Christmas debt: 'My shameful 22k credit card bill'

- Published

Sarah Douglas got into £22,000 of debt after using interest-free credit cards

"It felt so shameful that I had got myself into this mess. To the outside world I was intelligent, I had a degree - all of these things I so-called 'achieved' - but I could not control this very important and basic aspect of life."

Those are the words of Sarah Douglas, from Bristol, who, unbeknown to those around her, fell into £22,000 of debt.

It was mostly through using credit cards, which were originally interest free, to pay for shopping sprees as well as essentials for her family.

Sarah's debt grew over a period of about 20 years. After working through a series of low-paid jobs, she realised in 2016, that it had become "out of control".

"It was really scary. I had already had a fair few sleepless nights before the penny finally dropped, but it was a moment I had to get my head out of the sand," she said.

"I thought, is this going to be the end of my marriage? Am I going to have to tell my husband about this terrible thing? I had always told him it was all fine."

Living with ADHD and autism meant it was difficult for Sarah to control her spending habits, but it was at times like Christmas where it would get most out of control.

One in four people will struggle to afford Christmas this year, rising to more than one in three (34%) households with children, according to research by debt charity StepChange.

Sarah is urging anyone who is in debt to "reach out for help"

When Sarah finally admitted the truth to her husband, she said he showed her "kindness and love" while "understanding her differences".

The support of her family gave her the strength to tackle the debt so she contacted StepChange.

"They were amazing, they were completely non-judgemental. They said it was okay, it is only human, and we can help you get to the other side," Sarah added.

"They helped me work out a repayment plan and formed a buffer between myself and the banks."

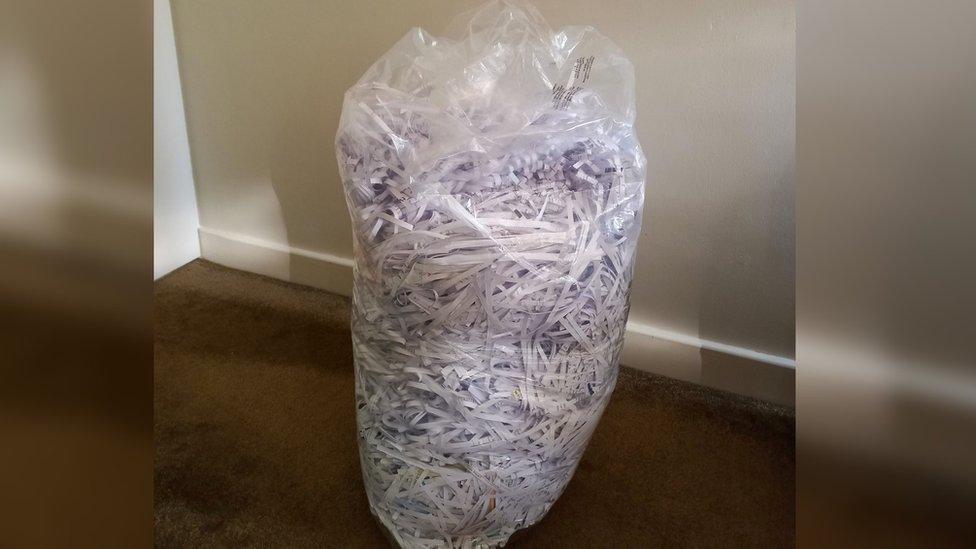

Sarah finally became debt free in November 2021 and she felt she needed to do something visual to make it "feel real".

She did this by shredding every debt collection letter she had ever received.

Sarah has now reclaimed financial control and shred her debt letters to make a visual point

"I filled a large bin bag with the shredded paper, it was incredible, and I felt a real sense of achievement. Five years of paying my debts had led to this point," Sarah said.

"We all mess up. If you're facing debt, you need to ask for help, please don't struggle with this on your own, as it can be incredibly lonely.

"Always reach out for help."

Sarah, having rebuilt her life, decided to share her story at a time of year which can be financially difficult for many families.

Charities who provide financial support across the West say they are seeing an increase in demand for their services as Christmas draws near.

Christians Against Poverty (CAP) run a weekly café in Chippenham, Wiltshire, which provides free money coaching courses and is attended by people who are struggling financially.

Tim Phillips fell into debt after being diagnosed with a heart condition

One of those who attends is Tim Phillips, from Chippenham, a former bus driver.

Earlier this year, he was diagnosed with a heart condition after collapsing.

"I couldn't drive anymore, so the pay cheques stopped and I ended up finding myself struggling with money," said Tim.

"I ended up sofa surfing and the council later put me in temporary accommodation."

The Christians Against Poverty (CAP) 2023 client report found:

CAP clients in the South West on average owed over £11,800 at the peak of their debts. It would take a client on average 10-and-a-half years to repay their debts without help.

On average they had 13 different debts, that can mean up to 13 different organisations could be chasing them for payment.

Almost half (49%) of the money owed by a typical CAP client in the South West is due to priority debts. These are often for essentials like rent arrears, mortgage, gas and electricity or Council Tax debts.

Tim says his situation has now improved after working with CAP.

"I am receiving free money coaching sessions and we have come up with a good plan to tackle my debt," he said.

"You can easily push debt under the carpet, but please face it head on, and talk to someone who can help."

Kathryn Ford from CAP said people in debt should not be ashamed

Kathyrn Ford, south west manager for CAP, said: "There are a wide variety of reasons people fall into debt, sometimes these factors are completely out of their control.

"You might have lost a partner, been made redundant, a victim of fraud - all of these things affect your income.

"There is no shame, come and talk to us and we can help you."

Information and support is available and free of charge - click here to find out about organisations who may be able to help.

Follow BBC West on Facebook, external, X, external and Instagram, external. Send your story ideas to: westinvestigations@bbc.co.uk, external

Related topics

- Published27 June 2024

- Published15 December 2023