

Freddie Bouchier was frustrated by a lack of control when renting

Freddie Bouchier belongs to the Sorrel Co-op in Bristol, which is currently looking for a suitable house to buy.

"Culturally, the aspiration is to be a homeowner and to do that you save up.

"We've been sold this dream that you work hard, you get a good job, get a mortgage and own your own property.

"But nowadays it seems to be really difficult to do that without some kind of support from family members or an inheritance," he said.

What is a co-op?

A housing co-operative, or co-op, is a legal term for a residence that is owned and controlled jointly by a group of individuals who buy shares, membership and/or stock in a financial non-profit corporation

The corporation owns the land, building and any common areas of the housing community

The co-op owner does not own their unit - but has the exclusive right to occupy a specific unit, relative to the number of shares owned

Residents are in control, run the homes in a democratic way, have long-term security and pay fairer costs

There are 900 co-op housing organisations across the UK, according to the Confederation of Housing Co-operatives.

They say this number has increased by almost 50% since 2018, when there were 685.

"I'm a passionate advocate of co-ops," said Trevor Houghton, a member of the Somewhere Co-operative Housing Group.

Trevor Houghton has been a member of a co-op for more than 40 years

"It think it's an extremely good way of us providing housing, which is an absolute basic need.

"Several of the people who've joined [us recently] have literally been shuffling from one private house to another.

"They've been in very insecure situations, often with children, having to move around with all the school and childcare problems that causes," he said.

However, Mr Houghton acknowledges the wait for a house can be long for members, something their increasing popularity is only likely to make worse.

"We don't have a waiting list and most of the time we have up to five unhoused members at any one time.

"They could be waiting a couple of years, I'm afraid there is a very slow turnover in terms of who actually lives here," he added.

Jimmy Thomson says equity is not needed to join the co-op

A crucial draw is the fact no individual member needs to have money upfront; a model which can be very appealing.

"That's quite important because we want it to be really accessible," explained Jimmy Thomson from the Sorrel Co-op.

"Quite often you need to bring equity into a purchase. We don't need to do that. Instead we run something called a loan stock campaign," he said.

Loan stock is money invested in a co-op by non-members - this could be from other co-ops, or from members' friends or family.

"A sense of community is also what motivates many to join a co-op. It takes time and patience, though, to nurture a shared vision and values.

"We meet regularly as it takes a long time to build those relationships of trust, care and support. That's part of the process," said Mr Thomson.

"The most common reason housing co-ops are unsuccessful is because the group falls apart. Putting in the groundwork for [a strong group] is a really significant part of what we do," he said.

Simon Crichton from Triodos Bank said co-op members needed to form a strong group before seeking finance

Simon Crichton works for Triodos Bank UK, one of two UK banks which lends to housing co-ops.

"New housing co-operatives will need initial capital to purchase or develop their homes, as well as a bank loan.

"Most communities have a members' agreement to formalise expectations and a dedicated treasurer who will be responsible for the society's financial activity.

"It's also very important to consider the legal structure and finances.

"There needs to be watertight agreements for what happens if anyone moves out or property repairs," he said.

Campaigner Sarah Gomes Harris, who is currently campaigning to raise awareness of co-ops, said politicians had failed to address the housing crisis.

"People can't report problems to their landlords for fear of evictions.

"It feels like no one politician has a solution, so we as a community need to lead the way," she said.

Faith Terry-Doyle said the co-op can offer security for her and others

Ultimately, Faith Terry-Doyle is hoping for security and autonomy by joining the Sorrel Co-op.

"For us, renting doesn't give us security.

"We don't have any autonomy over where we live in terms of what we can do to the house, improvements we can make to the house, getting rid of mould.

"We also don't have autonomy over the price being hitched up after our contract finishes.

"I don't have any inheritance or family help in terms of finances, so for me, getting on the housing ladder isn't an option right now.

"Housing co-ops provide a great alternative that is secure housing and is actually affordable and stays at an affordable rate over the years." she said.

Follow BBC West on Facebook, external, Twitter, external and Instagram, external. Send your story ideas to: bristol@bbc.co.uk , external

- Published14 May 2023

- Published31 May 2023

- Published29 January 2023

- Published4 February 2012