Cost of living: The homebuyers anxious about their mortgages

- Published

Interest rates have risen to 3% - the biggest hike since 1989 - and many people are worried about the cost of their mortgages.

BBC News has been talking to people who are going to be affected by the increase and has come to Derby to hear your stories.

'I'm thinking about leaving the country'

Omar has put his plans to buy a property on hold

Veterinary surgeon Omar Zaghloul moved to the UK from Italy in October 2018 and has been renting in Derby for the last two years.

He had hoped to buy his home in England by the end of the year, but a rise in interest rates and higher mortgage costs have thrown his plans into turmoil.

"My idea was to save for a deposit, but I cannot put all I save into that pot because I have rent to pay," he says.

"I've tried to find solutions like websites that offer low mortgage rates or low deposit options, but none have worked out.

"A variable rate mortgage would have been a disaster. It's not the right moment to make such an investment and a long term commitment."

Omar says "things went south" about a month ago and, as a result, has suspended all his plans to buy a flat - he is even considering leaving the UK.

The 38-year-old says: "I cannot buy now so I'll invest money in a different way and maybe later buy a house in another country.

"I'm really frustrated. If I want to settle here it's a 30-40 year commitment - a long-term plan is not clear and I cannot decide if it will be here in this country."

'I'm a lot more hesitant about buying my first home'

Becky says economic recovery won't happen overnight

Becky Smith, a case handler at a mortgage brokers in Derby, admits she is unsure about buying her first home.

The 31-year-old has been looking for a three bedroom semi-detached house in the city, which comes with a price tag in the region of £200,000. She has a decent income and a deposit but says it's still a gamble.

"We started to briefly look before the rates had increased thinking, 'Yeah, we can do this', but with the rates now, we're a lot more hesitant," she says.

"If things keep increasing the way they are, the likelihood is we won't... I think a lot of first-time buyers especially at my age are going to be in that position."

Through her work, Becky knows more than most how an interest rate rise could affect her, saying it would leave her with no "wiggle room" if she bought a property now.

If mortgage rates rise to 6%, Becky won't be able to buy a house.

"It's not going to happen," she says.

"A mortgage payment would be £150 more expensive. You've got to get to a point where you sit there and think, 'Financially, can I do this?'. And sadly for a lot of people the answer to that question is going to be 'No'.

"It's a scary time regardless of what type of borrower you are."

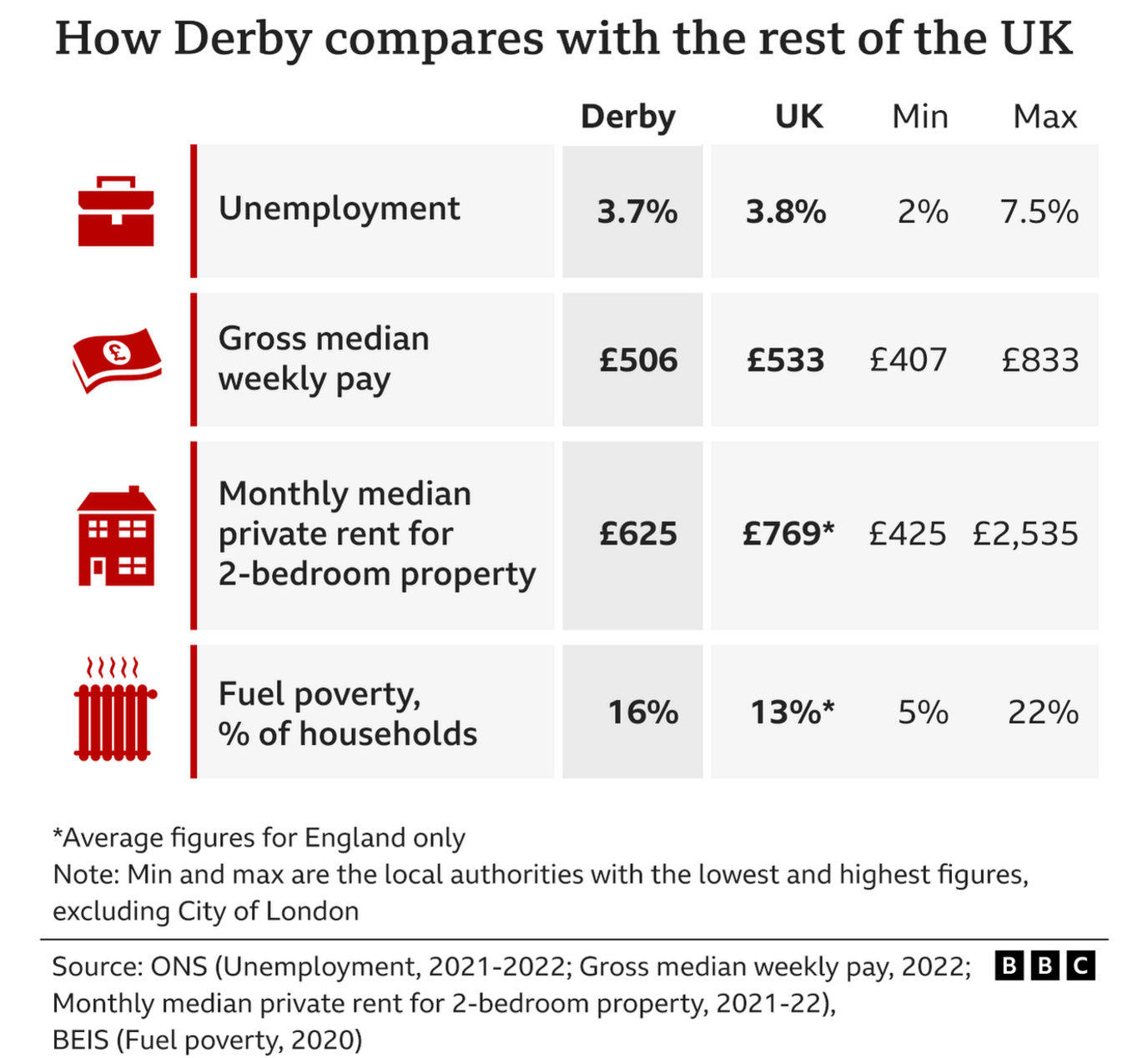

Counting the cost of living

Read our reports from other places in the UK:

'My mortgage is going to go up - I'm angry'

Jay's payments could increase by £150 a month

Jay Dean, director of Dubrek Studios, a music venue in the city centre, bought his home three-and-a-half years ago and is due to renew his mortgage early next year.

His fixed mortgage rate is set to triple from 1.89% to 5.8% - an increase of 4% and £150 a month.

"I will have to find more money for that, as will millions of other people. I'm angry about it because this really shouldn't be happening," the 49-year-old says.

Jay says he will have to think twice about doing a lot of the things he enjoys to find the extra money.

"Socialising, going to the pub, gigs, cinema, things that cost a bit of money and mount up over the month... am I going to be able to afford those?"

Jay says the economic situation is "unsustainable".

"Where is this going to go? We're hearing we are going to be paying more for our energy, food, mortgages, yet corporations are making record profits and shareholders are getting huge handouts.

"The basic things that people need are to keep a roof over your head, to keep warm, and to be able to eat. All three elements are being attacked by what's going on in the economy."

Related topics

- Published20 October 2022

- Published18 October 2022

- Published30 September 2022

- Published26 August 2022

- Published20 July 2022