Cluny Lace: Company faces 'nail in coffin' customs charges

- Published

The firm has survived two world wars but is struggling with rising costs and shrinking markets

New customs charges are "another nail in the coffin" of a historic textile business, according to its bosses.

Cluny Lace, in Ilkeston, Derbyshire, began making lace in the 19th Century and manufactured material for Kate Middleton's wedding dress in 2011.

But managing director Charles Mason said soaring costs, Covid, the loss of export markets and new customs tariffs had left the company struggling.

Six staff have been made redundant and the situation was "awful", he added.

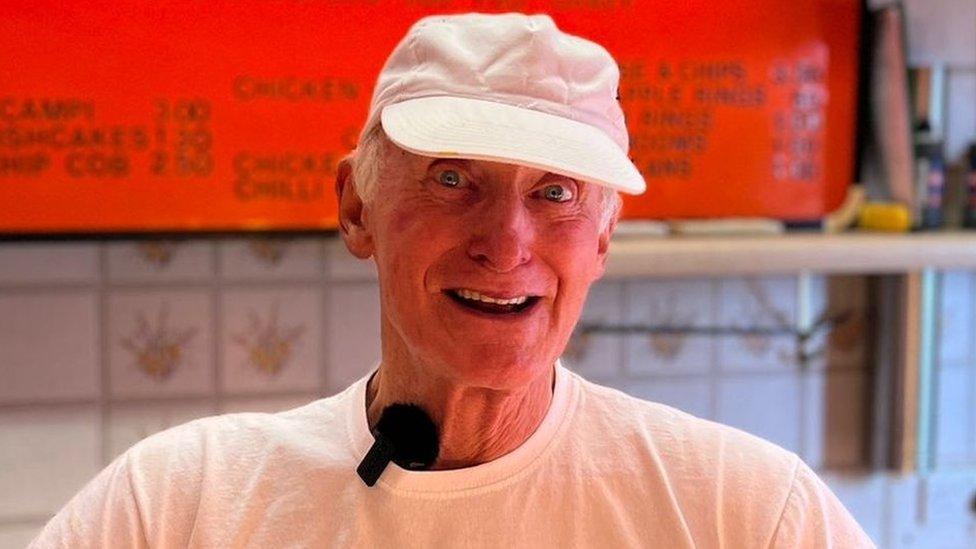

Kate Knight said there was a question mark over the firm's long-term viability

The Mason family started making lace in the 1760s but the company in its present form began in the 19th Century.

Mr Mason, the ninth generation to be involved, wrote a letter, external to the Financial Times saying a new 8% duty from HM Revenue & Customs (HMRC) on lace made in-house, then sent to France for dyeing before coming back was like being "killed off by our own side".

He said: "It's pretty tough because we are not making any money and have not done in the recent past.

"We decided we could not continue as a company as we were and we have had to make six people redundant, which is about 120 to 140 years' experience.

"It's pretty sad really - it's awful.

"It is hard to put into words when you know hundreds of years of technical innovation in this area is coming to an end."

'More difficult'

Kate Knight, head of sales at the firm, said: "We seem to have been hit by one thing after another.

"The Covid pandemic obviously. Brexit affected our sales because we largely export into Europe and there is the energy crisis.

"This latest hit is just another nail in the coffin as it were.

"Most high-end fashion garments are made in Europe so we have taken a hit there as it is more difficult for them to buy our goods - it takes a bit longer to get there.

"We would like to say we will still be here in five or 10 years but whether that is viable long-term, who knows?"

An HMRC spokesperson said: "Import duty is applied to goods imported into the UK.

"A number of procedures and reliefs are available which may reduce the amount payable, particularly where goods are reimported after processing."

Follow BBC East Midlands on Facebook, external, on Twitter, external, or on Instagram, external. Send your story ideas to eastmidsnews@bbc.co.uk, external.

Related topics

- Published11 April 2023

- Published8 April 2023

- Published1 February 2023

- Published10 November 2021