Dorset Council loophole warning over doubling council tax plan

- Published

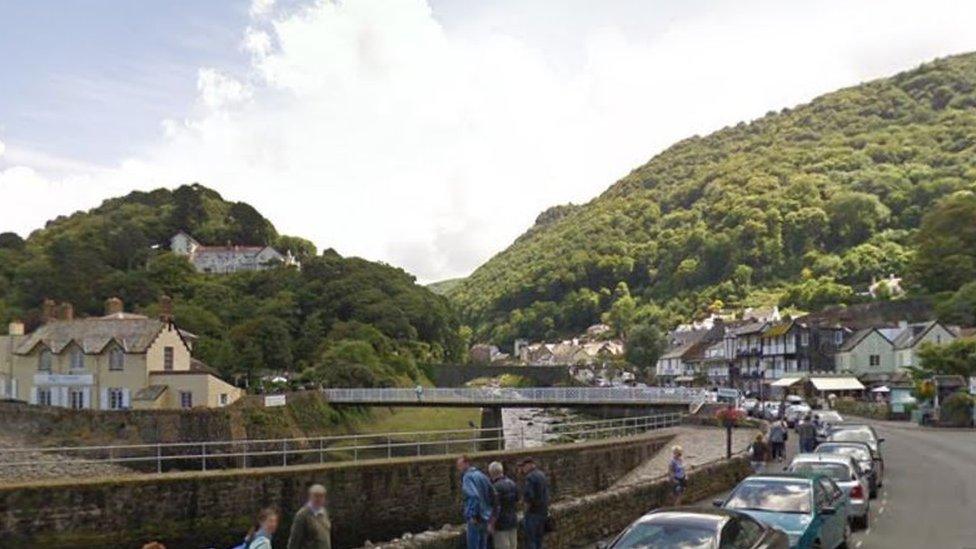

Many Dorset villages have a high proportion of second homes

Many second homeowners would try to avoid paying any doubling of council tax, councillors have warned.

Government proposals would give councils the option of upping council tax in areas with high numbers of second homes.

Dorset Council estimates it could gain at extra £9.5m from the 5,700 second homes in the county.

Deputy council leader Peter Wharf said the full amount may not be raised as many owners would find loopholes.

The government has included tax premiums for second homes in its Levelling Up and Regeneration Bill.

The plans would allow local councils to charge double council tax on furnished homes not used as a sole or main residence.

Concerns were raised during a Dorset Council debate that some second homeowners might register their properties as businesses and let them out through agents or Airbnb.

Dorchester councillor Les Fry said: "The occupants of these properties do very little to support our economy.

"The extra revenue anticipated will be valuable as Dorset Council seeks to balance the books and support our communities."

Another councillor, Sherry Jespersen, said it was "reasonable" to ask second homeowners to pay more when there were 3,700 people on the Dorset housing register in need of a home, and with house prices in the county at eleven times average local wages.

Val Pothecary, the council chairman, said there were villages near Gillingham where 30% of the homes were second properties, putting pubs, shops and even schools at risk of becoming unsustainable.

"This is an opportunity to redress the balance a bit" she said.

A final decision of whether or not to adopt the changes locally, should they be approved in time by the government, will go to a full council meeting at the end of March.

If the premium is to be implemented in 2024, the government's Levelling Up and Regeneration Bill must have received Royal Assent by 1 April.

Follow BBC South on Facebook, external, Twitter, external, or Instagram, external. Send your story ideas to south.newsonline@bbc.co.uk, external.

Related topics

- Published7 February 2023

- Published17 January 2023

- Published7 January 2023